KKR Real Estate Finance Trust Results Presentation Deck

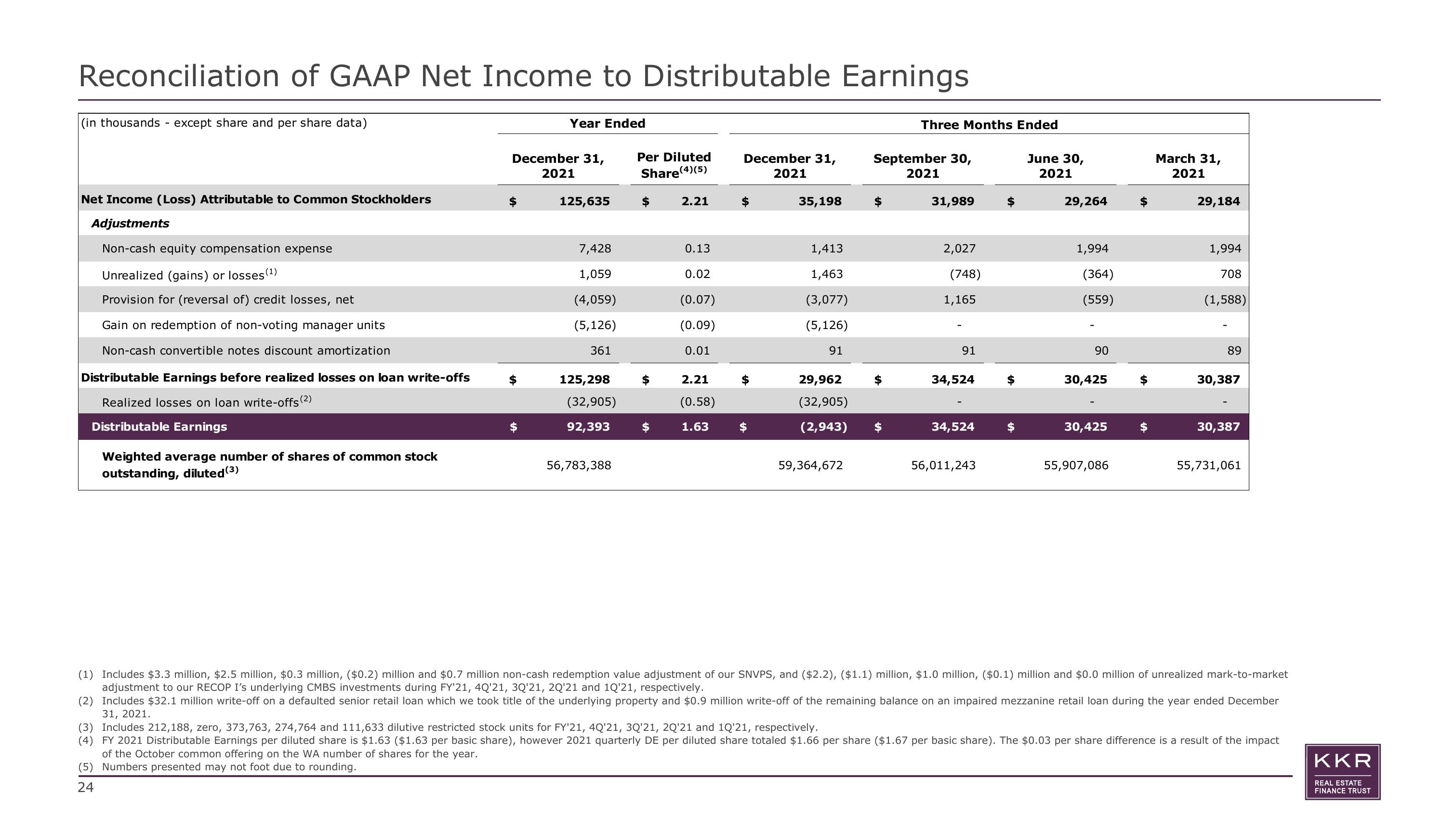

Reconciliation of GAAP Net Income to Distributable Earnings

(in thousands - except share and per share data)

Net Income (Loss) Attributable to Common Stockholders

Adjustments

Non-cash equity compensation expense

Unrealized (gains) or losses (¹)

Provision for (reversal of) credit losses, net

Gain on redemption of non-voting manager units

Non-cash convertible notes discount amortization

Distributable Earnings before realized losses on loan write-offs

Realized losses on loan write-offs (2)

Distributable Earnings

Weighted average number of shares of common stock

outstanding, diluted (3)

Year Ended

December 31,

2021

125,635

7,428

1,059

(4,059)

(5,126)

361

125,298

(32,905)

92,393

56,783,388

Per Diluted

Share (4)(5)

2.21

0.13

0.02

(0.07)

(0.09)

0.01

2.21

(0.58)

1.63

December 31,

2021

35,198

1,413

1,463

(3,077)

(5,126)

91

29,962

(32,905)

(2,943)

59,364,672

Three Months Ended

September 30,

2021

31,989

2,027

(748)

1,165

91

34,524

34,524

56,011,243

June 30,

2021

29,264

1,994

(364)

(559)

90

30,425

30,425

55,907,086

March 31,

2021

29,184

1,994

708

(1,588)

89

30,387

30,387

55,731,061

(1) Includes $3.3 million, $2.5 million, $0.3 million, ($0.2) million and $0.7 million non-cash redemption value adjustment of our SNVPS, and ($2.2), ($1.1) million, $1.0 million, ($0.1) million and $0.0 million of unrealized mark-to-market

adjustment to our RECOP I's underlying CMBS investments during FY'21, 4Q'21, 3Q'21, 2Q'21 and 1Q'21, respectively.

(2) Includes $32.1 million write-off on a defaulted senior retail loan which we took title of the underlying property and $0.9 million write-off of the remaining balance on an impaired mezzanine retail loan during the year ended December

31, 2021.

(3) Includes 212,188, zero, 373,763, 274,764 and 111,633 dilutive restricted stock units for FY'21, 4Q'21, 3Q'21, 2Q'21 and 1Q'21, respectively.

(4) FY 2021 Distributable Earnings per diluted share is $1.63 ($1.63 per basic share), however 2021 quarterly DE per diluted share totaled $1.66 per share ($1.67 per basic share). The $0.03 per share difference is a result of the impact

of the October common offering on the WA number of shares for the year.

(5) Numbers presented may not foot due to rounding.

24

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation