Olaplex Results Presentation Deck

1.

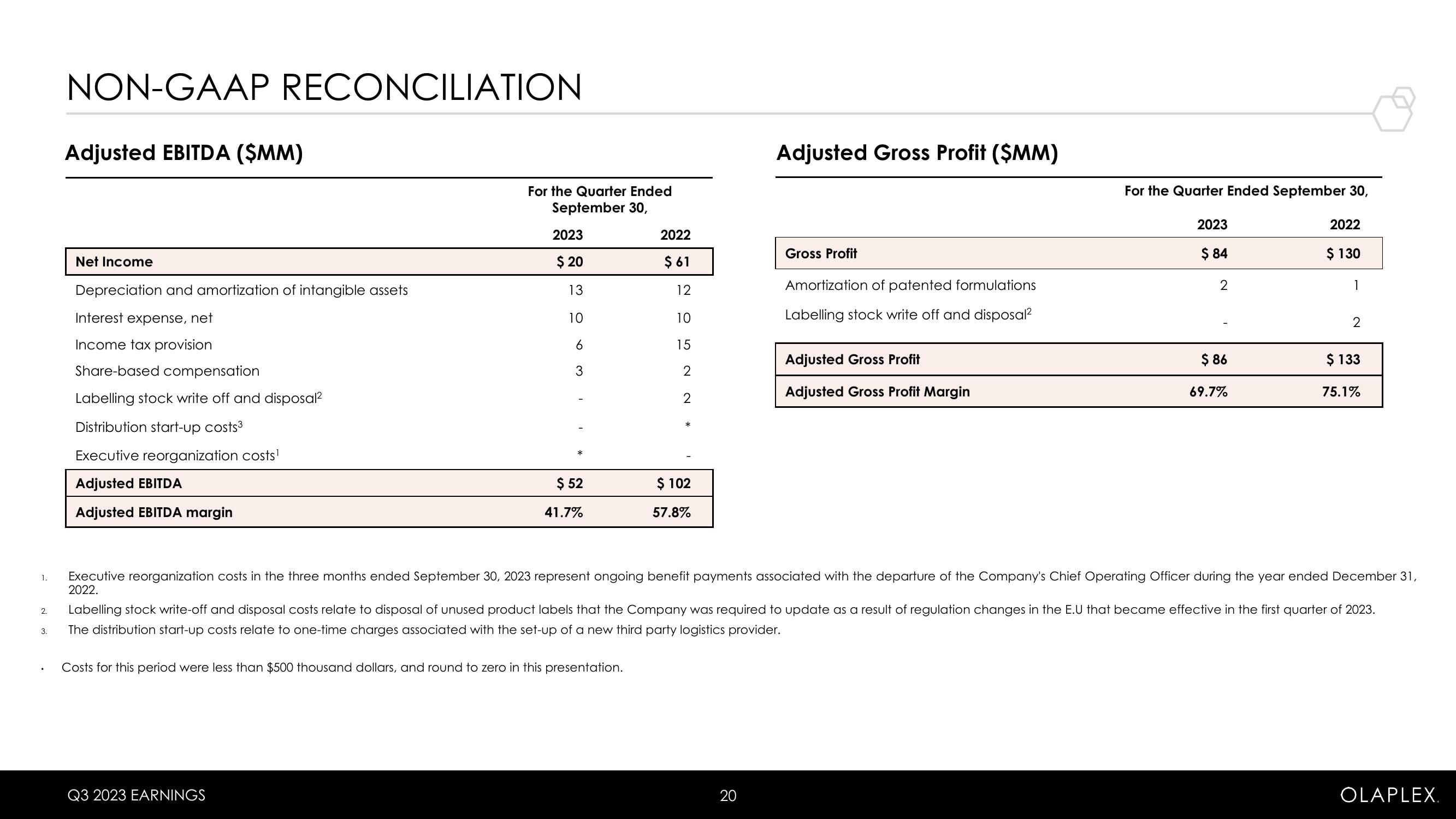

NON-GAAP RECONCILIATION

3.

Adjusted EBITDA ($MM)

Net Income

Depreciation and amortization of intangible assets

Interest expense, net

Income tax provision

Share-based compensation

Labelling stock write off and disposal²

Distribution start-up costs³

Executive reorganization costs¹

Adjusted EBITDA

Adjusted EBITDA margin

For the Quarter Ended

September 30,

2023

$ 20

13

10

6

3

$ 52

41.7%

Q3 2023 EARNINGS

2022

$ 61

12

10

15

2

2

Costs for this period were less than $500 thousand dollars, and round to zero in this presentation.

*

$ 102

57.8%

Adjusted Gross Profit ($MM)

Gross Profit

20

Amortization of patented formulations

Labelling stock write off and disposal²

Adjusted Gross Profit

Adjusted Gross Profit Margin

For the Quarter Ended September 30,

2023

$ 84

2

$ 86

69.7%

2022

$ 130

1

2

Executive reorganization costs in the three months ended September 30, 2023 represent ongoing benefit payments associated with the departure of the Company's Chief Operating Officer during the year ended December 31,

2022.

2. Labelling stock write-off and disposal costs relate to disposal of unused product labels that the Company was required to update as a result of regulation changes in the E.U that became effective in the first quarter of 2023.

The distribution start-up costs relate to one-time charges associated with the set-up of a new third party logistics provider.

$ 133

75.1%

OLAPLEX.View entire presentation