HashiCorp Investor Presentation Deck

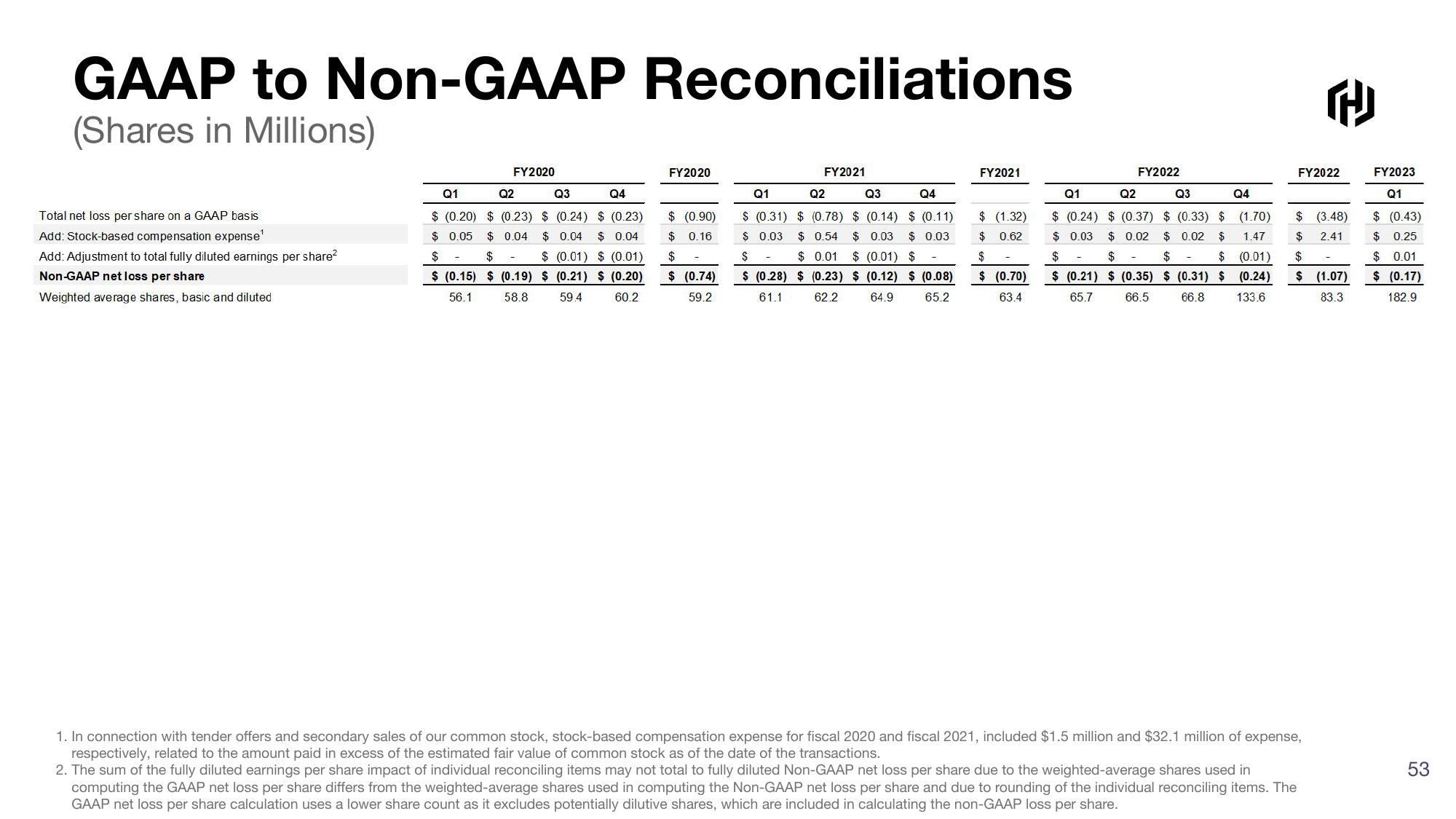

GAAP to Non-GAAP Reconciliations

(Shares in Millions)

Total net loss per share on a GAAP basis

Add: Stock-based compensation expense¹

Add: Adjustment to total fully diluted earnings per share²

Non-GAAP net loss per share

Weighted average shares, basic and diluted

FY2020

Q1

Q2

Q3

Q4

$ (0.20) $ (0.23) $ (0.24) $ (0.23)

$ 0.04 $ 0.04

$ 0.05 $ 0.04

$

$

$ (0.15) $ (0.19)

56.1

58.8

$ (0.01) $ (0.01)

$ (0.21) $ (0.20)

59.4

60.2

FY2020

$ (0.90)

$ 0.16

$

$ (0.74)

59.2

FY2021

Q1

Q2

Q3

Q4

$ (0.11)

$ (0.31) $ (0.78) $ (0.14)

$ 0.03

$ 0.54 $ 0.03 $ 0.03

$ 0.01 $ (0.01) $

$

$ (0.28) $ (0.23) $ (0.12) $ (0.08)

61.1

62.2

64.9

65.2

FY2021

$ (1.32)

$ 0.62

$

$ (0.70)

63.4

FY2022

Q1

Q2

Q3

$ (0.33) $

$ (0.24) $ (0.37)

$ 0.03

Q4

(1.70)

$ 1.47

$ 0.02

$

$ 0.02

$

$

$ (0.01)

$ (0.21) $ (0.35) $ (0.31) $ (0.24)

65.7

66.5

66.8 133.6

-

2

FY2022

(3.48)

$ 2.41

$

$ (1.07)

83.3

1. In connection with tender offers and secondary sales of our common stock, stock-based compensation expense for fiscal 2020 and fiscal 2021, included $1.5 million and $32.1 million of expense,

respectively, related to the amount paid in excess of the estimated fair value of common stock as of the date of the transactions.

2. The sum of the fully diluted earnings per share impact of individual reconciling items may not total to fully diluted Non-GAAP net loss per share due to the weighted-average shares used in

computing the GAAP net loss per share differs from the weighted-average shares used in computing the Non-GAAP net loss per share and due to rounding of the individual reconciling items. The

GAAP net loss per share calculation uses a lower share count as it excludes potentially dilutive shares, which are included in calculating the non-GAAP loss per share.

FY2023

Q1

$ (0.43)

$ 0.25

$ 0.01

$ (0.17)

182.9

53View entire presentation