Bakkt SPAC Presentation Deck

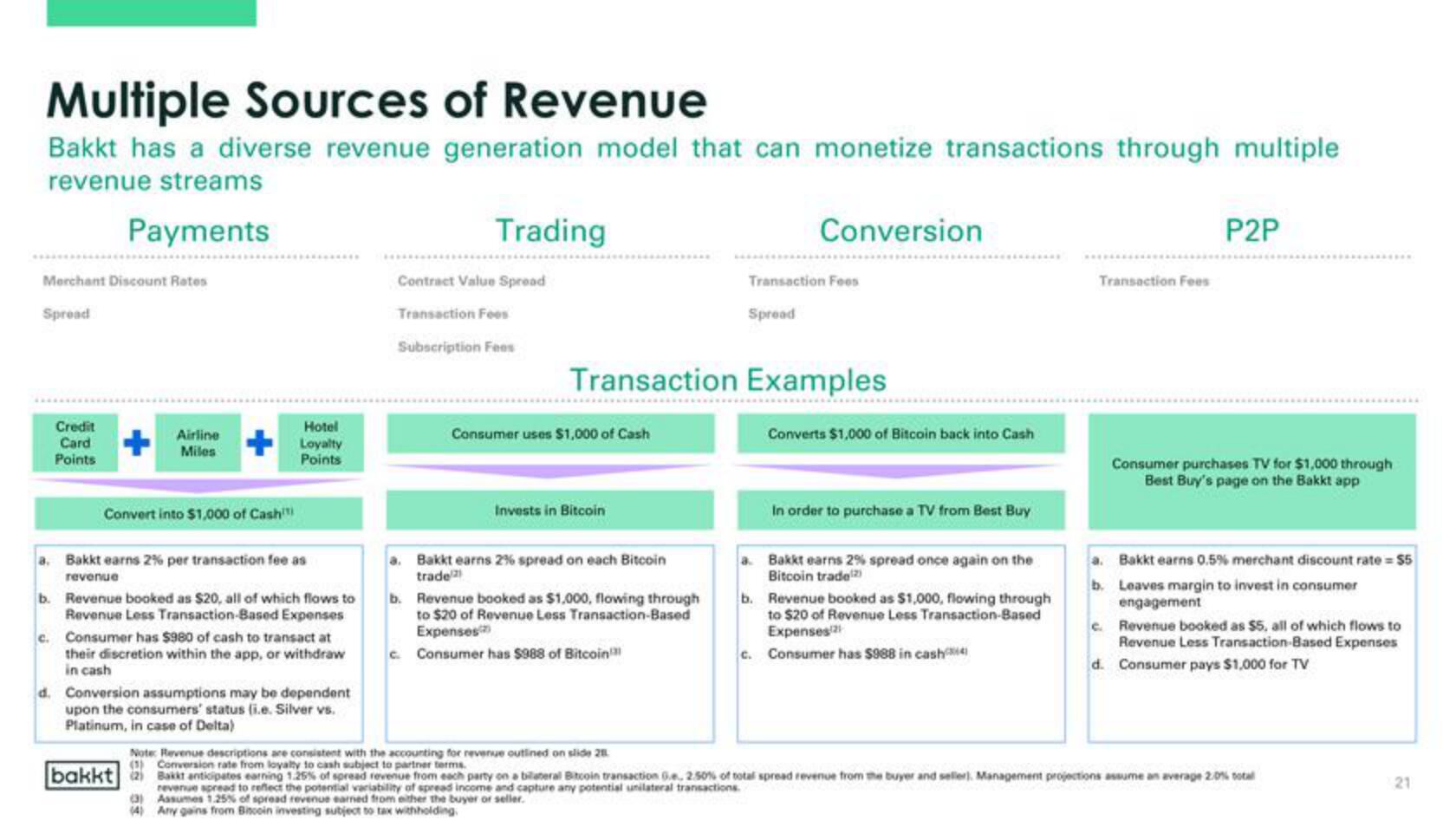

Multiple Sources of Revenue

Bakkt has a diverse revenue generation model that can monetize transactions through multiple

revenue streams

Payments

Merchant Discount Rates

Spread

Credit

Card

Points

Airline

Miles

Convert into $1,000 of Cash

Hotel

Loyalty

Points

a. Bakkt earns 2% per transaction fee as

revenue

b. Revenue booked as $20, all of which flows to

Revenue Less Transaction-Based Expenses

c. Consumer has $980 of cash to transact at

their discretion within the app, or withdraw

in cash

d. Conversion assumptions may be dependent

upon the consumers' status (i.e. Silver vs.

Platinum, in case of Delta)

Trading

Contract Value Spread

Transaction Foos

Subscription Fees

Consumer uses $1,000 of Cash

Invests in Bitcoin

Transaction Examples

a.

b.

Revenue booked as $1,000, flowing through

to $20 of Revenue Less Transaction-Based

Expenses

c. Consumer has $988 of Bitcoin

Bakkt earns 2% spread on each Bitcoin

trade

Conversion

Transaction Fees

Spread

Converts $1,000 of Bitcoin back into Cash

In order to purchase a TV from Best Buy

a. Bakkt earns 2% spread once again on the

Bitcoin trade

b. Revenue booked as $1,000, flowing through

to $20 of Revenue Less Transaction-Based

Expenses

c. Consumer has $988 in cash

Transaction Fees

P2P

Consumer purchases TV for $1,000 through

Best Buy's page on the Bakkt app

a. Bakkt earns 0.5% merchant discount rate = $5

b. Leaves margin to invest in consumer

engagement

e. Revenue booked as $5, all of which flows to

Revenue Less Transaction-Based Expenses

d. Consumer pays $1,000 for TV

Note: Revenue descriptions are consistent with the accounting for revenue outlined on slide 21

(1) Conversion rate from loyalty to cash subject to partner terms.

bakkt Bakkt anticipates earning 1.25% of spread revenue from each party on a bilateral Bitcoin transaction 6e, 2.50% of total spread revenue from the buyer and seller). Management projections assume an average 2.0% total

revenue spread to reflect the potential variability of spread income and capture any potential unilateral transactions.

(3) Assumes 1.25% of spread revenue earned from either the buyer or seller.

(4) Any gains from Bitcoin investing subject to tax withholding.

21View entire presentation