Silicon Valley Bank Results Presentation Deck

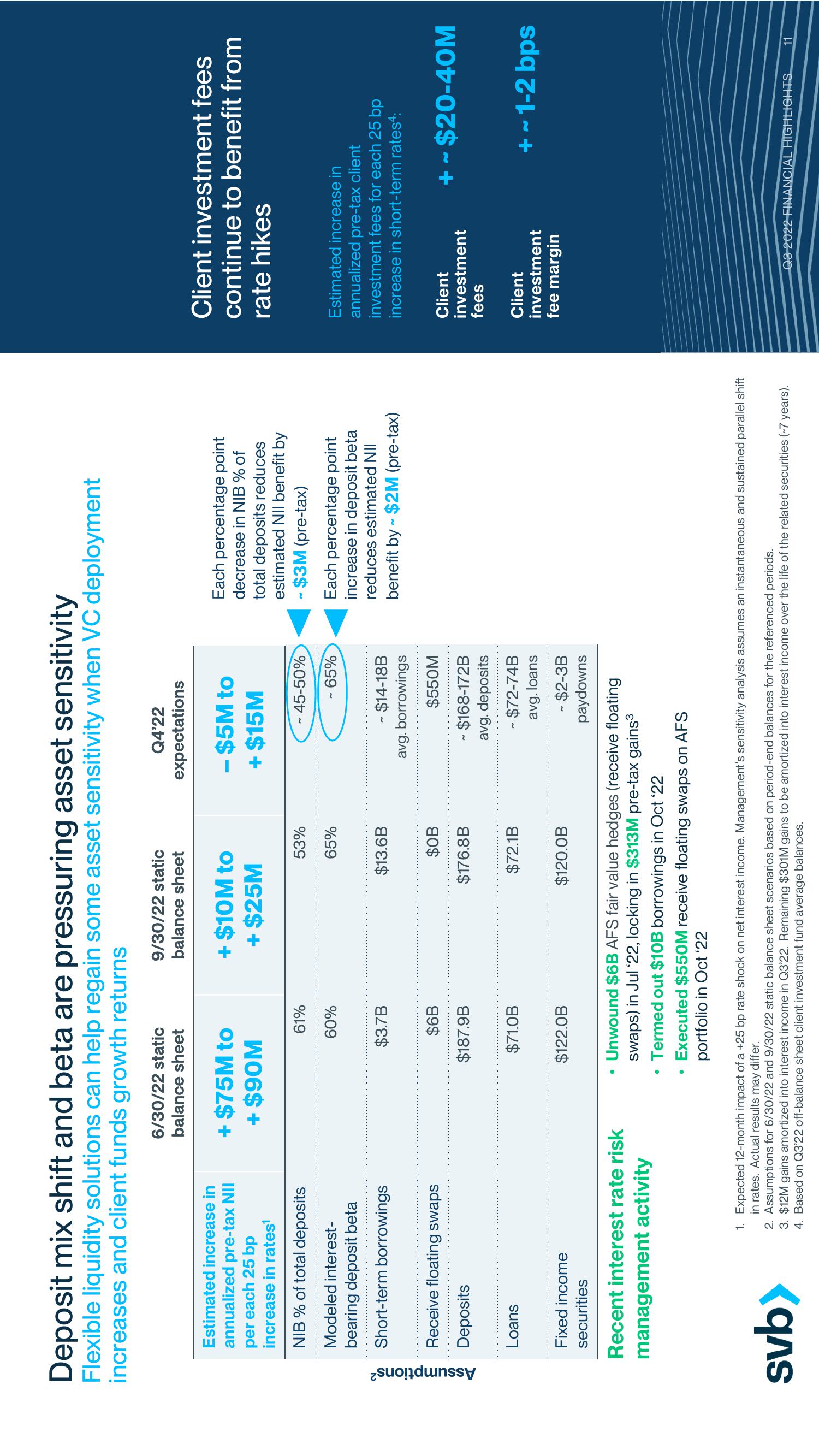

Deposit mix shift and beta are pressuring asset sensitivity

Flexible liquidity solutions can help regain some asset sensitivity when VC deployment

increases and client funds growth returns

Assumptions²

Estimated increase in

annualized pre-tax NII

per each 25 bp

increase in rates¹

NIB % of total deposits

Modeled interest-

bearing deposit beta

Short-term borrowings

Receive floating swaps

Deposits

Loans

Fixed income

securities

6/30/22 static

balance sheet

svb>

+ $75M to

+ $90M

Recent interest rate risk

management activity

♥

61%

60%

$3.7B

$6B

$187.9B

$71.0B

$122.0B

9/30/22 static

balance sheet

+ $10M to

+ $25M

53%

65%

$13.6B

$OB

$176.8B

$72.1B

$120.0B

Q4'22

expectations

- $5M to

+ $15M

~ 45-50%

~ 65%

- $14-18B

avg. borrowings

$550M

~ $168-172B

avg. deposits

~ $72-74B

avg. loans

~ $2-3B

paydowns

Unwound $6B AFS fair value hedges (receive floating

swaps) in Jul '22, locking in $313M pre-tax gains³

Termed out $10B borrowings in Oct ¹22

Executed $550M receive floating swaps on AFS

portfolio in Oct '22

Each percentage point

decrease in NIB % of

total deposits reduces

estimated NII benefit by

- $3M (pre-tax)

Each percentage point

increase in deposit beta

reduces estimated NII

benefit by $2M (pre-tax)

2

1. Expected 12-month impact of a +25 bp rate shock on net interest income. Management's sensitivity analysis assumes an instantaneous and sustained parallel shift

in rates. Actual results may differ.

2. Assumptions for 6/30/22 and 9/30/22 static balance sheet scenarios based on period-end balances for the referenced periods.

3. $12M gains amortized into interest income in Q3'22. Remaining $301M gains to be amortized into interest income over the life of the related securities (-7 years).

4. Based on Q3'22 off-balance sheet client investment fund average balances.

Client investment fees

continue to benefit from

rate hikes

Estimated increase in

annualized pre-tax client

investment fees for each 25 bp

increase in short-term rates4:

Client

investment

fees

Client

investment

fee margin

+~$20-40M

+~1-2 bps

Q3 2022 FINANCIAL HIGHLIGHTS

11View entire presentation