HSBC Investor Day Presentation Deck

ما

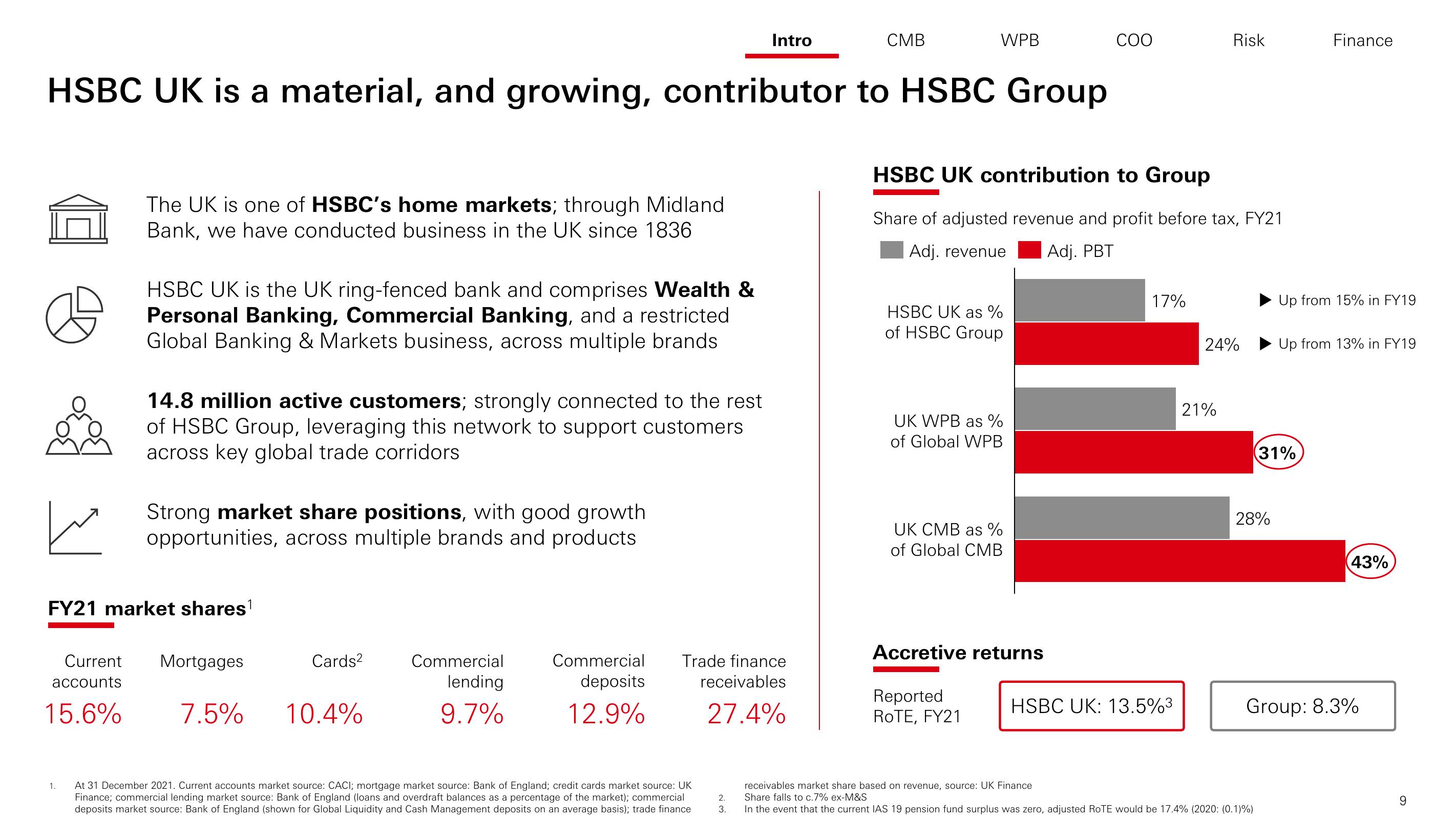

HSBC UK is a material, and growing, contributor to HSBC Group

The UK is one of HSBC's home markets; through Midland

Bank, we have conducted business in the UK since 1836

HSBC UK is the UK ring-fenced bank and comprises Wealth &

Personal Banking, Commercial Banking, and a restricted

Global Banking & Markets business, across multiple brands

1.

14.8 million active customers; strongly connected to the rest

of HSBC Group, leveraging this network to support customers

across key global trade corridors

Strong market share positions, with good growth

opportunities, across multiple brands and products

FY21 market shares¹

Current Mortgages

accounts

15.6%

7.5%

Cards²

10.4%

Commercial

lending

9.7%

Commercial

deposits

12.9%

Intro

Trade finance

receivables

27.4%

At 31 December 2021. Current accounts market source: CACI; mortgage market source: Bank of England; credit cards market source: UK

Finance; commercial lending market source: Bank of England (loans and overdraft balances as a percentage of the market); commercial

deposits market source: Bank of England (shown for Global Liquidity and Cash Management deposits on an average basis); trade finance

2.

3.

CMB

WPB

HSBC UK as %

of HSBC Group

HSBC UK contribution to Group

Share of adjusted revenue and profit before tax, FY21

Adj. revenue

Adj. PBT

UK WPB as %

of Global WPB

UK CMB as %

of Global CMB

Accretive returns

Reported

ROTE, FY21

COO

17%

HSBC UK: 13.5%³

Risk

24%

21%

28%

(31%

Finance

Up from 15% in FY19

receivables market share based on revenue, source: UK Finance

Share falls to c.7% ex-M&S

In the event that the current IAS 19 pension fund surplus was zero, adjusted ROTE would be 17.4% (2020: (0.1)%)

Up from 13% in FY19

43%

Group: 8.3%

9View entire presentation