Third Quarter 2019 Results

2018 Non-GAAP Financial Measures - 2018 Excluding Net

Gain on Dispositions, Repositioning Actions and Tax Reform

Act Adjustments

Operating Profit

(a)

Net Interest Expense

Income Tax Expense (¹)

Income from Equity

Method Investments

Net Income Attributed to

Noncontrolling Interests

Net Income - Omnicom

Group Inc.

Earnings per Share -

Diluted

OmnicomGroup

$

LA

2018

Third Quarter

502.3 $

56.7

115.3

1.0

Non-GAAP

Adjustments

32.4

298.9 $

1.32 $

29.0 $

3.9

|

6.9

Non-GAAP

2018

Adjusted

18.2 $

0.08 $

56.7

473.3 $ 1,506.3 $

111.4

1.0

25.5

$

1.24 $

2018

280.7

156.1

343.0

3.6

Year to Date

Non-GAAP

Adjustments

83.6

927.2 $

4.06 $

29.0 $

|

3.9

6.9

Non-GAAP

2018

Adjusted

18.2 $

0.08 $

October 15, 2019

1,477.3

156.1

339.1

3.6

76.7

909.0

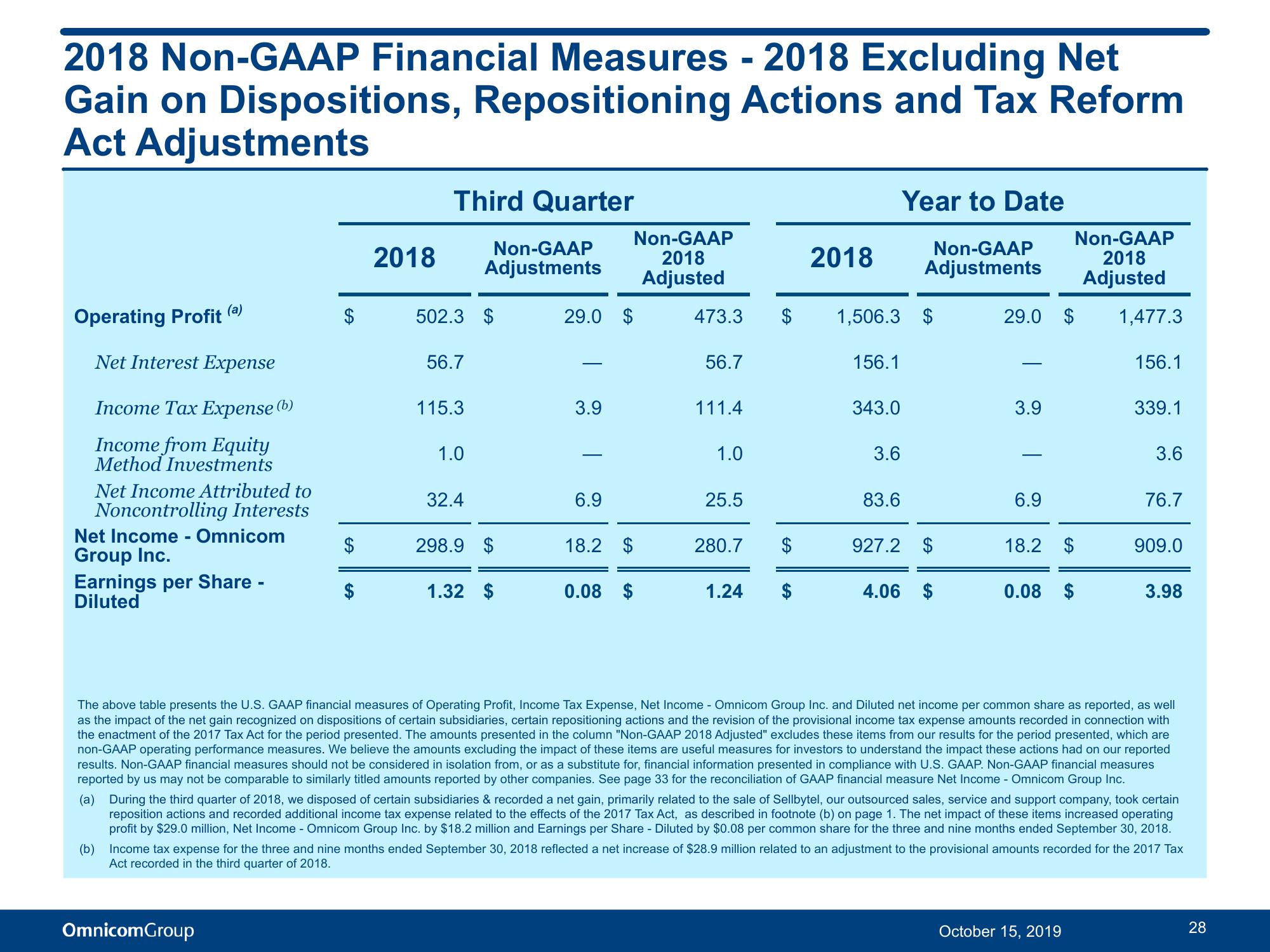

The above table presents the U.S. GAAP financial measures of Operating Profit, Income Tax Expense, Net Income - Omnicom Group Inc. and Diluted net income per common share as reported, as well

as the impact of the net gain recognized on dispositions of certain subsidiaries, certain repositioning actions and the revision of the provisional income tax expense amounts recorded in connection with

the enactment of the 2017 Tax Act for the period presented. The amounts presented in the column "Non-GAAP 2018 Adjusted" excludes these items from our results for the period presented, which are

non-GAAP operating performance measures. We believe the amounts excluding the impact of these items are useful measures for investors to understand the impact these actions had on our reported

results. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U.S. GAAP. Non-GAAP financial measures

reported by us may not be comparable to similarly titled amounts reported by other companies. See page 33 for the reconciliation of GAAP financial measure Net Income - Omnicom Group Inc.

(a) During the third quarter of 2018, we disposed of certain subsidiaries & recorded a net gain, primarily related to the sale of Sellbytel, our outsourced sales, service and support company, took certain

reposition actions and recorded additional income tax expense related to the effects of the 2017 Tax Act, as described in footnote (b) on page 1. The net impact of these items increased operating

profit by $29.0 million, Net Income - Omnicom Group Inc. by $18.2 million and Earnings per Share - Diluted by $0.08 per common share for the three and nine months ended September 30, 2018.

(b) Income tax expense for the three and nine months ended September 30, 2018 reflected a net increase of $28.9 million related to an adjustment to the provisional amounts recorded for the 2017 Tax

Act recorded in the third quarter of 2018.

3.98

28View entire presentation