Origin SPAC Presentation Deck

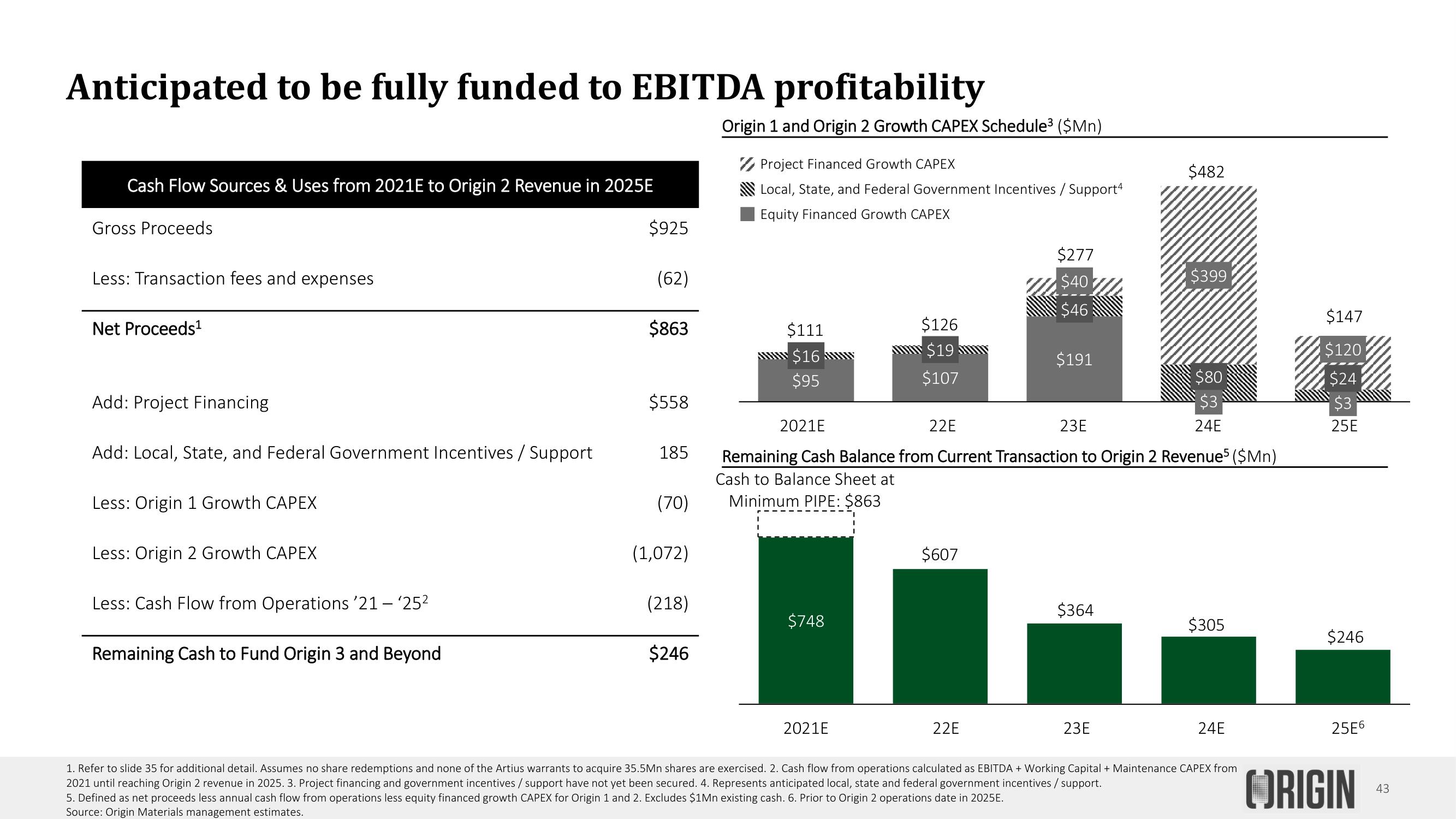

Anticipated to be fully funded to EBITDA profitability

Cash Flow Sources & Uses from 2021E to Origin 2 Revenue in 2025E

Gross Proceeds

Less: Transaction fees and expenses

Net Proceeds¹

Add: Project Financing

Add: Local, State, and Federal Government Incentives / Support

Less: Origin 1 Growth CAPEX

Less: Origin 2 Growth CAPEX

Less: Cash Flow from Operations '21 - '25²

Remaining Cash to Fund Origin 3 and Beyond

$925

(62)

$863

$558

185

(70)

(1,072)

(218)

$246

Origin 1 and Origin 2 Growth CAPEX Schedule³ ($Mn)

Project Financed Growth CAPEX

Local, State, and Federal Government Incentives / Support4

Equity Financed Growth CAPEX

$111

$16

$95

$748

$126

$19

$107

2021E

22E

$607

$277

$40

$46

2021E

23E

Remaining Cash Balance from Current Transaction to Origin 2 Revenue5 ($Mn)

Cash to Balance Sheet at

Minimum PIPE: $863

22E

$191

$364

$482

23E

$399

$80

$3

24E

$305

24E

1. Refer to slide 35 for additional detail. Assumes no share redemptions and none of the Artius warrants to acquire 35.5Mn shares are exercised. 2. Cash flow from operations calculated as EBITDA + Working Capital + Maintenance CAPEX from

2021 until reaching Origin 2 revenue in 2025. 3. Project financing and government incentives / support have not yet been secured. 4. Represents anticipated local, state and federal government incentives / support.

5. Defined as net proceeds less annual cash flow from operations less equity financed growth CAPEX for Origin 1 and 2. Excludes $1Mn existing cash. 6. Prior to Origin 2 operations date in 2025E.

Source: Origin Materials management estimates.

$147

$120

$24

$3

25E

$246

25E6

ORIGIN

43View entire presentation