Spotify Results Presentation Deck

Operating Expenses

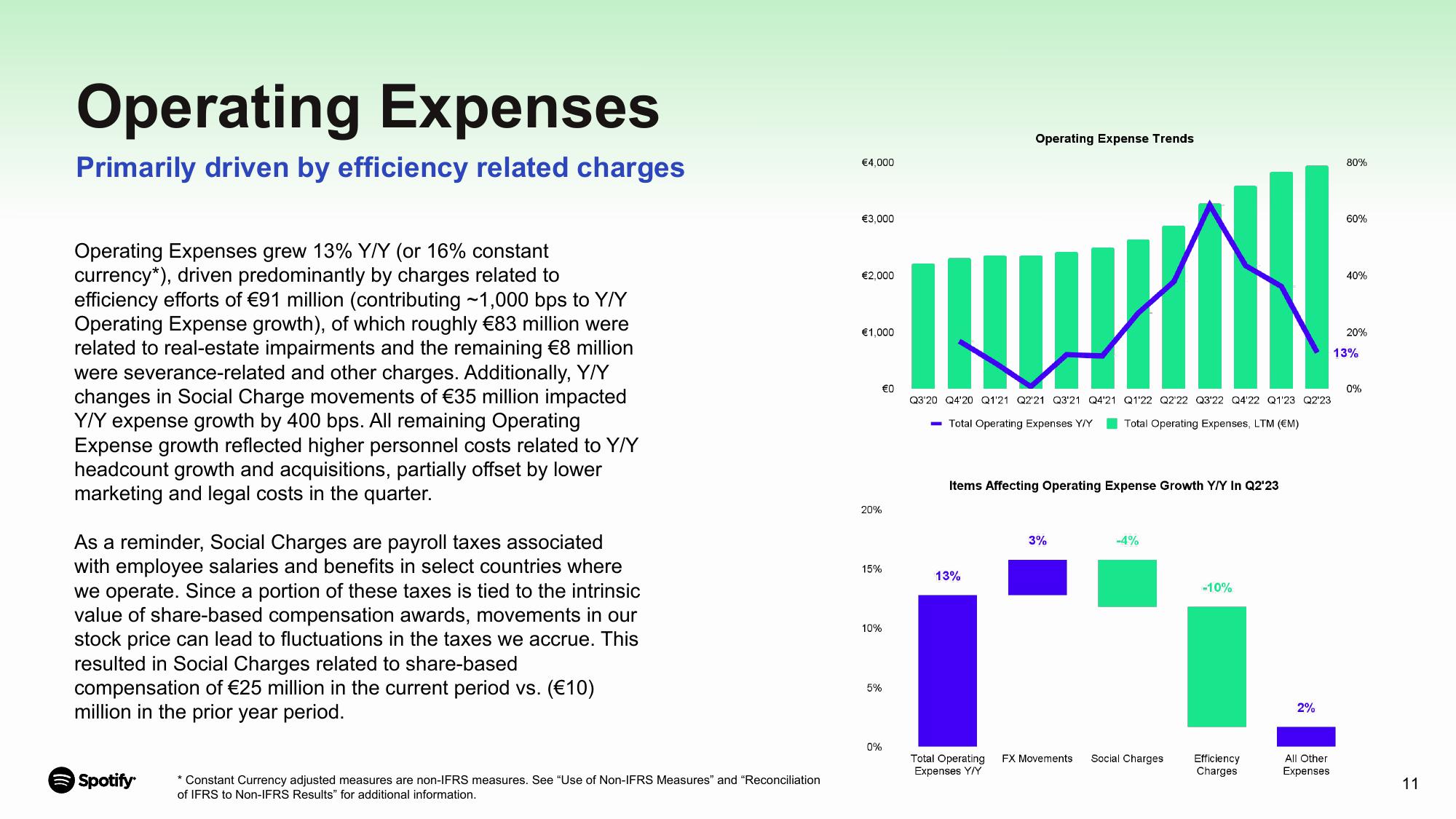

Primarily driven by efficiency related charges

Operating Expenses grew 13% Y/Y (or 16% constant

currency*), driven predominantly by charges related to

efficiency efforts of €91 million (contributing ~1,000 bps to Y/Y

Operating Expense growth), of which roughly €83 million were

related to real-estate impairments and the remaining €8 million

were severance-related and other charges. Additionally, Y/Y

changes in Social Charge movements of €35 million impacted

Y/Y expense growth by 400 bps. All remaining Operating

Expense growth reflected higher personnel costs related to Y/Y

headcount growth and acquisitions, partially offset by lower

marketing and legal costs in the quarter.

As a reminder, Social Charges are payroll taxes associated

with employee salaries and benefits in select countries where

we operate. Since a portion of these taxes is tied to the intrinsic

value of share-based compensation awards, movements in our

stock price can lead to fluctuations in the taxes we accrue. This

resulted in Social Charges related to share-based

compensation of €25 million in the current period vs. (€10)

million in the prior year period.

Spotify

* Constant Currency adjusted measures are non-IFRS measures. See "Use of Non-IFRS Measures" and "Reconciliation

of IFRS to Non-IFRS Results" for additional information.

€4,000

€3,000

€2,000

€1,000

20%

15%

10%

5%

€0

0%

Operating Expense Trends

INMI

Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

- Total Operating Expenses Y/Y Total Operating Expenses, LTM (EM)

13%

Items Affecting Operating Expense Growth Y/Y In Q2¹23

Total Operating

Expenses Y/Y

3%

FX Movements

TH

-4%

Social Charges

-10%

Efficiency

Charges

2%

All Other

Expenses

80%

60%

40%

20%

13%

0%

11View entire presentation