Pershing Square Activist Presentation Deck

(1)

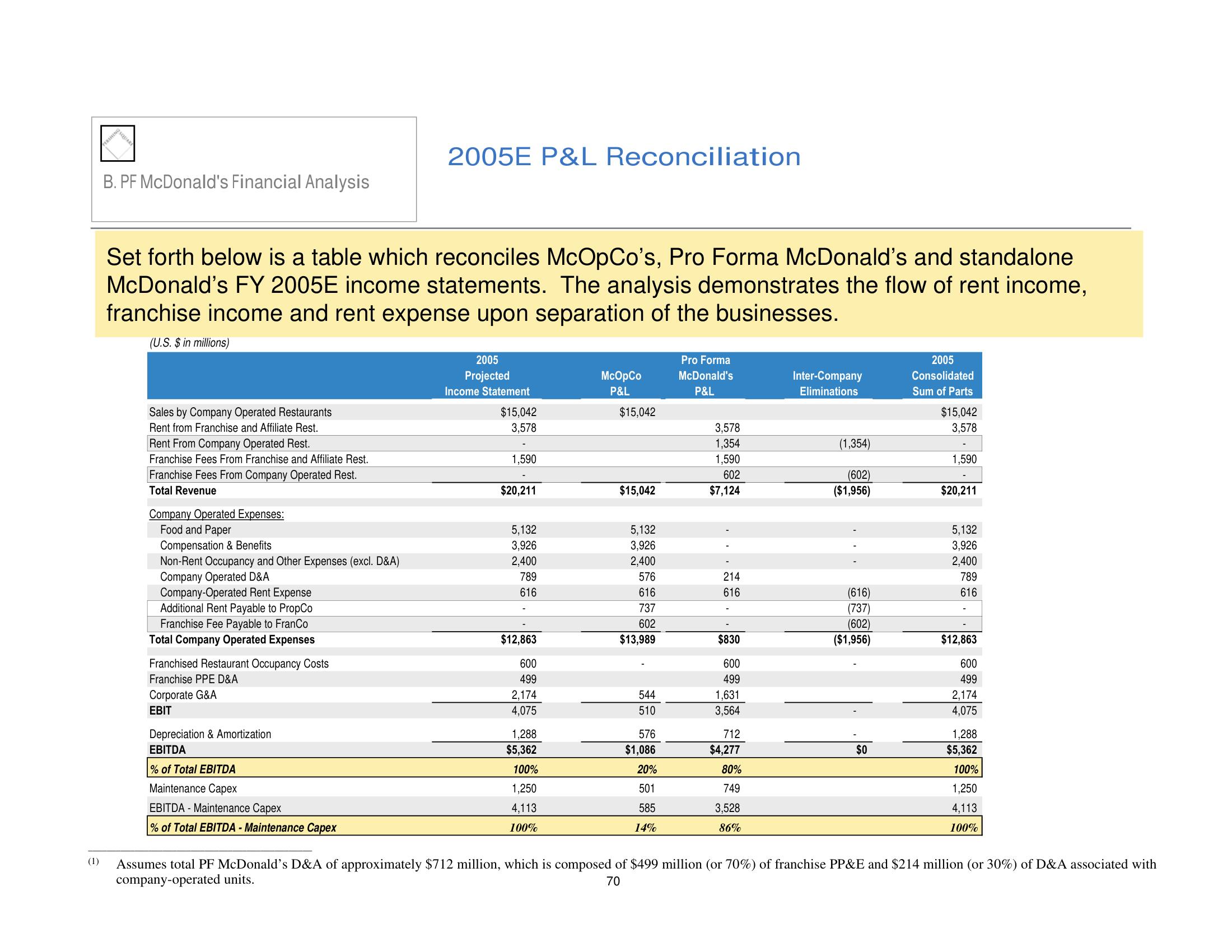

B. PF McDonald's Financial Analysis

Set forth below is a table which reconciles McOpCo's, Pro Forma McDonald's and standalone

McDonald's FY 2005E income statements. The analysis demonstrates the flow of rent income,

franchise income and rent expense upon separation of the businesses.

(U.S. $ in millions)

Sales by Company Operated Restaurants

Rent from Franchise and Affiliate Rest.

Rent From Company Operated Rest.

Franchise Fees From Franchise and Affiliate Rest.

Franchise Fees From Company Operated Rest.

Total Revenue

Company Operated Expenses:

Food and Paper

Compensation & Benefits

Non-Rent Occupancy and Other Expenses (excl. D&A)

Company Operated D&A

Company-Operated Rent Expense

Additional Rent Payable to Propo

Franchise Fee Payable to FranCo

Total Company Operated Expenses

Franchised Restaurant Occupancy Costs

Franchise PPE D&A

Corporate G&A

EBIT

2005E P&L Reconciliation

Depreciation & Amortization

EBITDA

% of Total EBITDA

Maintenance Capex

EBITDA - Maintenance Capex

% of Total EBITDA - Maintenance Capex

2005

Projected

Income Statement

$15,042

3,578

1,590

$20,211

5,132

3,926

2,400

789

616

$12,863

600

499

2,174

4,075

1,288

$5,362

100%

1,250

4,113

100%

McOpCo

P&L

$15,042

$15,042

5,132

3,926

2,400

576

616

737

602

$13,989

544

510

576

$1,086

20%

501

585

14%

Pro Forma

McDonald's

P&L

3,578

1,354

1,590

602

$7,124

214

616

$830

600

499

1,631

3,564

712

$4,277

80%

749

3,528

86%

Inter-Company

Eliminations

(1,354)

(602)

($1,956)

(616)

(737)

(602)

($1,956)

$0

2005

Consolidated

Sum of Parts

$15,042

3,578

1,590

$20,211

5,132

3,926

2,400

789

616

$12,863

600

499

2,174

4,075

1,288

$5,362

100%

1,250

4,113

100%

Assumes total PF McDonald's D&A of approximately $712 million, which is composed of $499 million (or 70%) of franchise PP&E and $214 million (or 30%) of D&A associated with

company-operated units.

70View entire presentation