Carlyle Investor Conference Presentation Deck

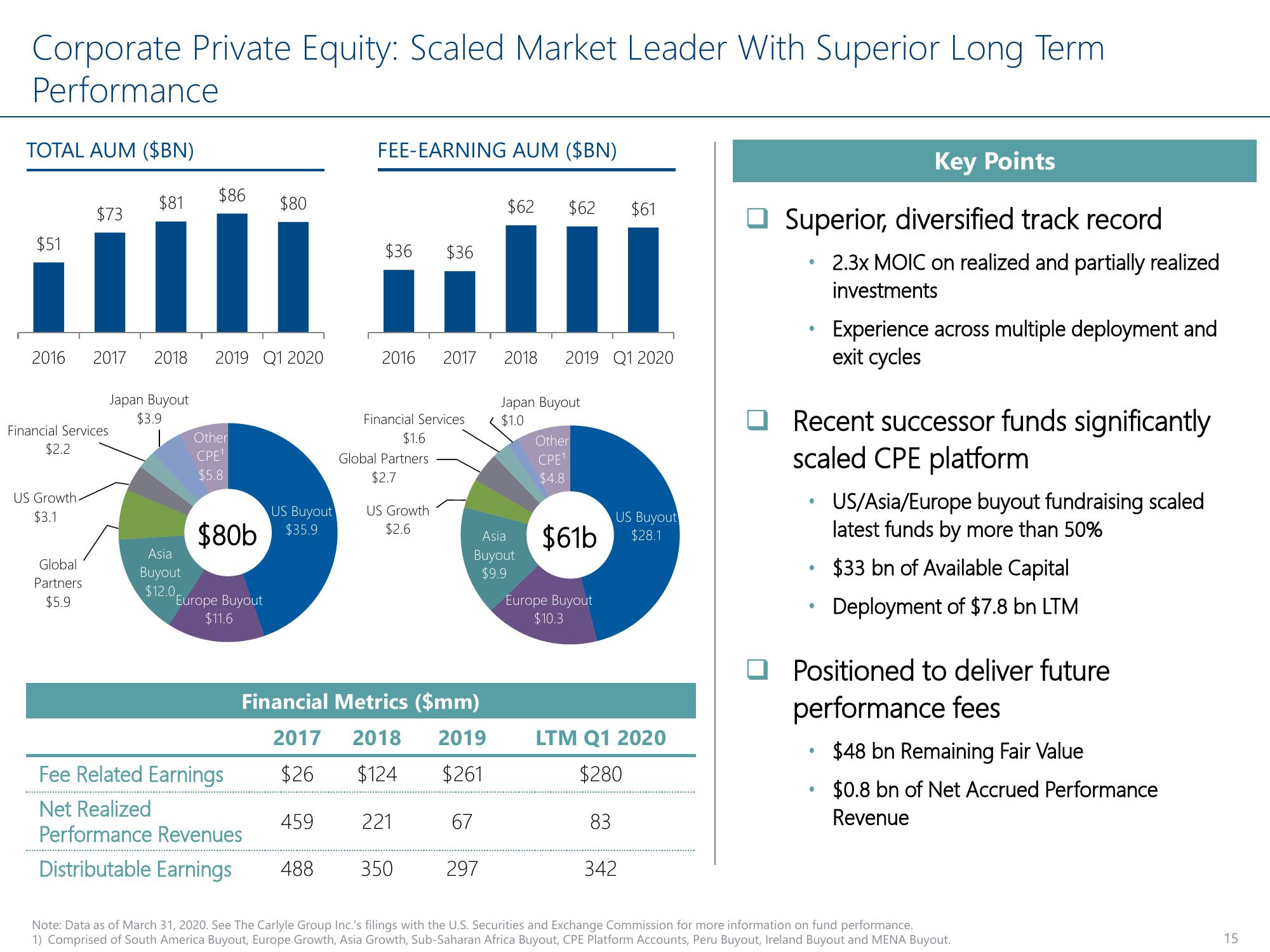

Corporate Private Equity: Scaled Market Leader With Superior Long Term

Performance

TOTAL AUM ($BN)

$73

US Growth.

$3.1

$51

1

2016 2017 2018 2019 Q1 2020

Financial Services

$2.2

Global

Partners

$5.9

$86

$81

Japan Buyout

$3.9

Asia

Buyout

$12.0,

Other

CPE¹

$5.8

$80b

Europe Buyout

$11.6

$80

Fee Related Earnings

Net Realized

Performance Revenues

Distributable Earnings

US Buyout

$35.9

459

FEE-EARNING AUM ($BN)

488

$36 $36

2016 2017

Financial Services

$1.6

Global Partners

$2.7

Financial Metrics ($mm)

2017 2018 2019

$26

$124

$261

US Growth

$2.6

221

350

67

$62

297

2018 2019 Q1 2020

Asia

Buyout

$9.9

$62 $61

Japan Buyout

< $1.0

Other

CPE1

$4.8

$61b

Europe Buyout

$10.3

US Buyout

$28.1

LTM Q1 2020

$280

83

342

Key Points

Superior, diversified track record

●

2.3x MOIC on realized and partially realized

investments

Recent successor funds significantly

scaled CPE platform

●

Experience across multiple deployment and

exit cycles

·

Positioned to deliver future

performance fees

US/Asia/Europe buyout fundraising scaled

latest funds by more than 50%

$33 bn of Available Capital

Deployment of $7.8 bn LTM

$48 bn Remaining Fair Value

$0.8 bn of Net Accrued Performance

Revenue

Note: Data as of March 31, 2020. See The Carlyle Group Inc.'s filings with the U.S. Securities and Exchange Commission for more information on fund performance.

1) Comprised of South America Buyout, Europe Growth, Asia Growth, Sub-Saharan Africa Buyout, CPE Platform Accounts, Peru Buyout, Ireland Buyout and MENA Buyout.

15View entire presentation