Apollo Global Management Investor Day Presentation Deck

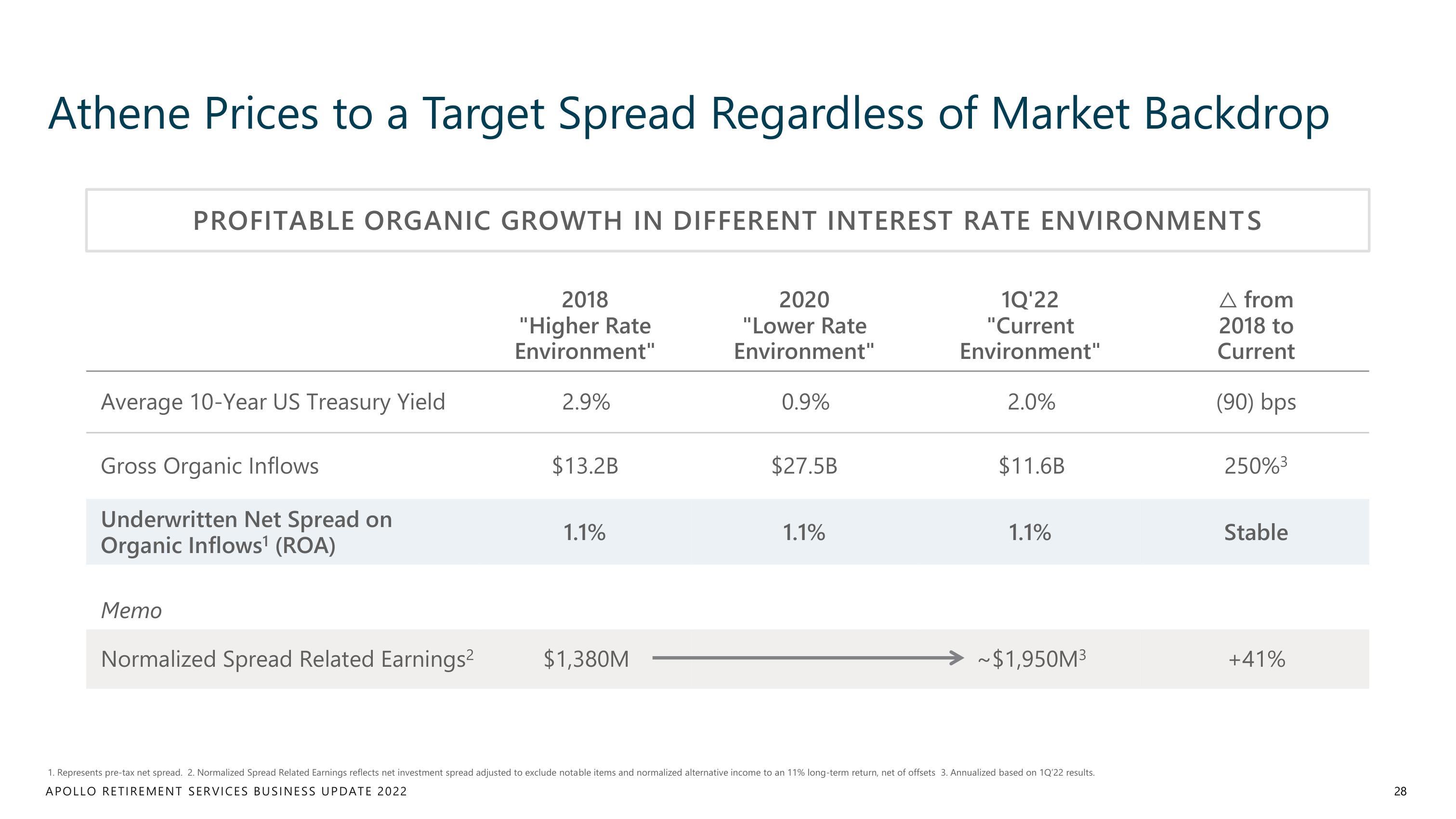

Athene Prices to a Target Spread Regardless of Market Backdrop

PROFITABLE ORGANIC GROWTH IN DIFFERENT INTEREST RATE ENVIRONMENTS

Average 10-Year US Treasury Yield

Gross Organic Inflows

Underwritten Net Spread on

Organic Inflows¹ (ROA)

Memo

Normalized Spread Related Earnings²

2018

"Higher Rate

Environment"

2.9%

$13.2B

1.1%

$1,380M

2020

"Lower Rate

Environment"

0.9%

$27.5B

1.1%

1Q'22

"Current

Environment"

2.0%

$11.6B

1.1%

~$1,950M³

1. Represents pre-tax net spread. 2. Normalized Spread Related Earnings reflects net investment spread adjusted to exclude notable items and normalized alternative income to an 11% long-term return, net of offsets 3. Annualized based on 1Q'22 results.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

A from

2018 to

Current

(90) bps

250%³

Stable

+41%

28View entire presentation