WeWork Restructuring Presentation Deck

Transaction Term Sheet (Cont'd)

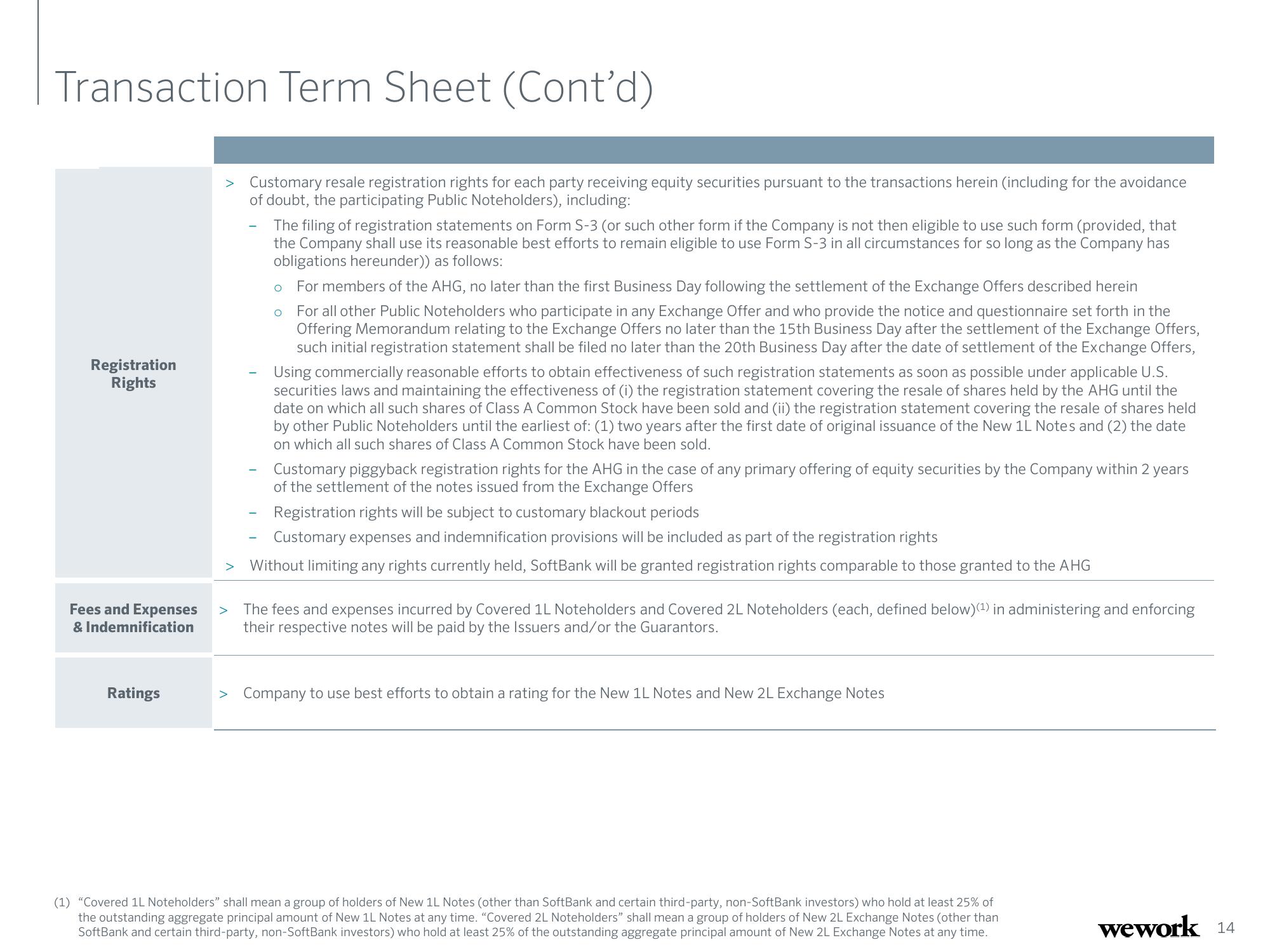

Registration

Rights

Fees and Expenses

& Indemnification

Ratings

Customary resale registration rights for each party receiving equity securities pursuant to the transactions herein (including for the avoidance

of doubt, the participating Public Noteholders), including:

The filing of registration statements on Form S-3 (or such other form if the Company is not then eligible to use such form (provided, that

the Company shall use its reasonable best efforts to remain eligible to use Form S-3 in all circumstances for so long as the Company has

obligations hereunder)) as follows:

O For members of the AHG, no later than the first Business Day following the settlement of the Exchange Offers described herein

O For all other Public Noteholders who participate in any Exchange Offer and who provide the notice and questionnaire set forth in the

Offering Memorandum relating to the Exchange Offers no later than the 15th Business Day after the settlement of the Exchange Offers,

such initial registration statement shall be filed no later than the 20th Business Day after the date of settlement of the Exchange Offers,

Using commercially reasonable efforts to obtain effectiveness of such registration statements as soon as possible under applicable U.S.

securities laws and maintaining the effectiveness of (i) the registration statement covering the resale of shares held by the AHG until the

date on which all such shares of Class A Common Stock have been sold and (ii) the registration statement covering the resale of shares held

by other Public Noteholders until the earliest of: (1) two years after the first date of original issuance of the New 1L Notes and (2) the date

on which all such shares of Class A Common Stock have been sold.

Customary piggyback registration rights for the AHG in the case of any primary offering of equity securities by the Company within 2 years

of the settlement of the notes issued from the Exchange Offers

Registration rights will be subject to customary blackout periods

Customary expenses and indemnification provisions will be included as part of the registration rights

Without limiting any rights currently held, SoftBank will be granted registration rights comparable to those granted to the AHG

The fees and expenses incurred by Covered 1L Noteholders and Covered 2L Noteholders (each, defined below)(¹) in administering and enforcing

their respective notes will be paid by the Issuers and/or the Guarantors.

> Company to use best efforts to obtain a rating for the New 1L Notes and New 2L Exchange Notes

(1) "Covered 1L Noteholders" shall mean a group of holders of New 1L Notes (other than SoftBank and certain third-party, non-SoftBank investors) who hold at least 25% of

the outstanding aggregate principal amount of New 1L Notes at any time. "Covered 2L Noteholders" shall mean a group of holders of New 2L Exchange Notes (other than

SoftBank and certain third-party, non-SoftBank investors) who hold at least 25% of the outstanding aggregate principal amount of New 2L Exchange Notes at any time.

wework 14View entire presentation