Pearson Results Presentation Deck

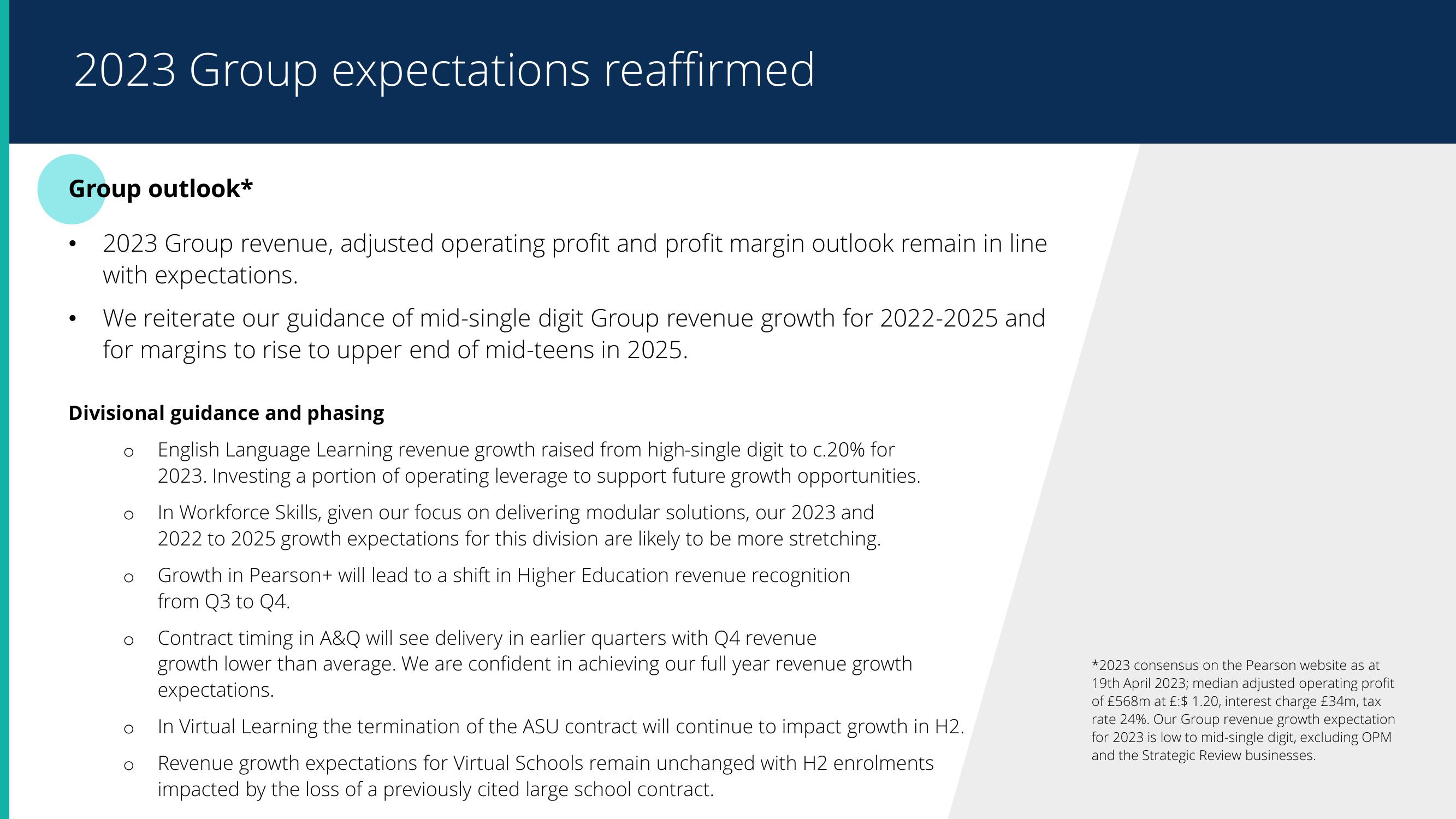

2023 Group expectations reaffirmed

Group outlook*

2023 Group revenue, adjusted operating profit and profit margin outlook remain in line

with expectations.

●

We reiterate our guidance of mid-single digit Group revenue growth for 2022-2025 and

for margins to rise to upper end of mid-teens in 2025.

Divisional guidance and phasing

O

O

O

O

O

O

English Language Learning revenue growth raised from high-single digit to c.20% for

2023. Investing a portion of operating leverage to support future growth opportunities.

In Workforce Skills, given our focus on delivering modular solutions, our 2023 and

2022 to 2025 growth expectations for this division are likely to be more stretching.

Growth in Pearson+ will lead to a shift in Higher Education revenue recognition

from Q3 to Q4.

Contract timing in A&Q will see delivery in earlier quarters with Q4 revenue

growth lower than average. We are confident in achieving our full year revenue growth

expectations.

In Virtual Learning the termination of the ASU contract will continue to impact growth in H2.

Revenue growth expectations for Virtual Schools remain unchanged with H2 enrolments

impacted by the loss of a previously cited large school contract.

*2023 consensus on the Pearson website as at

19th April 2023; median adjusted operating profit

of £568m at £:$ 1.20, interest charge £34m, tax

rate 24%. Our Group revenue growth expectation

for 2023 is low to mid-single digit, excluding OPM

and the Strategic Review businesses.View entire presentation