Paysafe Results Presentation Deck

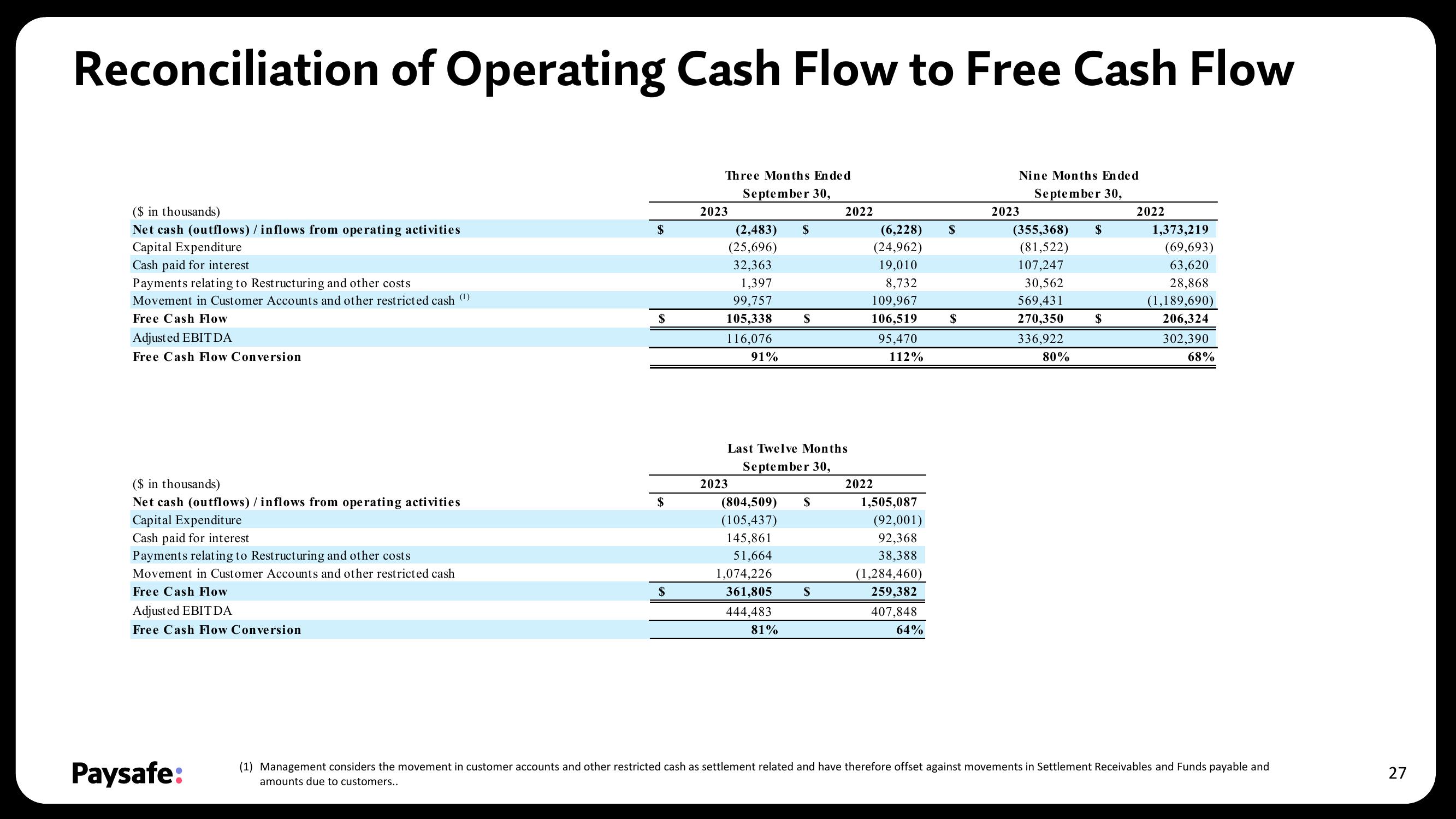

Reconciliation of Operating Cash Flow to Free Cash Flow

($ in thousands)

Net cash (outflows) / inflows from operating activities

Capital Expenditure

Cash paid for interest

Payments relating to Restructuring and other costs

Movement in Customer Accounts and other restricted cash (¹)

Free Cash Flow

Adjusted EBITDA

Free Cash Flow Conversion

($ in thousands)

Net cash (outflows) / inflows from operating activities

Capital Expenditure

Cash paid for interest

Payments relating to Restructuring and other costs

Movement in Customer Accounts and other restricted cash

Free Cash Flow

Adjusted EBITDA

Free Cash Flow Conversion

Paysafe:

$

$

$

$

Three Months Ended

September 30,

2023

(2,483) $

(25,696)

32,363

1,397

99,757

105,338

116,076

91%

2023

$

Last Twelve Months

September 30,

(804,509) $

(105,437)

145,861

51,664

1,074,226

361,805

444,483

81%

2022

$

(6,228)

(24,962)

19,010

8,732

109,967

106,519

95,470

112%

2022

1,505,087

(92,001)

92,368

38,388

(1,284,460)

259,382

407,848

64%

$

$

Nine Months Ended

September 30,

2023

(355,368) $

(81,522)

107,247

30,562

569,431

270,350

336,922

80%

$

2022

1,373,219

(69,693)

63,620

28,868

(1,189,690)

206,324

302,390

68%

(1) Management considers the movement in customer accounts and other restricted cash as settlement related and have therefore offset against movements in Settlement Receivables and Funds payable and

amounts due to customers..

27View entire presentation