Evercore Investment Banking Pitch Book

Why Evercore?

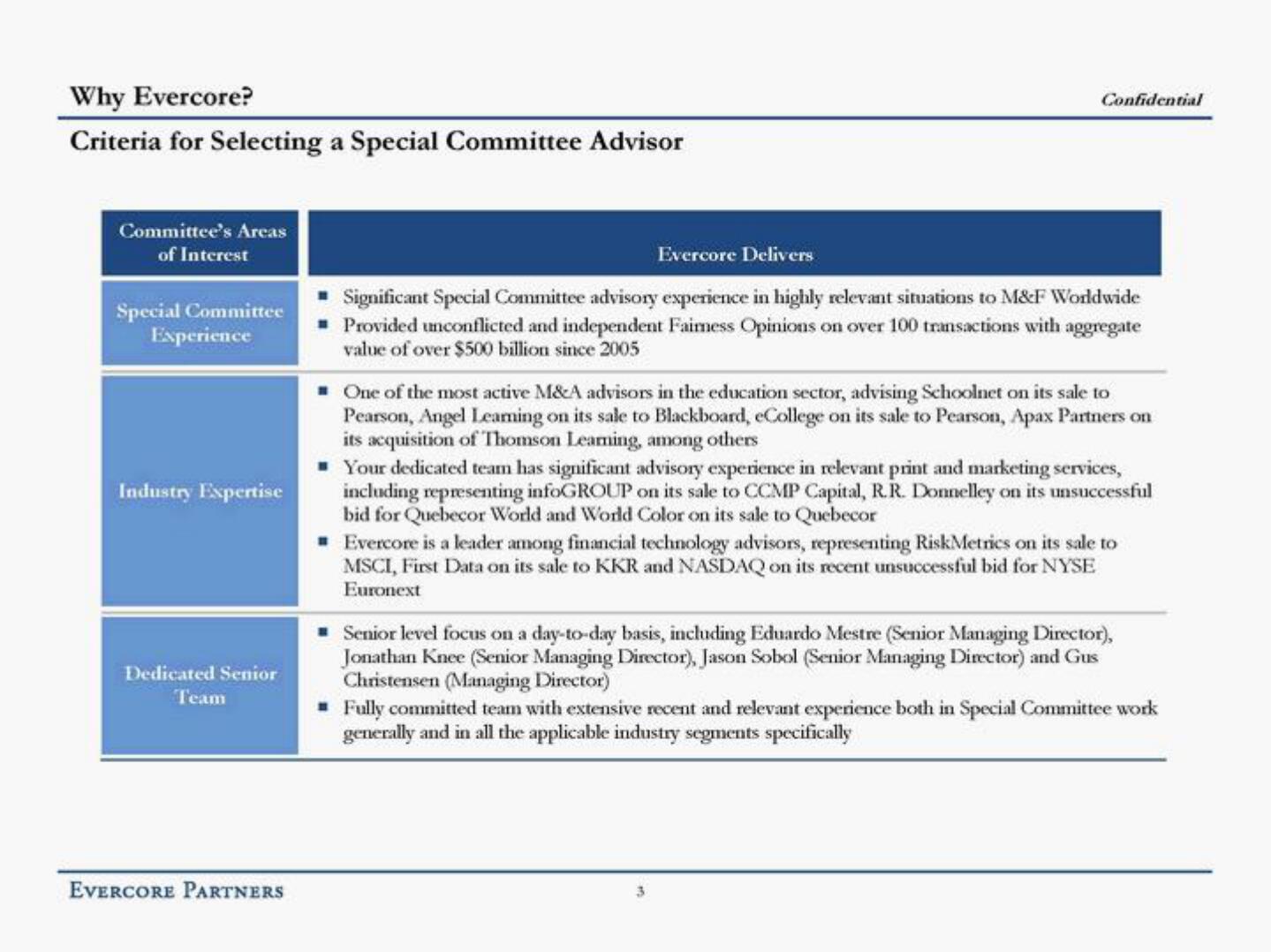

Criteria for Selecting a Special Committee Advisor

Committee's Areas

of Interest

Special Committee

Experience

Industry Expertise

Dedicated Senior

Team

EVERCORE PARTNERS

Confidential

Evercore Delivers

Significant Special Committee advisory experience in highly relevant situations to M&F Worldwide

Provided unconflicted and independent Faimess Opinions on over 100 transactions with aggregate

value of over $500 billion since 2005

■ One of the most active M&A advisors in the education sector, advising Schoolnet on its sale to

Pearson, Angel Leaming on its sale to Blackboard, eCollege on its sale to Pearson, Apax Partners on

its acquisition of Thomson Learning, among others

Your dedicated team has significant advisory experience in relevant print and marketing services,

including representing infoGROUP on its sale to CCMP Capital, R.R. Donnelley on its unsuccessful

bid for Quebecor World and World Color on its sale to Quebecor

■Evercore is a leader among financial technology advisors, representing RiskMetrics on its sale to

MSCI, First Data on its sale to KKR and NASDAQ on its recent unsuccessful bid for NYSE

Euronext

Senior level focus on a day-to-day basis, including Eduardo Mestre (Senior Managing Director),

Jonathan Knee (Senior Managing Director), Jason Sobol (Senior Managing Director) and Gus

Christensen (Managing Director)

Fully committed team with extensive recent and relevant experience both in Special Committee work

generally and in all the applicable industry segments specificallyView entire presentation