AngloAmerican Results Presentation Deck

2022 simplified earnings by BU - notes

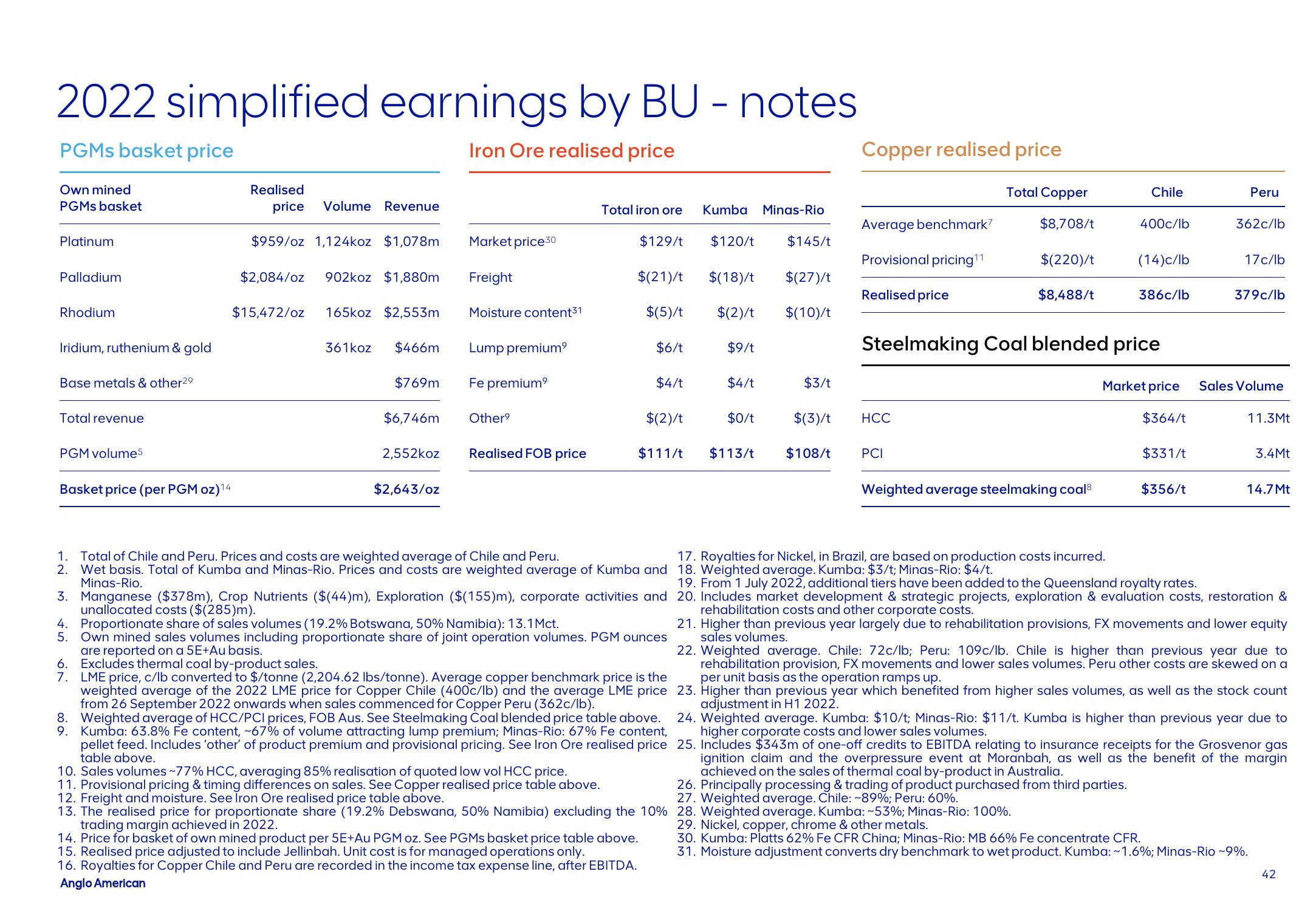

PGMs basket price

Iron Ore realised price

Own mined

PGMs basket

Platinum

Palladium

Rhodium

Iridium, ruthenium & gold

Base metals & other29

Total revenue

PGM volume5

Total iron ore Kumba Minas-Rio

$959/oz 1,124koz $1,078m Market price 30

$129/t $120/t $145/t

$2,084/oz 902koz $1,880m Freight

$(21)/t $(18)/t $(27)/t

$15,472/oz 165koz $2,553m Moisture content31

$(5)/t $(2)/t

2012

361koz $466m Lump premium⁹

$6/t

$9/t

$769m Fe premium

$4/t

$4/t

$(2)/t

$0/t $(3)/t HCC

2,552koz Realised FOB price

$111/t $113/t $108/t PCI

Basket price (per PGM oz)14

Realised

6.

7.

price Volume Revenue

$6,746m Other⁹

$2,643/oz

1. Total of Chile and Peru. Prices and costs are weighted average of Chile and Peru.

2.

Wet basis. Total of Kumba and Minas-Rio. Prices and costs are weighted average of Kumba and

Minas-Rio.

3. Manganese ($378m), Crop Nutrients ($(44)m), Exploration ($(155)m), corporate activities and

unallocated costs ($(285)m).

4. Proportionate share of sales volumes (19.2% Botswana, 50% Namibia): 13.1 Mct.

5. Own mined sales volumes including proportionate share of joint operation volumes. PGM ounces

are reported on a 5E+Au basis.

Excludes thermal coal by-product sales.

LME price, c/lb converted to $/tonne (2,204.62 lbs/tonne). Average copper benchmark price is the

weighted average of the 2022 LME price for Copper Chile (400c/lb) and the average LME price

from 26 September 2022 onwards when sales commenced for Copper Peru (362c/lb).

8. Weighted average of HCC/PCI prices, FOB Aus. See Steelmaking Coal blended price table above.

9. Kumba: 63.8% Fe content, ~67% of volume attracting lump premium; Minas-Rio: 67% Fe content,

pellet feed. Includes 'other' of product premium and provisional pricing. See Iron Ore realised price

table above.

10. Sales volumes ~77% HCC, averaging 85% realisation of quoted low vol HCC price.

11. Provisional pricing & timing differences on sales. See Copper realised price table above.

12. Freight and moisture. See Iron Ore realised price table above.

13. The realised price for proportionate share (19.2% Debswana, 50% Namibia) excluding the 10%

trading margin achieved in 2022.

14. Price for basket of own mined product per 5E+Au PGM oz. See PGMs basket price table above.

15. Realised price adjusted to include Jellinbah. Unit cost is for managed operations only.

16. Royalties for Copper Chile and Peru are recorded in the income tax expense line, after EBITDA.

Anglo American

$(10)/t

Copper realised price

$3/t

Average benchmark7

Provisional pricing¹1

Realised price

Total Copper

$8,708/t

$(220)/t

$8,488/t

Weighted average steelmaking coal

Chile

400c/lb

17. Royalties for Nickel, in Brazil, are based on production costs incurred.

18. Weighted average. Kumba: $3/t; Minas-Rio: $4/t.

(14)c/lb

Steelmaking Coal blended price

386c/lb

Market price

$364/t

$331/t

$356/t

Peru

362c/lb

17c/lb

379c/lb

Sales Volume

11.3Mt

3.4Mt

14.7 Mt

19. From 1 July 2022, additional tiers have been added to the Queensland royalty rates.

20. Includes market development & strategic projects, exploration & evaluation costs, restoration &

rehabilitation costs and other corporate costs.

21. Higher than previous year largely due to rehabilitation provisions, FX movements and lower equity

sales volumes.

22. Weighted average. Chile: 72c/lb; Peru: 109c/lb. Chile is higher than previous year due to

rehabilitation provision, FX movements and lower sales volumes. Peru other costs are skewed on a

per unit basis as the operation ramps up.

23. Higher than previous year which benefited from higher sales volumes, as well as the stock count

adjustment in H1 2022.

24. Weighted average. Kumba: $10/t; Minas-Rio: $11/t. Kumba is higher than previous year due to

higher corporate costs and lower sales volumes.

27. Weighted average. Chile: ~89%; Peru: 60%.

28. Weighted average. Kumba: ~53%; Minas-Rio: 100%.

29. Nickel, copper, chrome & other metals.

30. Kumba: Platts 62% Fe CFR China; Minas-Rio: MB 66% Fe concentrate CFR.

31. Moisture adjustment converts dry benchmark to wet product. Kumba: ~1.6%; Minas-Rio ~9%.

25. Includes $343m of one-off credits to EBITDA relating to insurance receipts for the Grosvenor gas

ignition claim and the overpressure event at Moranbah, as well as the benefit of the margin

achieved on the sales of thermal coal by-product in Australia.

26. Principally processing & trading of product purchased from third parties.

42View entire presentation