Cadre Holdings IPO Presentation Deck

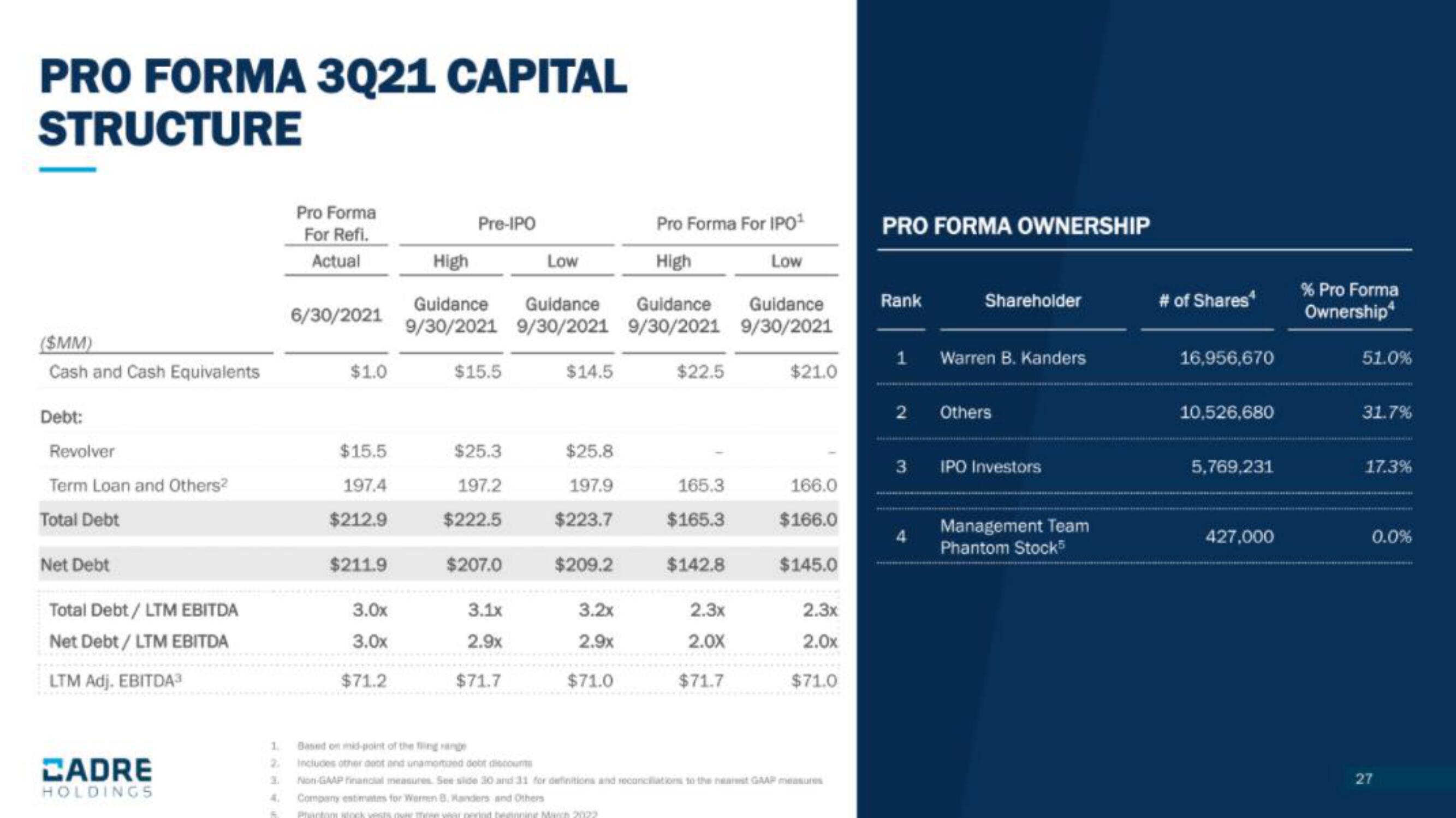

PRO FORMA 3021 CAPITAL

STRUCTURE

(SMM)

Cash and Cash Equivalents

Debt:

Revolver

Term Loan and Others²

Total Debt

Net Debt

Total Debt / LTM EBITDA

Net Debt/LTM EBITDA

LTM Adj. EBITDA³

CADRE

HOLDINGS

Pro Forma

For Refi.

Actual

1

6/30/2021

$1.0

$15.5

197.4

$212.9

$211.9

3.0x

3.0x

$71.2

Pre-IPO

$15.5

High

Guidance Guidance Guidance Guidance

9/30/2021 9/30/2021 9/30/2021 9/30/2021

$25.3

197.2

$222.5

$207.0

3.1x

2.9x

Low

$71.7

$14.5

$25.8

197.9

$223.7

$209.2

Pro Forma For IPO¹

Low

High

3.2x

2.9x

$71.0

$22.5

165.3

$165.3

$142.8

2.3x

2.0X

$71.7

$21.0

166.0

$166.0

$145.0

2.3x

2.0x

$71.0

Based on mid-point of the fing range

Includes other doot and unamortized debt discounts

3. Non-GAAP Financial measures. See side 30 and 31 for definitions and reconciliations to the nearest GAAP measures

Company estimates for Warren 8, Randers and Others

6 Phantom stock vests over three year perind beginning March 2022

PRO FORMA OWNERSHIP

Rank

Shareholder

1 Warren B. Kanders

2 Others

3

IPO Investors

Management Team

Phantom Stock5

# of Shares¹

16,956,670

10,526,680

5,769,231

427,000

% Pro Forma

Ownership

51.0%

31.7%

17.3%

0.0%

27View entire presentation