Nuvei Results Presentation Deck

Financial Outlook

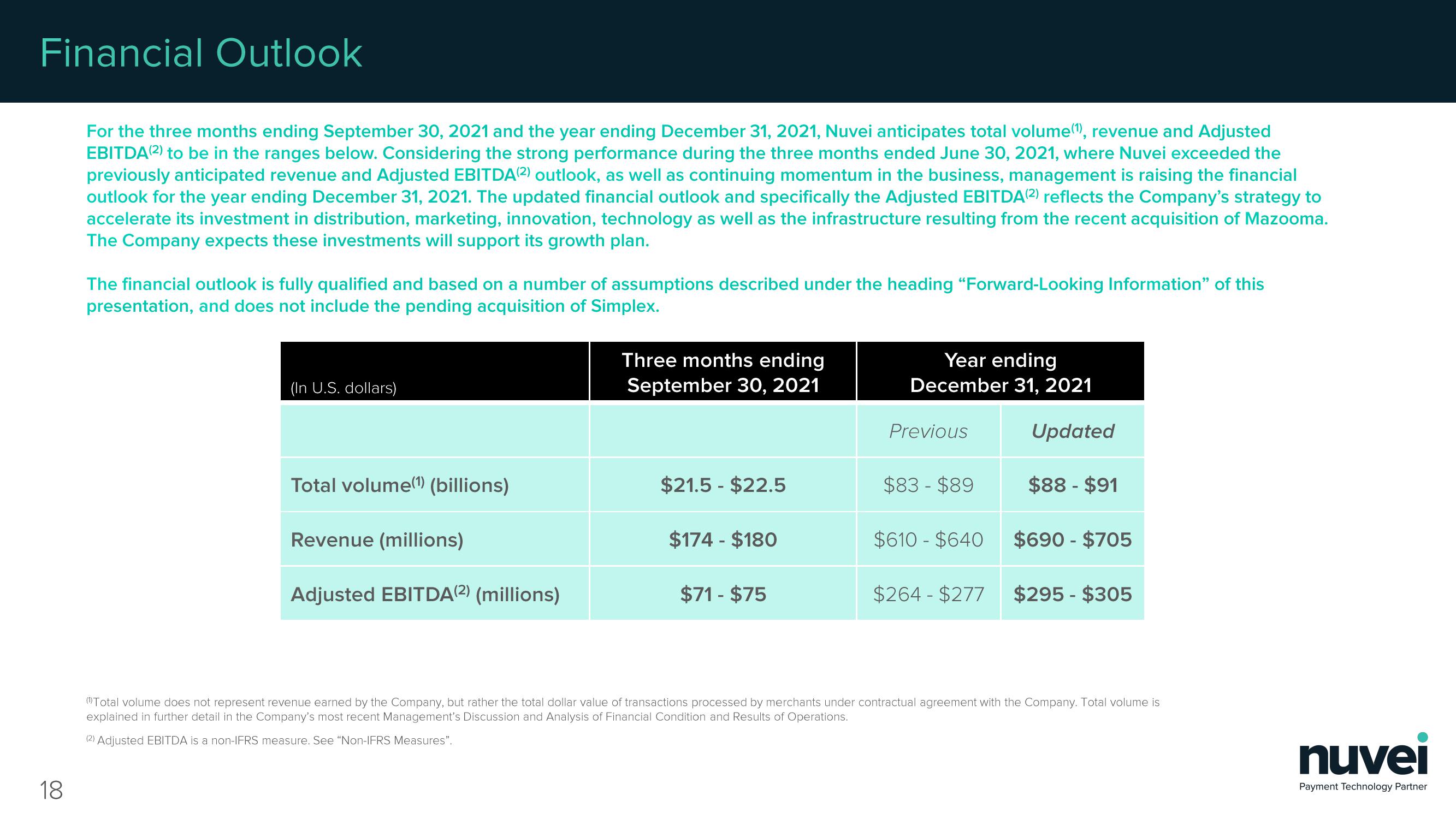

For the three months ending September 30, 2021 and the year ending December 31, 2021, Nuvei anticipates total volume(¹), revenue and Adjusted

EBITDA (2) to be in the ranges below. Considering the strong performance during the three months ended June 30, 2021, where Nuvei exceeded the

previously anticipated revenue and Adjusted EBITDA(2) outlook, as well as continuing momentum in the business, management is raising the financial

outlook for the year ending December 31, 2021. The updated financial outlook and specifically the Adjusted EBITDA(2) reflects the Company's strategy to

accelerate its investment in distribution, marketing, innovation, technology as well as the infrastructure resulting from the recent acquisition of Mazooma.

The Company expects these investments will support its growth plan.

18

The financial outlook is fully qualified and based on a number of assumptions described under the heading "Forward-Looking Information" of this

presentation, and does not include the pending acquisition of Simplex.

(In U.S. dollars)

Total volume(¹) (billions)

Revenue (millions)

Adjusted EBITDA(2) (millions)

Three months ending

September 30, 2021

$21.5 - $22.5

$174 - $180

$71 - $75

Year ending

December 31, 2021

Previous

$83 - $89

$610 - $640

$264 - $277

Updated

$88 - $91

$690 - $705

$295 - $305

(1)Total volume es not represent revenue earned by the Company, but rather the total dollar value of transactions processed by merchants under contractual agreement with the Company. Total volume is

explained in further detail in the Company's most recent Management's Discussion and Analysis of Financial Condition and Results of Operations.

(2) Adjusted EBITDA is a non-IFRS measure. See "Non-IFRS Measures".

nuvei

Payment Technology PartnerView entire presentation