Cboe Results Presentation Deck

Non-GAAP Information

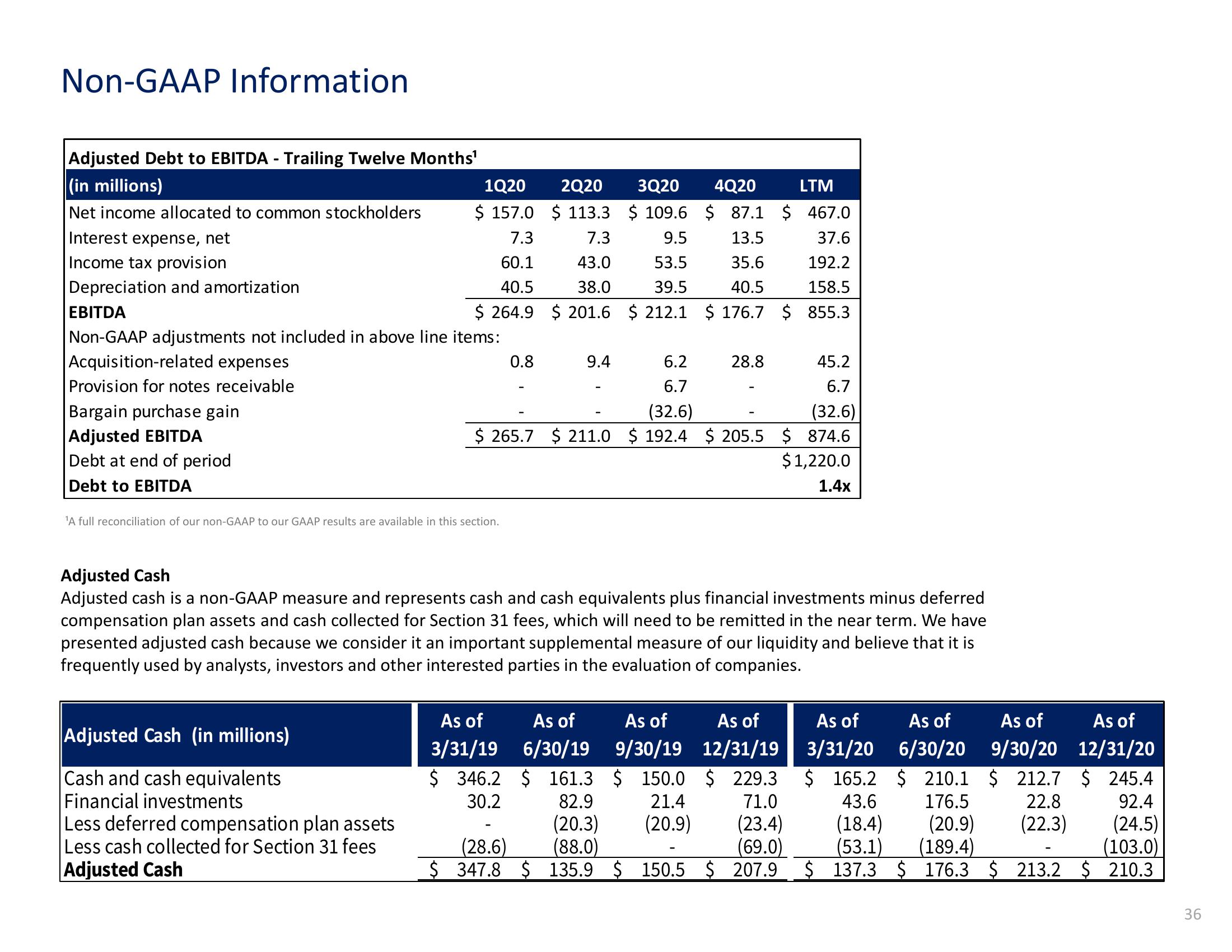

Adjusted Debt to EBITDA - Trailing Twelve Months¹

(in millions)

Net income allocated to common stockholders

1Q20

$ 157.0

7.3

60.1

40.5

EBITDA

$ 264.9

Non-GAAP adjustments not included in above line items:

Acquisition-related expenses

Provision for notes receivable

Interest expense, net

Income tax provision

Depreciation and amortization

Bargain purchase gain

Adjusted EBITDA

Debt at end of period

Debt to EBITDA

¹A full reconciliation of our non-GAAP to our GAAP results are available in this section.

6.2

45.2

6.7

6.7

(32.6)

(32.6)

$265.7 $211.0 $ 192.4 $205.5 $ 874.6

$1,220.0

1.4x

Adjusted Cash (in millions)

Cash and cash equivalents

Financial investments

Less deferred compensation plan assets

Less cash collected for Section 31 fees

Adjusted Cash

2Q20 3Q20 4Q20

LTM

$ 113.3

$ 109.6 $ 87.1 $ 467.0

7.3

9.5

13.5

37.6

43.0

53.5

35.6

192.2

39.5

40.5

158.5

38.0

$201.6 $ 212.1 $ 176.7 $ 855.3

0.8

9.4

28.8

Adjusted Cash

Adjusted cash is a non-GAAP measure and represents cash and cash equivalents plus financial investments minus deferred

compensation plan assets and cash collected for Section 31 fees, which will need to be remitted in the near term. We have

presented adjusted cash because we consider it an important supplemental measure of our liquidity and believe that it is

frequently used by analysts, investors and other interested parties in the evaluation of companies.

As of

3/31/19

As of As

As of

6/30/19 9/30/19 12/31/19

$ 346.2 $ 161.3 $ 150.0 $ 229.3

30.2

82.9

21.4

71.0

(20.3)

(20.9)

(23.4)

(28.6)

(88.0)

(69.0)

$347.8 $ 135.9 $ 150.5 $ 207.9

As of

3/31/20

$ 165.2 $ 210.1

43.6

(18.4)

(53.1)

$ 137.3

As of

12/31/20

$ 212.7 $ 245.4

176.5

22.8

92.4

(20.9) (22.3) (24.5)

(103.0)

(189.4)

$ 176.3 $ 213.2 $ 210.3

As of As of

6/30/20 9/30/20

36View entire presentation