Evercore Investment Banking Pitch Book

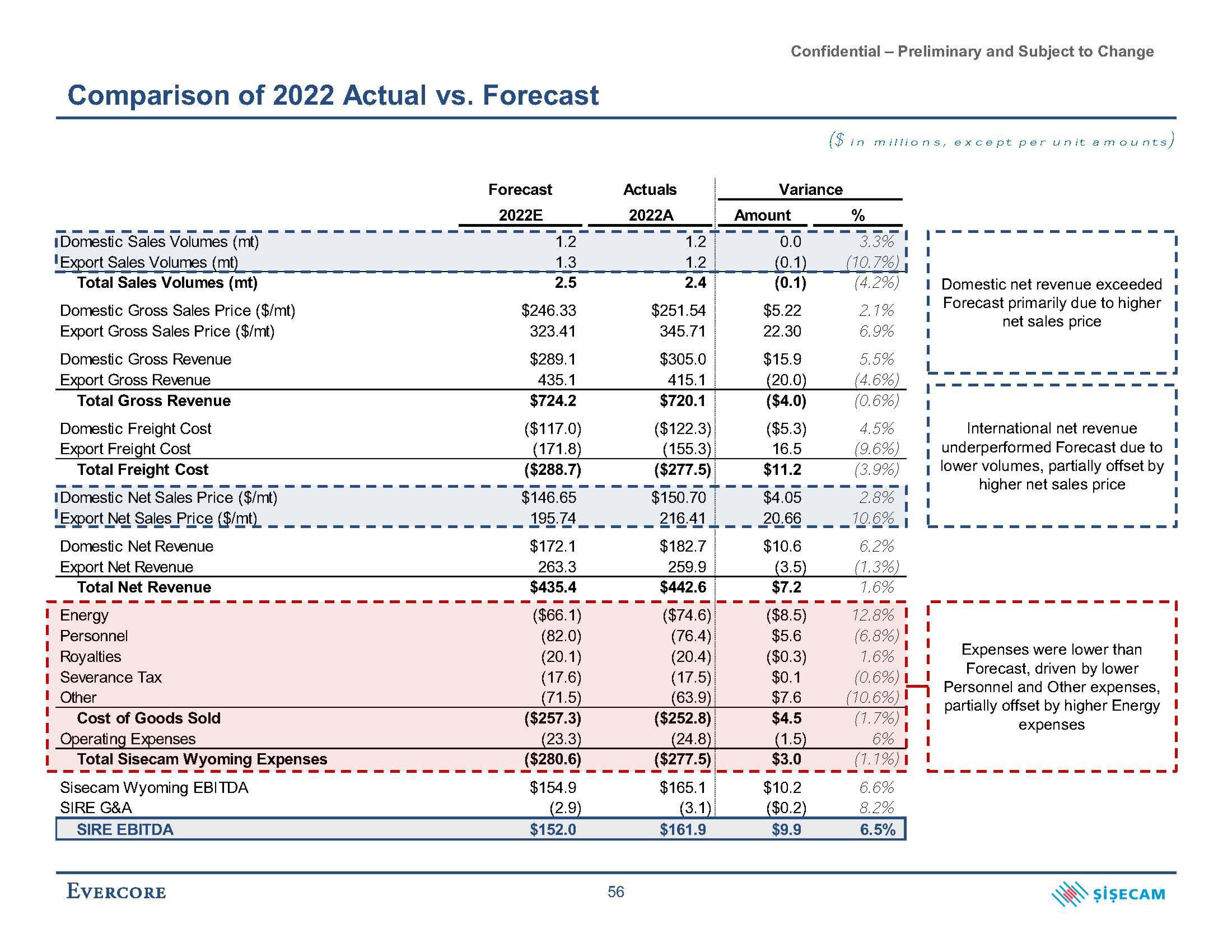

Comparison of 2022 Actual vs. Forecast

I Domestic Sales Volumes (mt)

Export Sales Volumes (mt)

Total Sales Volumes (mt)

I

I

Domestic Gross Sales Price ($/mt)

Export Gross Sales Price ($/mt)

Domestic Gross Revenue

Export Gross Revenue

Total Gross Revenue

Domestic Freight Cost

Export Freight Cost

Total Freight Cost

I Domestic Net Sales Price ($/mt)

Export Net Sales Price ($/mt)

Domestic Net Revenue

Export Net Revenue

Total Net Revenue

I Energy

Personnel

Royalties

I Severance Tax

Other

Cost of Goods Sold

Operating Expenses

I Total Sisecam Wyoming Expenses

Sisecam Wyoming EBITDA

SIRE G&A

SIRE EBITDA

EVERCORE

———

I

Forecast

2022E

1.2

1.3

2.5

$246.33

323.41

$289.1

435.1

$724.2

($117.0)

(171.8)

($288.7)

$146.65

195.74

$172.1

263.3

$435.4

($66.1)

(82.0)

(20.1)

(17.6)

(71.5)

($257.3)

(23.3)

($280.6)

$154.9

(2.9)

$152.0

Actuals

2022A

56

1.2

1.2

2.4

$251.54

345.71

$305.0

415.1

$720.1

($122.3)

(155.3)

($277.5)

$150.70

216.41

$182.7

259.9

$442.6

($74.6)

(76.4)

(20.4)

(17.5)

(63.9)

($252.8)

(24.8)

($277.5)

$165.1

(3.1)

$161.9

Confidential - Preliminary and Subject to Change

Variance

Amount

0.0

(0.1)

(0.1)

$5.22

22.30

$15.9

(20.0)

($4.0)

($5.3)

16.5

$11.2

$4.05

20.66

$10.6

(3.5)

$7.2

($8.5)

$5.6

($0.3)

$0.1

$7.6

$4.5

(1.5)

$3.0

($ in millions, except per un it amounts

unts)

$10.2

($0.2)

$9.9

%

3.3%

(10.7%)

(4.2%) I Domestic net revenue exceeded

I Forecast primarily due to higher

net sales price

2.1% I

6.9%

5.5%

(4.6%)

(0.6%)

4.5%

(9.6%)

(3.9%)

2.8%

10.6%

6.2%

(1.3%)

1.6%

12.8%

(6.8%)

1.6%

(0.6%)

(10.6%)

(1.7%)

6%

(1.1%)

6.6%

8.2%

6.5%

International net revenue

underperformed Forecast due to

I lower volumes, partially offset by

higher net sales price

Expenses were lower than

Forecast, driven by lower

Personnel and Other expenses,

I partially offset by higher Energy

expenses

ŞİŞECAMView entire presentation