Fastly Investor Presentation Deck

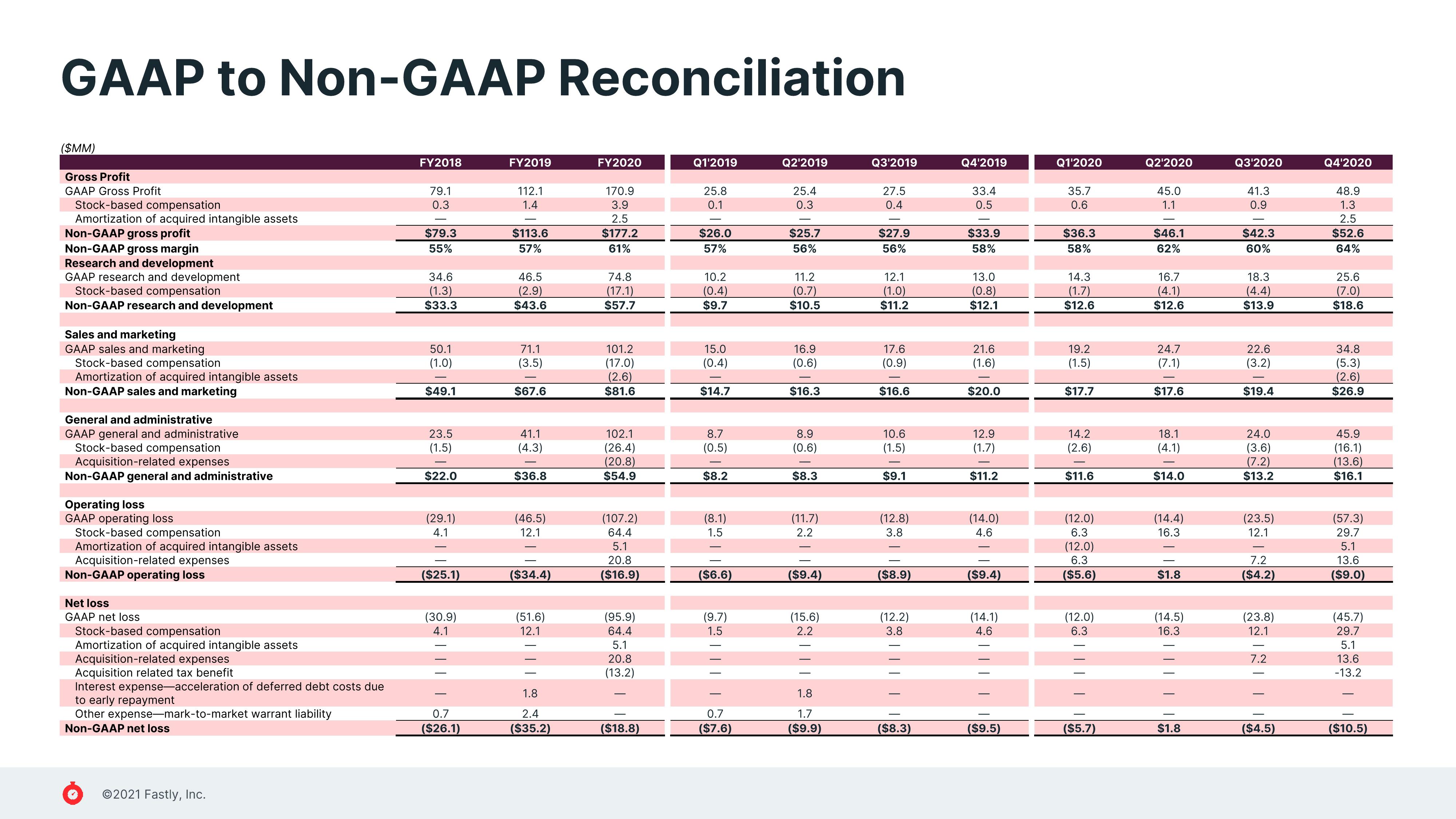

GAAP to Non-GAAP Reconciliation

($MM)

Gross Profit

GAAP Gross Profit

Stock-based compensation

Amortization of acquired intangible assets

Non-GAAP gross profit

Non-GAAP gross margin

Research and development

GAAP research and development

Stock-based compensation

Non-GAAP research and development

Sales and marketing

GAAP sales and marketing

Stock-based compensation

Amortization of acquired intangible assets

Non-GAAP sales and marketing

General and administrative

GAAP general and administrative

Stock-based compensation

Acquisition-related expenses

Non-GAAP general and administrative

Operating loss

GAAP operating loss

Stock-based compensation

Amortization of acquired intangible assets

Acquisition-related expenses

Non-GAAP operating loss

Net loss

GAAP net loss

Stock-based compensation

Amortization of acquired intangible assets

Acquisition-related expenses

Acquisition related tax benefit

Interest expense-acceleration of deferred debt costs due

to early repayment

Other expense-mark-to-market warrant liability

Non-GAAP net loss

Ⓒ2021 Fastly, Inc.

FY2018

79.1

0.3

$79.3

55%

34.6

(1.3)

$33.3

50.1

(1.0)

$49.1

23.5

(1.5)

$22.0

(29.1)

4.1

($25.1)

(30.9)

4.1

0.7

($26.1)

FY2019

112.1

1.4

$113.6

57%

46.5

(2.9)

$43.6

71.1

(3.5)

$67.6

41.1

(4.3)

$36.8

(46.5)

12.1

($34.4)

(51.6)

12.1

1.8

2.4

($35.2)

FY2020

170.9

3.9

2.5

$177.2

61%

74.8

(17.1)

$57.7

101.2

(17.0)

(2.6)

$81.6

102.1

(26.4)

(20.8)

$54.9

(107.2)

64.4

5.1

20.8

($16.9)

(95.9)

64.4

5.1

20.8

(13.2)

($18.8)

Q1'2019

25.8

0.1

$26.0

57%

10.2

(0.4)

$9.7

15.0

(0.4)

$14.7

8.7

(0.5)

$8.2

(8.1)

1.5

($6.6)

(9.7)

1.5

0.7

($7.6)

Q2'2019

25.4

0.3

$25.7

56%

11.2

(0.7)

$10.5

16.9

(0.6)

$16.3

8.9

(0.6)

$8.3

(11.7)

2.2

($9.4)

(15.6)

2.2

1.8

1.7

($9.9)

Q3'2019

27.5

0.4

$27.9

56%

12.1

(1.0)

$11.2

17.6

(0.9)

$16.6

10.6

(1.5)

$9.1

(12.8)

3.8

($8.9)

(12.2)

3.8

|||||

($8.3)

Q4'2019

33.4

0.5

$33.9

58%

13.0

(0.8)

$12.1

21.6

(1.6)

$20.0

12.9

(1.7)

$11.2

(14.0)

4.6

($9.4)

(14.1)

4.6

($9.5)

Q1'2020

35.7

0.6

$36.3

58%

14.3

(1.7)

$12.6

19.2

(1.5)

$17.7

14.2

(2.6)

$11.6

(12.0)

6.3

(12.0)

6.3

($5.6)

(12.0)

6.3

($5.7)

Q2¹2020

45.0

1.1

$46.1

62%

16.7

(4.1)

$12.6

24.7

(7.1)

$17.6

18.1

(4.1)

$14.0

(14.4)

16.3

$1.8

(14.5)

16.3

$1.8

Q3'2020

41.3

0.9

$42.3

60%

18.3

(4.4)

$13.9

22.6

(3.2)

$19.4

24.0

(3.6)

(7.2)

$13.2

(23.5)

12.1

7.2

($4.2)

(23.8)

12.1

7.2

3

($4.5)

Q4¹2020

48.9

1.3

2.5

$52.6

64%

25.6

(7.0)

$18.6

34.8

(5.3)

(2.6)

$26.9

45.9

(16.1)

(13.6)

$16.1

(57.3)

29.7

5.1

13.6

($9.0)

(45.7)

29.7

5.1

13.6

-13.2

($10.5)View entire presentation