Cboe Results Presentation Deck

2021 Full-Year Guidance Summary

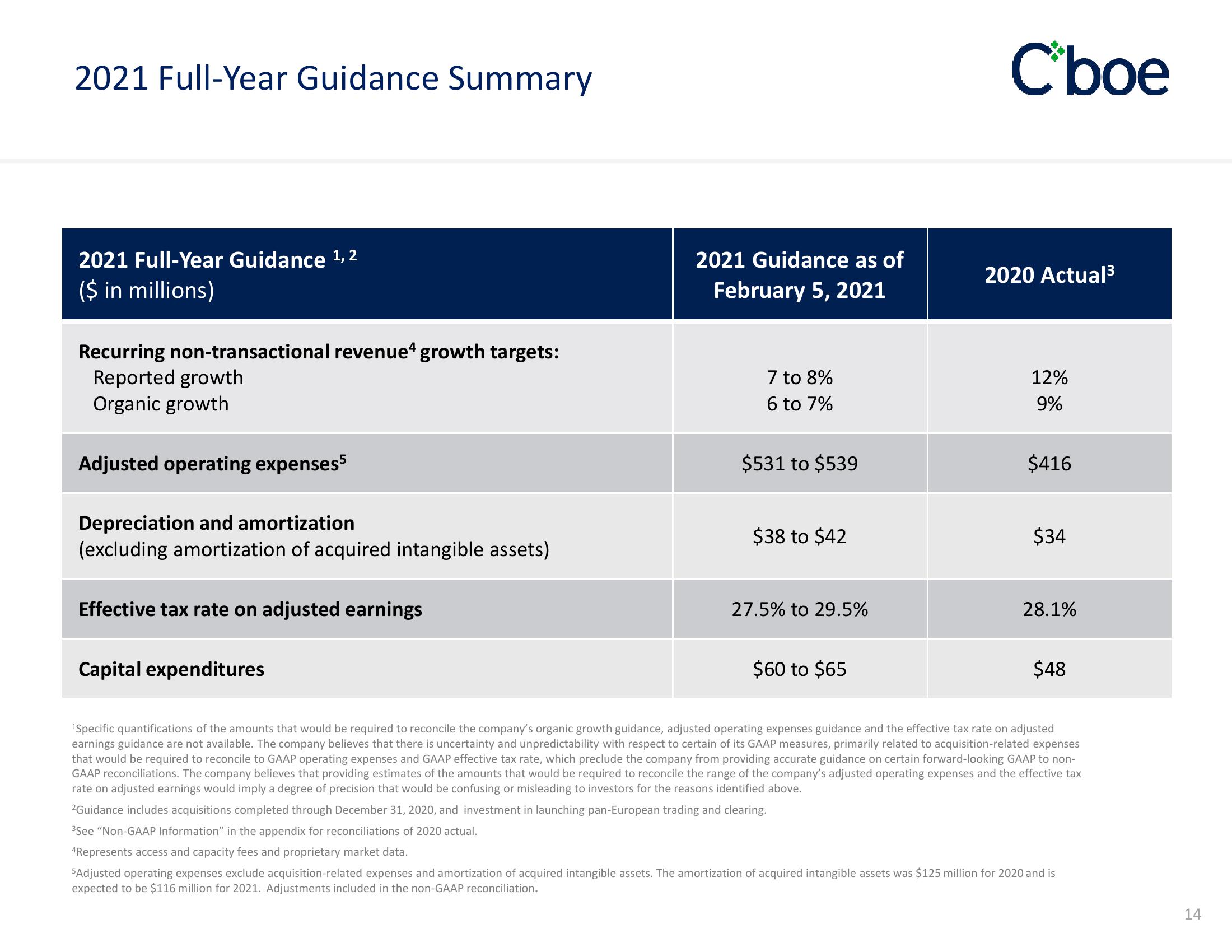

2021 Full-Year Guidance 1, 2

($ in millions)

Recurring non-transactional revenue growth targets:

Reported growth

Organic growth

Adjusted operating expenses5

Depreciation and amortization

(excluding amortization of acquired intangible assets)

Effective tax rate on adjusted earnings

Capital expenditures

2021 Guidance as of

February 5, 2021

7 to 8%

6 to 7%

$531 to $539

$38 to $42

27.5% to 29.5%

$60 to $65

Cboe

2020 Actual³

12%

9%

$416

$34

28.1%

$48

¹Specific quantifications of the amounts that would be required to reconcile the company's organic growth guidance, adjusted operating expenses guidance and the effective tax rate on adjusted

earnings guidance are not available. The company believes that there is uncertainty and unpredictability with respect to certain of its GAAP measures, primarily related to acquisition-related expenses

that would be required to reconcile to GAAP operating expenses and GAAP effective tax rate, which preclude the company from providing accurate guidance on certain forward-looking GAAP to non-

GAAP reconciliations. The company believes that providing estimates of the amounts that would be required to reconcile the range of the company's adjusted operating expenses and the effective tax

rate on adjusted earnings would imply a degree of precision that would be confusing or misleading to investors for the reasons identified above.

²Guidance includes acquisitions completed through December 31, 2020, and investment in launching pan-European trading and clearing.

³See "Non-GAAP Information" in the appendix for reconciliations of 2020 actual.

4Represents access and capacity fees and proprietary market data.

5Adjusted operating expenses exclude acquisition-related expenses and amortization of acquired intangible assets. The amortization of acquired intangible assets was $125 million for 2020 and is

expected to be $116 million for 2021. Adjustments included in the non-GAAP reconciliation.

14View entire presentation