3Q20 Earnings Call Presentation

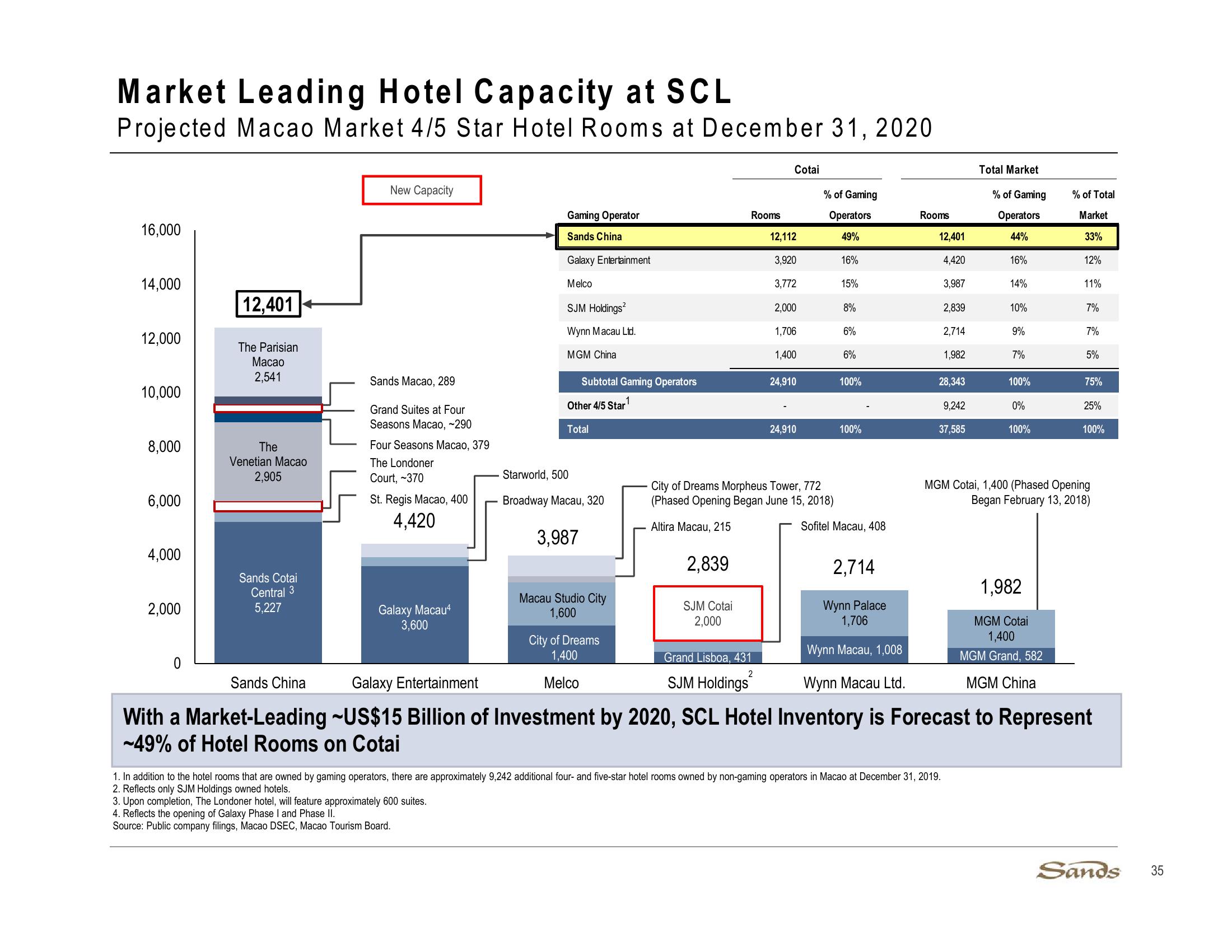

Market Leading Hotel Capacity at SCL

Projected Macao Market 4/5 Star Hotel Rooms at December 31, 2020

Cotai

Total Market

New Capacity

% of Gaming

% of Gaming

% of Total

Gaming Operator

Rooms

Operators

Rooms

Operators

Market

16,000

Sands China

12,112

49%

12,401

44%

33%

Galaxy Entertainment

3,920

16%

4,420

16%

12%

14,000

12,401

Melco

3,772

15%

3,987

14%

11%

SJM Holdings²

2,000

8%

2,839

10%

7%

Wynn Macau Ltd.

1,706

6%

2,714

9%

7%

12,000

The Parisian

MGM China

1,400

6%

1,982

7%

5%

Macao

2,541

Sands Macao, 289

Subtotal Gaming Operators

24,910

100%

28,343

100%

75%

10,000

Other 4/5 Star

9,242

0%

25%

Grand Suites at Four

Seasons Macao, ~290

Total

24,910

100%

37,585

100%

100%

8,000

The

Venetian Macao

Four Seasons Macao, 379

The Londoner

2,905

Court, -370

Starworld, 500

6,000

St. Regis Macao, 400

4,420

Broadway Macau, 320

City of Dreams Morpheus Tower, 772

(Phased Opening Began June 15, 2018)

Altira Macau, 215

Sofitel Macau, 408

3,987

2,839

2,714

MGM Cotai, 1,400 (Phased Opening

Began February 13, 2018)

4,000

Sands Cotai

Central 3

2,000

5,227

Galaxy Macau4

3,600

Macau Studio City

1,600

SJM Cotai

2,000

Wynn Palace

1,706

City of Dreams

Wynn Macau, 1,008

0

Grand Lisboa, 431

2

Sands China

Galaxy Entertainment

SJM Holdings

Wynn Macau Ltd.

1,400

Melco

1,982

MGM Cotai

1,400

MGM Grand, 582

MGM China

With a Market-Leading ~US$15 Billion of Investment by 2020, SCL Hotel Inventory is Forecast to Represent

~49% of Hotel Rooms on Cotai

1. In addition to the hotel rooms that are owned by gaming operators, there are approximately 9,242 additional four- and five-star hotel rooms owned by non-gaming operators in Macao at December 31, 2019.

2. Reflects only SJM Holdings owned hotels.

3. Upon completion, The Londoner hotel, will feature approximately 600 suites.

4. Reflects the opening of Galaxy Phase I and Phase II.

Source: Public company filings, Macao DSEC, Macao Tourism Board.

Sands

35View entire presentation