Jefferies Financial Group Investor Day Presentation Deck

Growth and Momentum

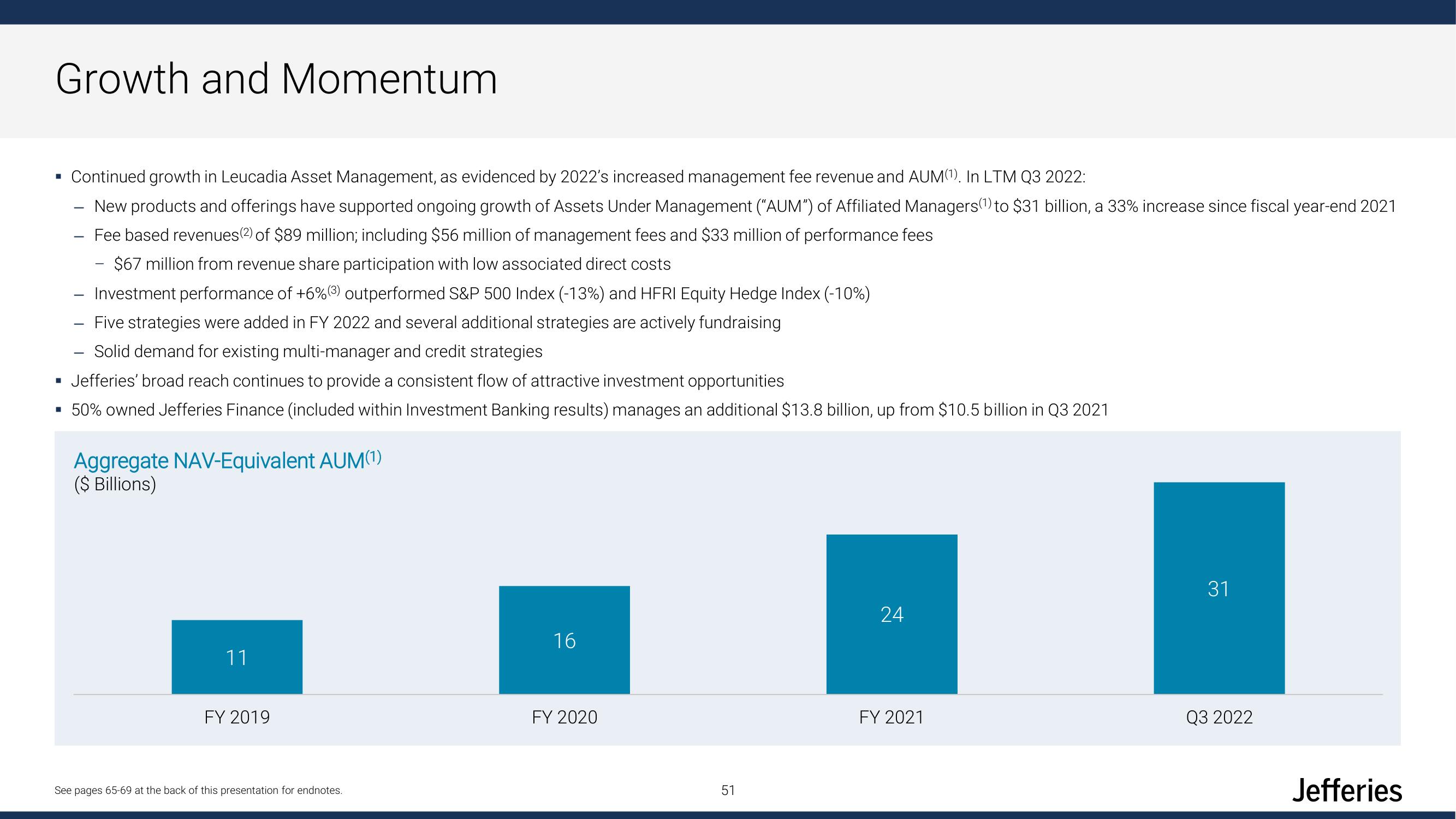

Continued growth in Leucadia Asset Management, as evidenced by 2022's increased management fee revenue and AUM(¹). In LTM Q3 2022:

New products and offerings have supported ongoing growth of Assets Under Management ("AUM") of Affiliated Managers(¹) to $31 billion, a 33% increase since fiscal year-end 2021

Fee based revenues(2) of $89 million; including $56 million of management fees and $33 million of performance fees

$67 million from revenue share participation with low associated direct costs

Investment performance of +6%(³) outperformed S&P 500 Index (-13%) and HFRI Equity Hedge Index (-10%)

Five strategies were added in FY 2022 and several additional strategies are actively fundraising

- Solid demand for existing multi-manager and credit strategies

▪ Jefferies' broad reach continues to provide a consistent flow of attractive investment opportunities

▪ 50% owned Jefferies Finance (included within Investment Banking results) manages an additional $13.8 billion, up from $10.5 billion in Q3 2021

■

Aggregate NAV-Equivalent AUM(1)

($ Billions)

11

FY 2019

See pages 65-69 at the back of this presentation for endnotes.

16

FY 2020

51

24

FY 2021

31

Q3 2022

JefferiesView entire presentation