BlackSky SPAC Presentation Deck

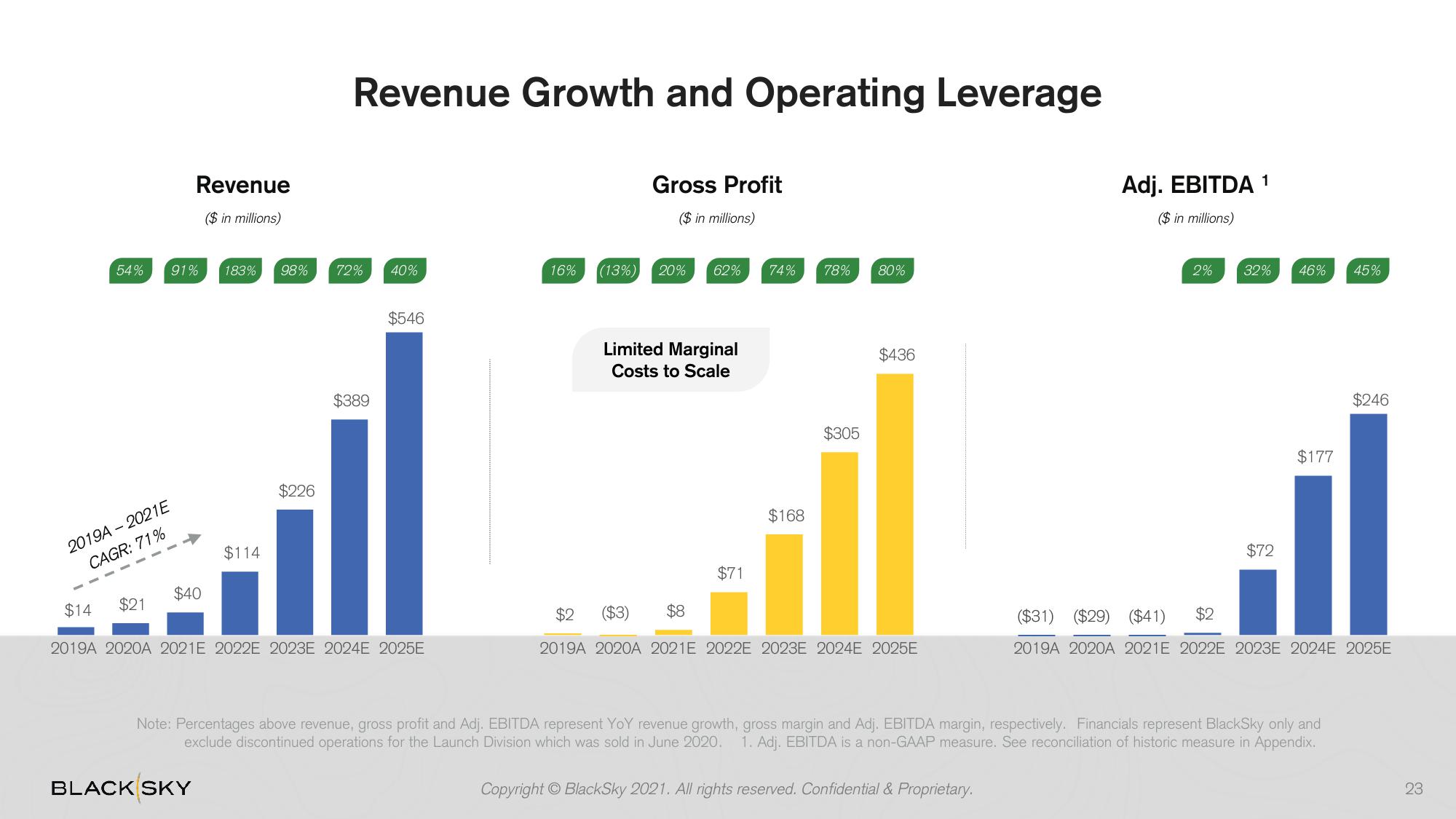

54%

$14

2019A-2021E

CAGR: 71%

$21

Revenue

91% 183% 98% 72%

$40

($ in millions)

BLACK SKY

$114

Revenue Growth and Operating Leverage

$226

$389

40%

$546

2019A 2020A 2021E 2022E 2023E 2024 2025E

Gross Profit

($ in millions)

16% (13%) 20% 62%

Limited Marginal

Costs to Scale

$71

74% 78%

$168

$305

80%

$436

$2 ($3) $8

2019A 2020A 2021E 2022E 2023E 2024 2025E

Adj. EBITDA 1

($ in millions)

Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary.

2% 32% 46% 45%

$72

$177

Note: Percentages above revenue, gross profit and Adj. EBITDA represent YoY revenue growth, gross margin and Adj. EBITDA margin, respectively. Financials represent BlackSky only and

exclude discontinued operations for the Launch Division which was sold in June 2020. 1. Adj. EBITDA is a non-GAAP measure. See reconciliation of historic measure in Appendix.

$246

($31) ($29) ($41) $2

2019A 2020A 2021E 2022E 2023E 2024 2025E

23View entire presentation