ICG Strategic Partnership Presentation to State of Connecticut Retirement Plans and Trust Funds (CRPTF)

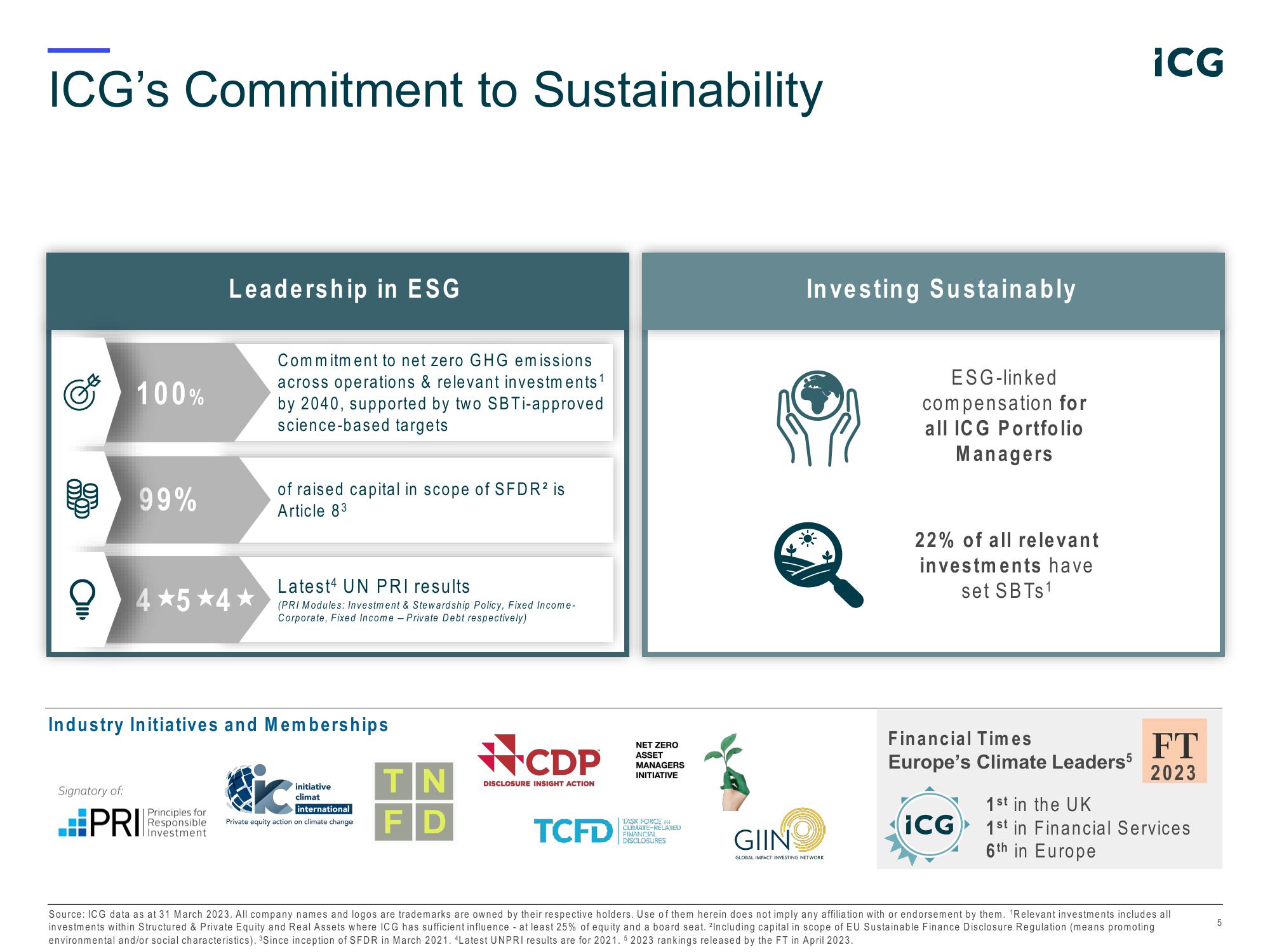

ICG's Commitment to Sustainability

100%

Signatory of:

99%

4 *5*4*

Leadership in ESG

PRII

Principles for

Responsible

Investment

Commitment to net zero GHG emissions

across operations & relevant investments ¹

by 2040, supported by two SBTi-approved

science-based targets

Industry Initiatives and Memberships

of raised capital in scope of SFDR² is

Article 83

Latest4 UN PRI results

(PRI Modules: Investment & Stewardship Policy, Fixed Income-

Corporate, Fixed Income - Private Debt respectively)

initiative

climat

international

Private equity action on climate change

ΤΙΝ

FD

CDP

DISCLOSURE INSIGHT ACTION

TCFD

NET ZERO

ASSET

MANAGERS

INITIATIVE

TASK FORCE ON

CLIMATE-RELATED

FINANCIAL

DISCLOSURES

Investing Sustainably

GIIN

GLOBAL IMPACT INVESTING NETWORK

ESG-linked

compensation for

all ICG Portfolio

Managers

22% of all relevant

investments have

set SBTS¹

Financial Times

Europe's Climate Leaders5

(ICG)

¡CG

FT

2023

1st in the UK

1st in Financial Services

6th in Europe

Source: ICG data as at 31 March 2023. All company names and logos are trademarks are owned by their respective holders. Use of them herein does not imply any affiliation with or endorsement by them. ¹Relevant investments includes all

investments within Structured & Private Equity and Real Assets where ICG has sufficient influence - at least 25% of equity and a board seat. ²Including capital in scope of EU Sustainable Finance Disclosure Regulation (means promoting

environmental and/or social characteristics). ³Since inception of SFDR in March 2021. 4Latest UNPRI results are for 2021. 5 2023 rankings released by the FT in April 2023.

5View entire presentation