Apollo Global Management Investor Day Presentation Deck

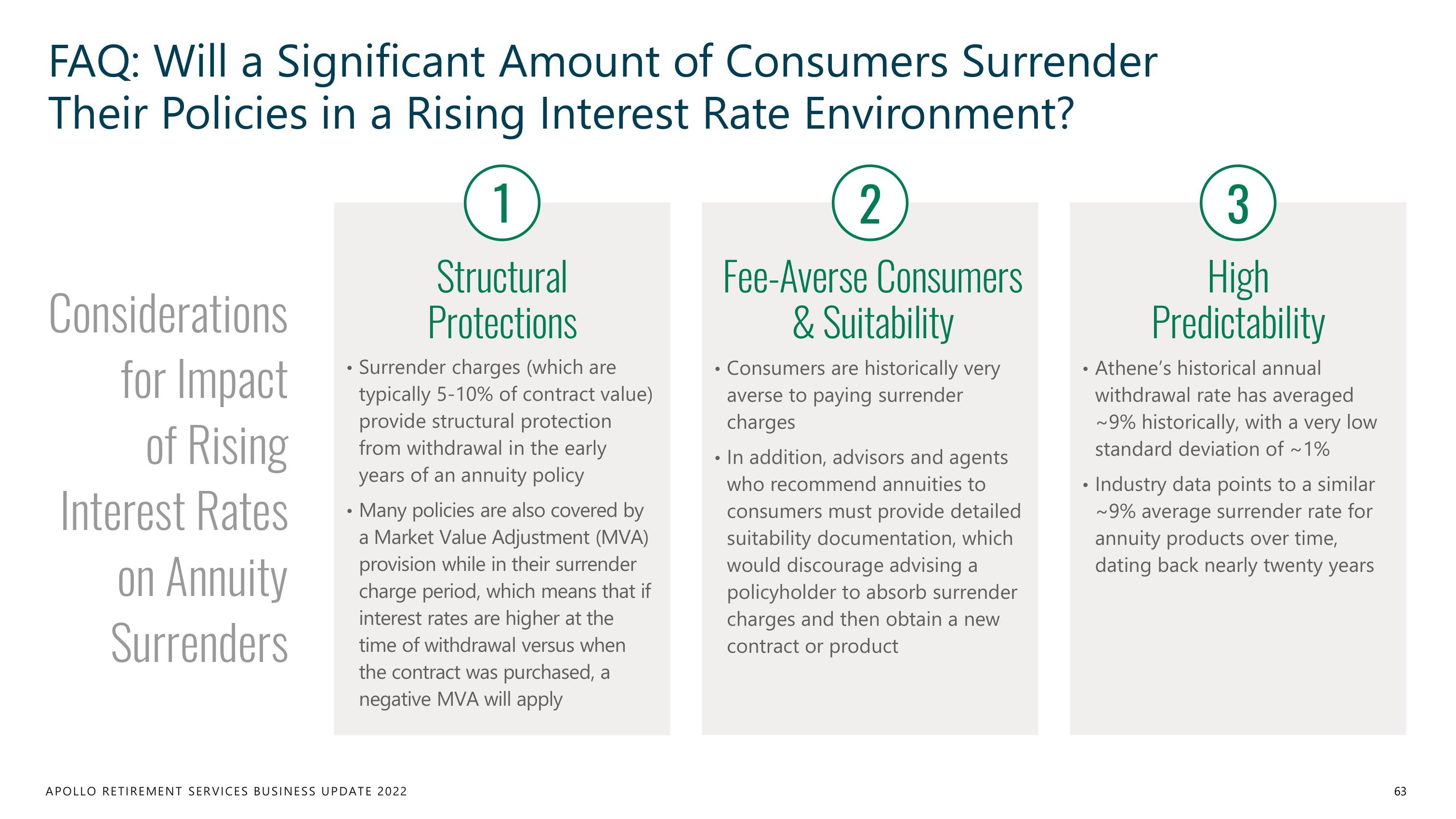

FAQ: Will a Significant Amount of Consumers Surrender

Their Policies in a Rising Interest Rate Environment?

Considerations

for Impact

of Rising

Interest Rates

on Annuity

Surrenders

1

Structural

Protections

Surrender charges (which are

typically 5-10% of contract value)

provide structural protection

from withdrawal in the early

years of an annuity policy

• Many policies are also covered by

a Market Value Adjustment (MVA)

provision while in their surrender

charge period, which means that if

interest rates are higher at the

time of withdrawal versus when

the contract was purchased, a

negative MVA will apply

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

●

2

Fee-Averse Consumers

& Suitability

Consumers are historically very

averse to paying surrender

charges

. In addition, advisors and agents

who recommend annuities to

consumers must provide detailed

suitability documentation, which

would discourage advising a

policyholder to absorb surrender

charges and then obtain a new

contract or product

●

3

High

Predictability

Athene's historical annual

withdrawal rate has averaged

~9% historically, with a very low

standard deviation of ~1%

Industry data points to a similar

~9% average surrender rate for

annuity products over time,

dating back nearly twenty years

63View entire presentation