Lilium: Revolutionizing Travel

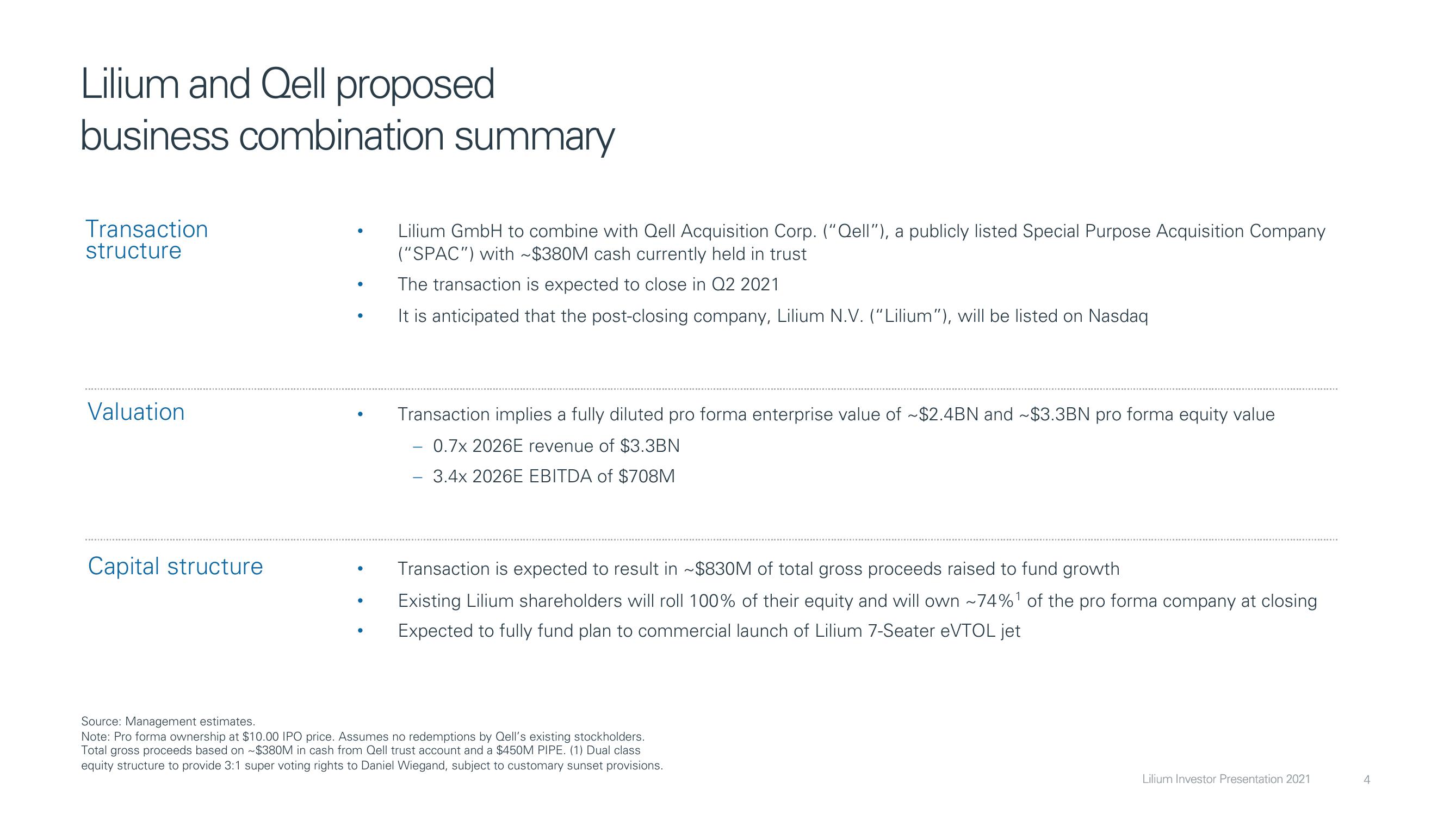

Lilium and Qell proposed

business combination summary

Transaction

structure

Valuation

Capital structure

●

●

Lilium GmbH to combine with Qell Acquisition Corp. ("Qell"), a publicly listed Special Purpose Acquisition Company

("SPAC") with ~$380M cash currently held in trust

The transaction is expected to close in Q2 2021

It is anticipated that the post-closing company, Lilium N.V. ("Lilium"), will be listed on Nasdaq

Transaction implies a fully diluted pro forma enterprise value of ~$2.4BN and ~$3.3BN pro forma equity value

0.7x 2026E revenue of $3.3BN

- 3.4x 2026E EBITDA of $708M

Transaction is expected to result in ~$830M of total gross proceeds raised to fund growth

Existing Lilium shareholders will roll 100% of their equity and will own ~74%¹ of the pro forma company at closing

Expected to fully fund plan to commercial launch of Lilium 7-Seater eVTOL jet

Source: Management estimates.

Note: Pro forma ownership at $10.00 IPO price. Assumes no redemptions by Qell's existing stockholders.

Total gross proceeds based on ~$380M in cash from Qell trust account and a $450M PIPE. (1) Dual class

equity structure to provide 3:1 super voting rights to Daniel Wiegand, subject to customary sunset provisions.

Lilium Investor Presentation 2021

4View entire presentation