Oatly Results Presentation Deck

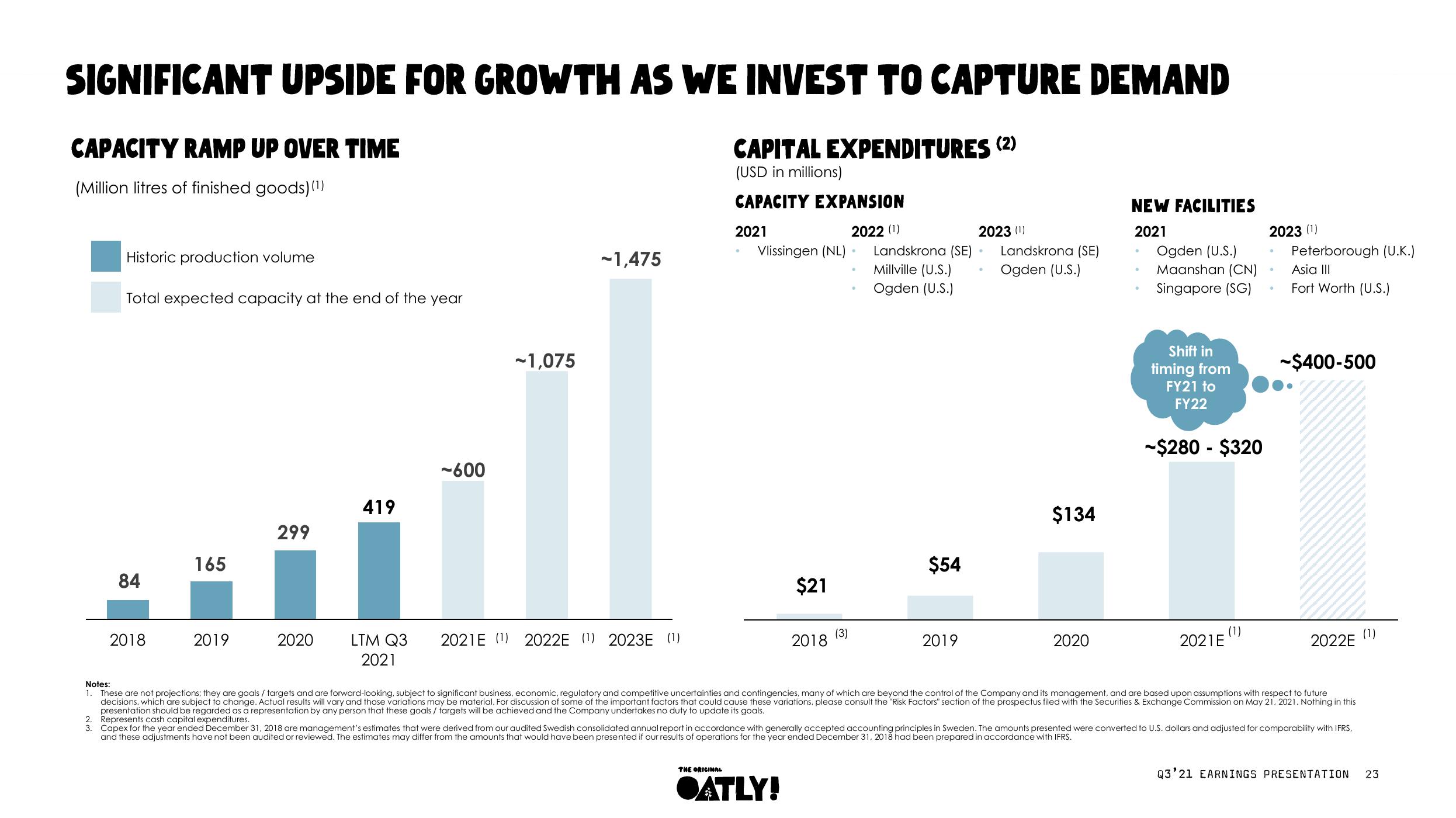

SIGNIFICANT UPSIDE FOR GROWTH AS WE INVEST TO CAPTURE DEMAND

CAPITAL EXPENDITURES (2)

(USD in millions)

CAPACITY EXPANSION

CAPACITY RAMP UP OVER TIME

(Million litres of finished goods) (¹)

Historic production volume

Total expected capacity at the end of the year

84

2018

165

2019

299

2020

419

-600

LTM Q3 2021E (1)

2021

-1,075

-1,475

2022E (1) 2023E (1)

2021

Vlissingen (NL)

THE ORIGINAL

$21

2018

OATLY!

(3)

2022 (¹)

Landskrona (SE)

Millville (U.S.)

Ogden (U.S.)

$54

2019

2023 (¹)

Landskrona (SE)

Ogden (U.S.)

$134

2020

NEW FACILITIES

2021

Ogden (U.S.)

Maanshan (CN)

Singapore (SG)

Shift in

timing from

FY21 to

FY22

-$280 - $320

2021E

(1)

2023 (1)

Peterborough (U.K.)

Asia III

Fort Worth (U.S.)

-$400-500

Notes:

1. These are not projections; they are goals / targets and are forward-looking, subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future

decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the "Risk Factors" section of the prospectus filed with the Securities & Exchange Commission on May 21, 2021. Nothing in this

presentation should be regarded as a representation by any person that these goals/ targets will be achieved and the Company undertakes no duty to update its goals.

2. Represents cash capital expenditures.

3.

2022E

Capex for the year ended December 31, 2018 are management's estimates that were derived from our audited Swedish consolidated annual report in accordance with generally accepted accounting principles in Sweden. The amounts presented were converted to U.S. dollars and adjusted for comparability with IFRS.

and these adjustments have not been audited or reviewed. The estimates may differ from the amounts that would have been presented if our results of operations for the year ended December 31, 2018 had been prepared in accordance with IFRS.

Q3'21 EARNINGS PRESENTATION

(1)

23View entire presentation