Li-Cycle SPAC Presentation Deck

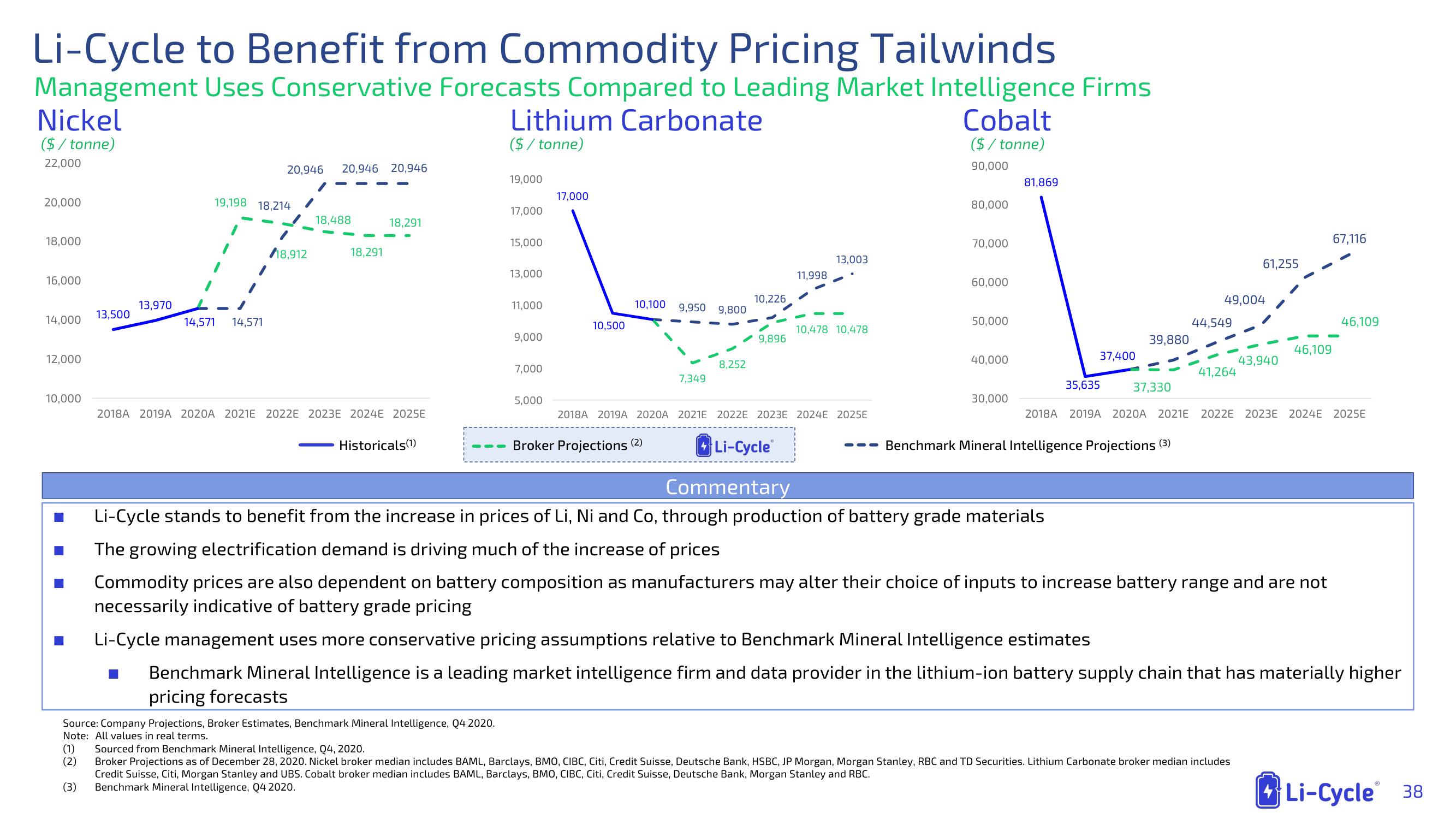

Li-Cycle to Benefit from Commodity Pricing Tailwinds

Management Uses Conservative Forecasts Compared to Leading Market Intelligence Firms

Cobalt

($ / tonne)

90,000

Nickel

($ / tonne)

22,000

20,000

18,000

16,000

14,000

12,000

10,000

13,500

(1)

(2)

(3)

13,970

20,946

19,198 18,214

14,571 14,571

118,912

20,946 20,946

18,488

18,291

18,291

2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025E

Lithium Carbonate

($/tonne)

Historicals (1)

19,000

17,000

15,000

13,000

11,000

9,000

7,000

5,000

17,000

10,500

10,100 9,950 9,800

7,349

8,252

Broker Projections (2)

10,226

9,896

11,998

13,003

10,478 10,478

2018A 2019A 2020A 2021E 2022E 2023E 2024 2025E

80,000

70,000

60,000

50,000

40,000

30,000

81,869

37,400

35,635

39,880

37,330

49,004

44,549

Benchmark Mineral Intelligence Projections (3)

41,264

61,255

Li-Cycle

Commentary

Li-Cycle stands to benefit from the increase in prices of Li, Ni and Co, through production of battery grade materials

The growing electrification demand is driving much of the increase of prices

Commodity prices are also dependent on battery composition as manufacturers may alter their choice of inputs to increase battery range and are not

necessarily indicative of battery grade pricing

Li-Cycle management uses more conservative pricing assumptions relative to Benchmark Mineral Intelligence estimates

43,940

46,109

Sourced from Benchmark Mineral Intelligence, Q4, 2020.

Broker Projections as of December 28, 2020. Nickel broker median includes BAML, Barclays, BMO, CIBC, Citi, Credit Suisse, Deutsche Bank, HSBC, JP Morgan, Morgan Stanley, RBC and TD Securities. Lithium Carbonate broker median includes

Credit Suisse, Citi, Morgan Stanley and UBS. Cobalt broker median includes BAML, Barclays, BMO, CIBC, Citi, Credit Suisse, Deutsche Bank, Morgan Stanley and RBC.

Benchmark Mineral Intelligence, Q4 2020.

2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025E

67,116

46,109

■ Benchmark Mineral Intelligence is a leading market intelligence firm and data provider in the lithium-ion battery supply chain that has materially higher

pricing forecasts

Source: Company Projections, Broker Estimates, Benchmark Mineral Intelligence, Q4 2020.

Note: All values in real terms.

Li-Cycle 38View entire presentation