Allwyn Results Presentation Deck

Consolidated P&L

■

■

■

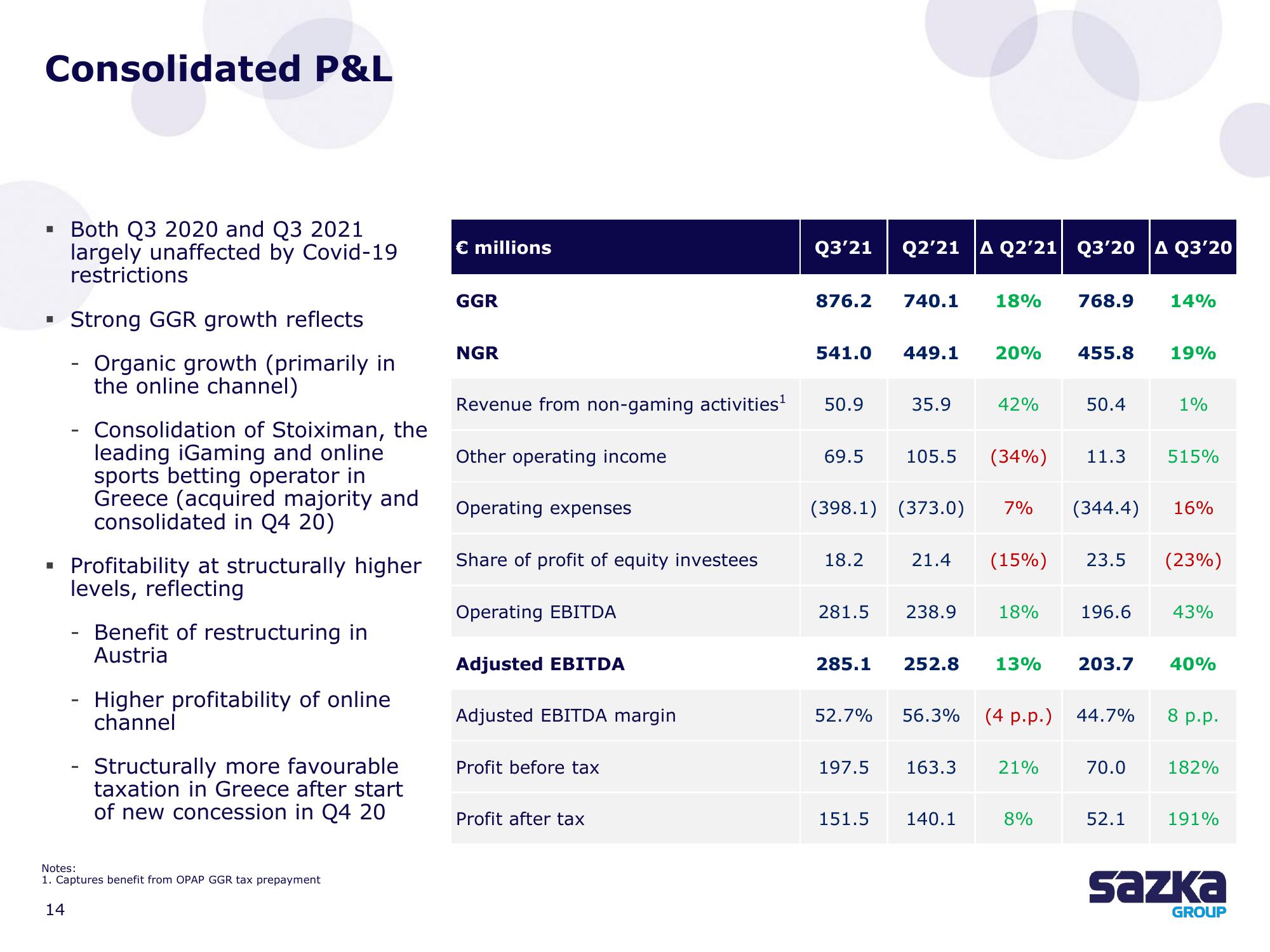

Both Q3 2020 and Q3 2021

largely unaffected by Covid-19

restrictions

Strong GGR growth reflects

Organic growth (primarily in

the online channel)

-

Consolidation of Stoiximan, the

leading iGaming and online

sports betting operator in

Greece (acquired majority and

consolidated in Q4 20)

Profitability at structurally higher

levels, reflecting

Benefit of restructuring in

Austria

- Higher profitability of online

channel

Structurally more favourable

taxation in Greece after start

of new concession in Q4 20

Notes:

1. Captures benefit from OPAP GGR tax prepayment

14

€ millions

GGR

NGR

Revenue from non-gaming activities¹

Other operating income

Operating expenses

Share of profit of equity investees

Operating EBITDA

Adjusted EBITDA

Adjusted EBITDA margin

Profit before tax

Profit after tax

Q3'21

876.2

541.0

50.9

69.5

18.2

285.1

52.7%

Q2'21 A Q2'21 Q3'20 A Q3'20

197.5

740.1 18%

151.5

449.1

35.9

281.5 238.9

105.5 (34%)

20% 455.8

42%

(398.1) (373.0) 7% (344.4) 16%

56.3%

163.3

21.4 (15%) 23.5

252.8 13%

140.1

18%

768.9

(4 p.p.)

21%

50.4

8%

11.3

196.6

203.7

44.7%

70.0

14%

52.1

19%

1%

515%

(23%)

43%

40%

8 p.p.

182%

191%

Sazka

GROUPView entire presentation