HSBC Results Presentation Deck

Business highlights

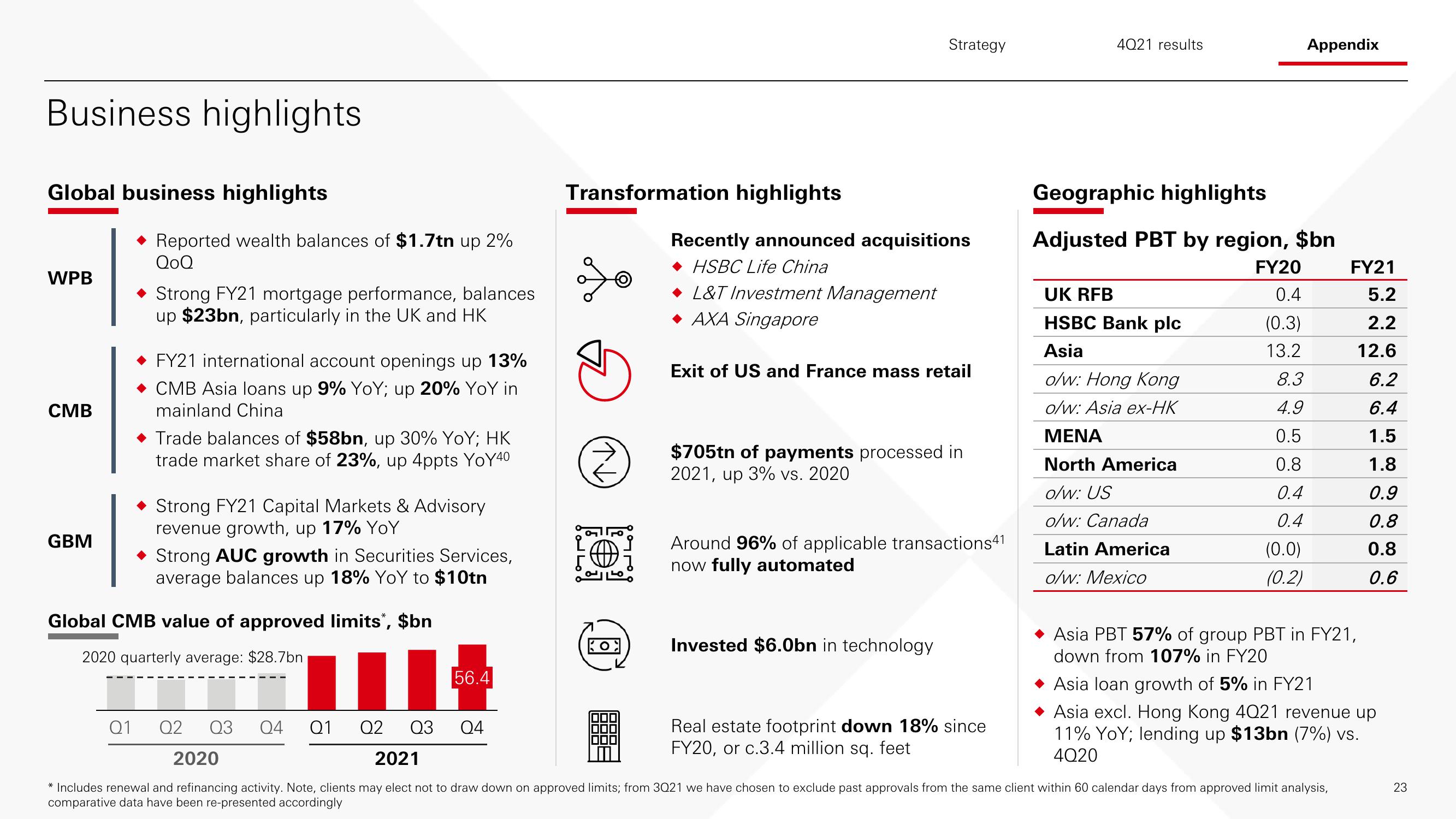

Global business highlights

WPB

CMB

GBM

◆ Reported wealth balances of $1.7tn up 2%

QoQ

◆ Strong FY21 mortgage performance, balances

up $23bn, particularly in the UK and HK

Q1

FY21 international account openings up 13%

◆ CMB Asia loans up 9% YoY; up 20% YoY in

mainland China

◆ Trade balances of $58bn, up 30% YoY; HK

trade market share of 23%, up 4ppts YoY40

Strong FY21 Capital Markets & Advisory

revenue growth, up 17% YoY

◆ Strong AUC growth in Securities Services,

average balances up 18% YoY to $10tn

Global CMB value of approved limits*, $bn

2020 quarterly average: $28.7bn

II

Q2 Q3 Q4

56.4

Transformation highlights

KOX

Strategy

Recently announced acquisitions

HSBC Life China

L&T Investment Management

AXA Singapore

Exit of US and France mass retail

$705tn of payments processed in

2021, up 3% vs. 2020

Around 96% of applicable transactions41

now fully automated

Invested $6.0bn in technology

Real estate footprint down 18% since

FY20, or c.3.4 million sq. feet

4021 results

Geographic highlights

Adjusted PBT by region, $bn

FY20

0.4

(0.3)

13.2

8.3

4.9

0.5

0.8

0.4

0.4

UK RFB

HSBC Bank plc

Asia

o/w: Hong Kong

o/w: Asia ex-HK

ΜΕΝΑ

North America

o/w: US

o/w: Canada

Latin America

o/w: Mexico

Appendix

(0.0)

(0.2)

FY21

5.2

2.2

Asia PBT 57% of group PBT in FY21,

down from 107% in FY20

Q2 Q3 Q4 Q1

2020

2021

* Includes renewal and refinancing activity. Note, clients may elect not to draw down on approved limits; from 3021 we have chosen to exclude past approvals from the same client within 60 calendar days from approved limit analysis,

comparative data have been re-presented accordingly

12.6

6.2

6.4

1.5

1.8

0.9

0.8

0.8

0.6

Asia loan growth of 5% in FY21

Asia excl. Hong Kong 4021 revenue up

11% YoY; lending up $13bn (7%) vs.

4Q20

23View entire presentation