Allwyn Results Presentation Deck

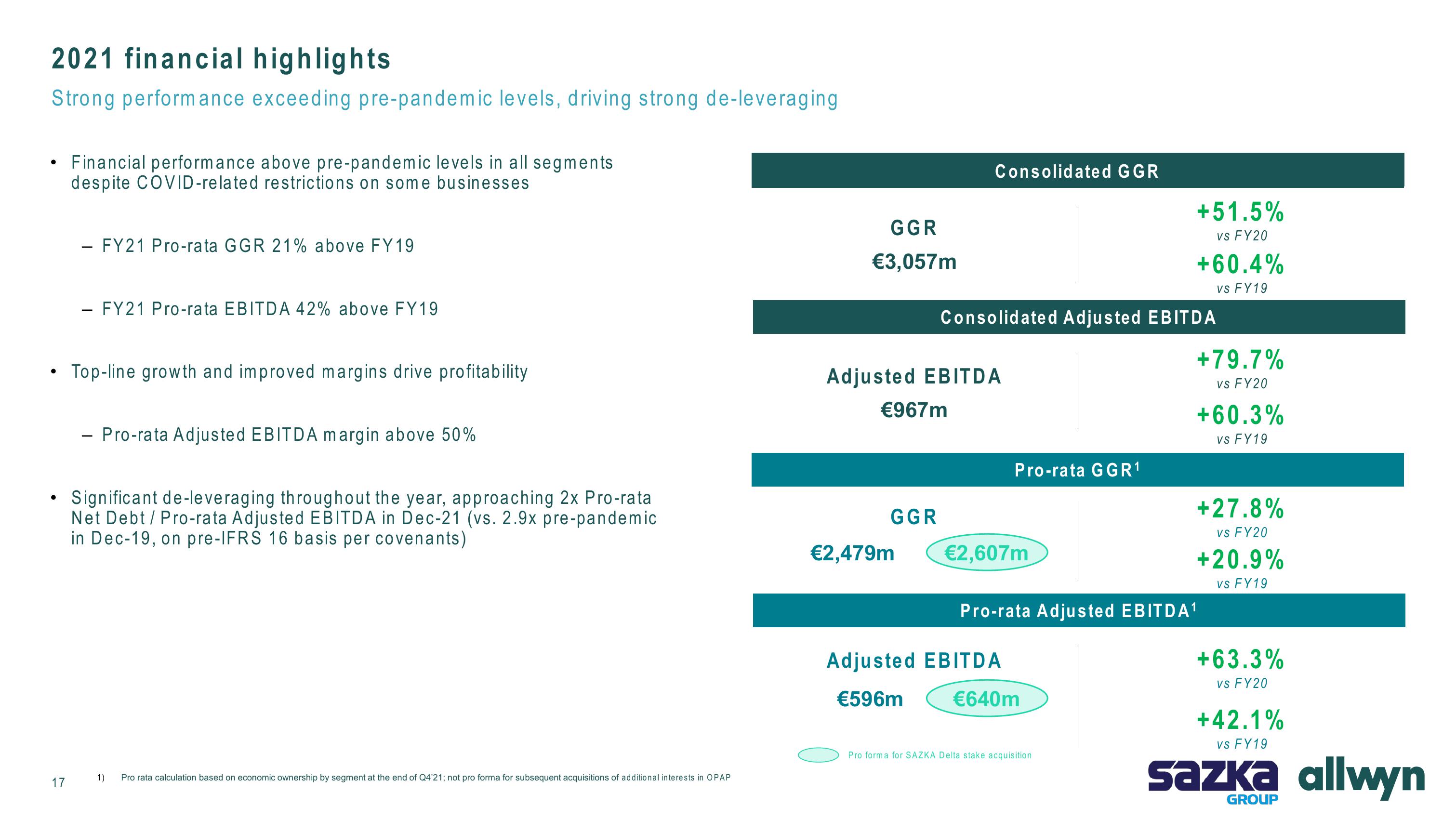

2021 financial highlights

Strong performance exceeding pre-pandemic levels, driving strong de-leveraging

●

●

17

Financial performance above pre-pandemic levels in all segments

despite COVID-related restrictions on some businesses

FY21 Pro-rata GGR 21% above FY19

- FY21 Pro-rata EBITDA 42% above FY19

Top-line growth and improved margins drive profitability

- Pro-rata Adjusted EBITDA margin above 50%

Significant de-leveraging throughout the year, approaching 2x Pro-rata

Net Debt / Pro-rata Adjusted EBITDA in Dec-21 (vs. 2.9x pre-pandemic.

in Dec-19, on pre-IFRS 16 basis per covenants)

1)

Pro rata calculation based on economic ownership by segment at the end of Q4'21; not pro forma for subsequent acquisitions of additional interests in OPAP

GGR

€3,057m

Adjusted EBITDA

€967m

GGR

Consolidated GGR

€2,479m

Consolidated Adjusted EBITDA

Pro-rata GGR¹

€2,607m

Pro-rata Adjusted EBITDA¹

Adjusted EBITDA

€596m

€640m

+51.5%

vs FY20

Pro forma for SAZKA Delta stake acquisition

+60.4%

vs FY19

+79.7%

vs FY20

+60.3%

vs FY19

+27.8%

vs FY20

+20.9%

vs FY19

+63.3%

vs FY20

+42.1%

vs FY19

sazka allwyn

GROUPView entire presentation