J.P.Morgan Investment Banking Pitch Book

APPENDIX

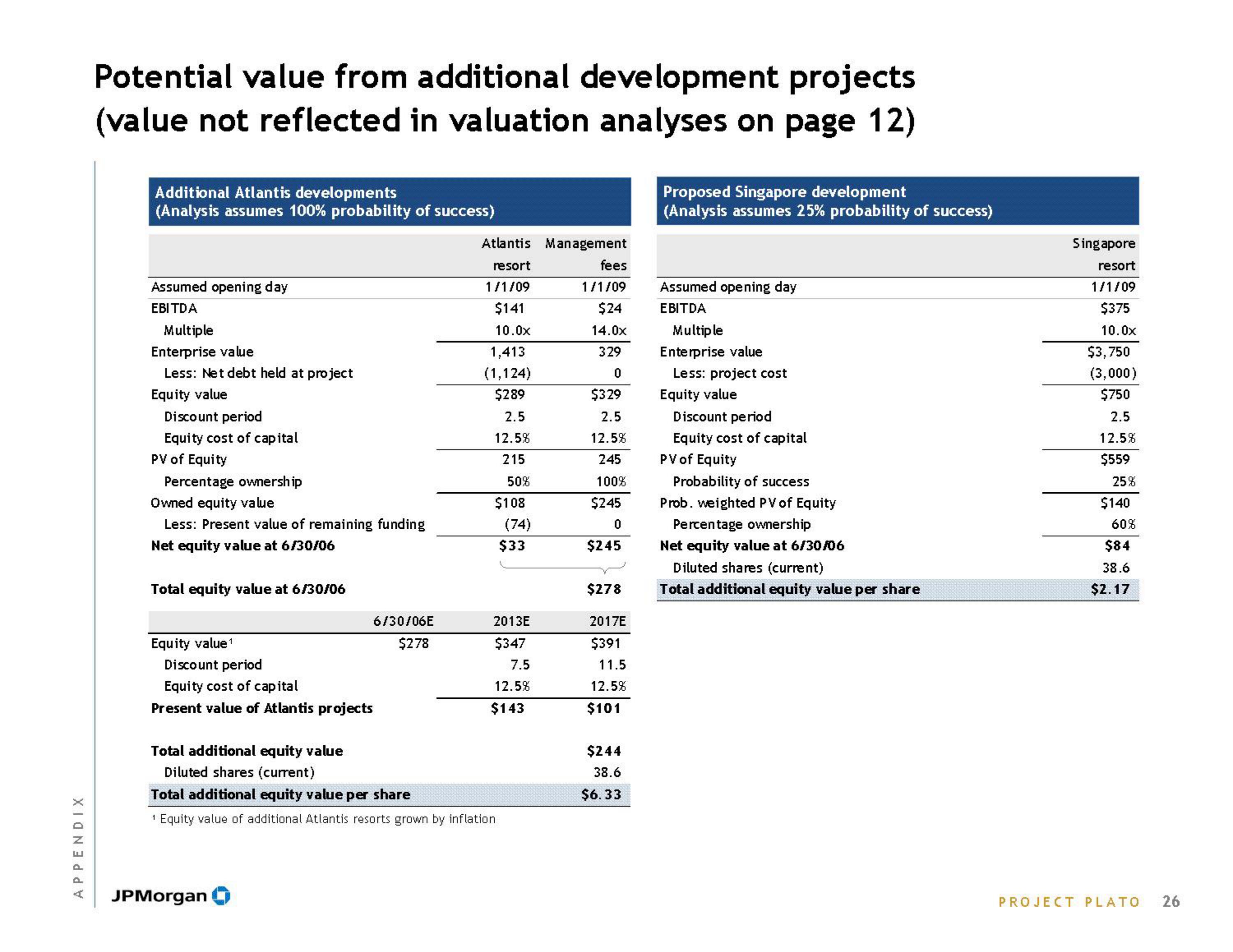

Potential value from additional development projects

(value not reflected in valuation analyses on page 12)

Additional Atlantis developments

(Analysis assumes 100% probability of success)

Assumed opening day

EBITDA

Multiple

Enterprise value

Less: Net debt held at project

Equity value

Discount period

Equity cost of capital

PV of Equity

Percentage ownership

Owned equity value

Less: Present value of remaining funding

Net equity value at 6/30/06

Total equity value at 6/30/06

Equity value¹

6/30/06E

$278

Discount period

Equity cost of capital

Present value of Atlantis projects

JPMorgan

Atlantis Management

resort

1/1/09

$141

10.0x

1,413

(1,124)

$289

2.5

12.5%

215

50%

$108

(74)

$33

2013E

$347

Total additional equity value

Diluted shares (current)

Total additional equity value per share

¹ Equity value of additional Atlantis resorts grown by inflation

7.5

12.5%

$143

fees

1/1/09

$24

14.0x

329

0

$329

2.5

12.5%

245

100%

$245

0

$245

$278

2017E

$391

11.5

12.5%

$101

$244

38.6

$6.33

Proposed Singapore development

(Analysis assumes 25% probability of success)

Assumed opening day

EBITDA

Multiple

Enterprise value

Less: project cost

Equity value

Discount period

Equity cost of capital

PV of Equity

Probability of success

Prob. weighted PV of Equity

Percentage ownership

Net equity value at 6/30/06

Diluted shares (current)

Total additional equity value per share

Singapore

resort

1/1/09

$375

10.0x

$3,750

(3,000)

$750

2.5

12.5%

$559

25%

$140

60%

$84

38.6

$2.17

PROJECT PLATO

26View entire presentation