Truist Financial Corp Results Presentation Deck

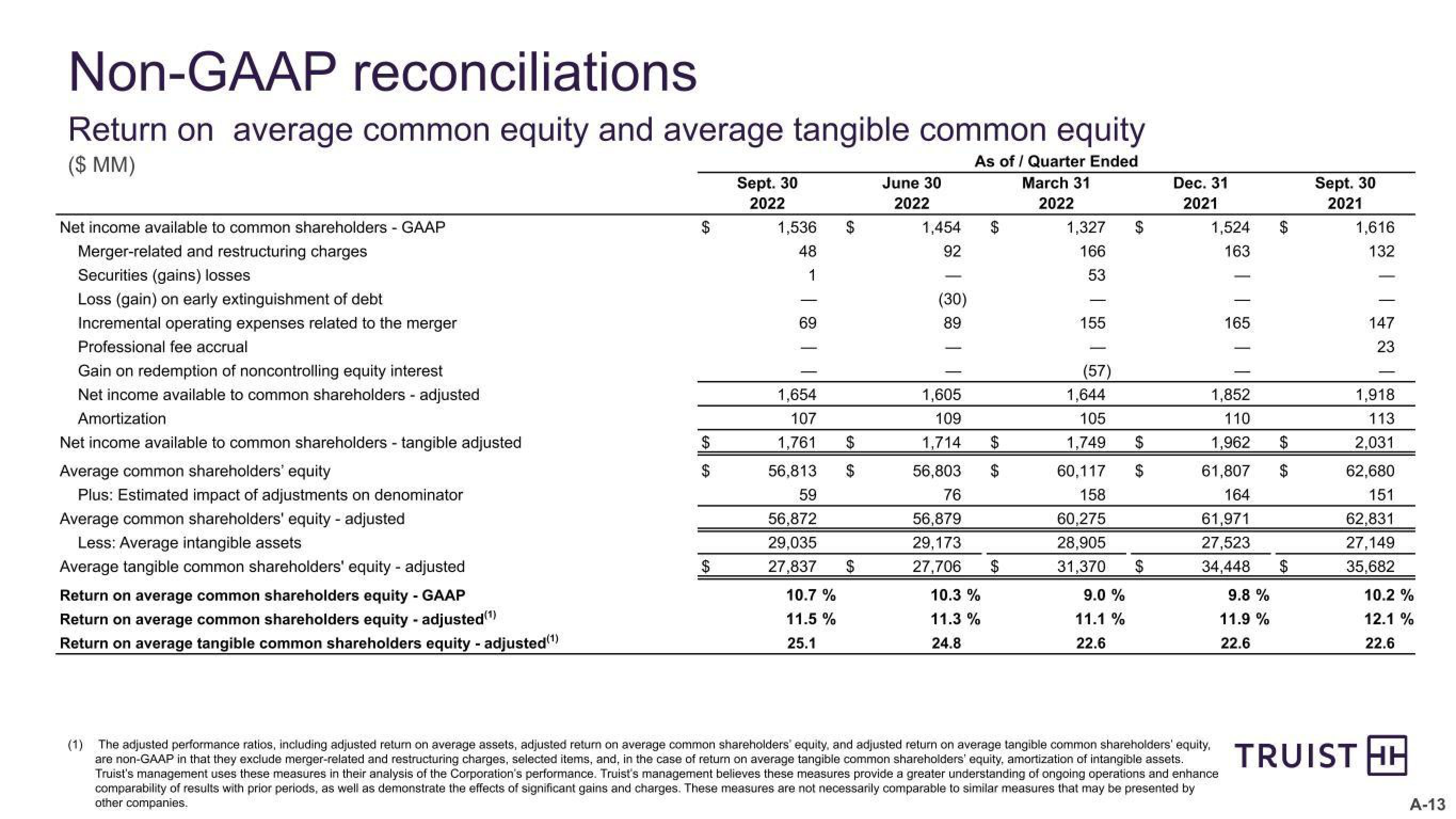

Non-GAAP reconciliations

Return on average common equity and average tangible common equity

($ MM)

As of/ Quarter Ended

March 31

2022

Net income available to common shareholders - GAAP

Merger-related and restructuring charges

Securities (gains) losses

Loss (gain) on early extinguishment of debt

Incremental operating expenses related to the merger

Professional fee accrual

Gain on redemption of noncontrolling equity interest

Net income available to common shareholders - adjusted

Amortization

Net income available to common shareholders - tangible adjusted

Average common shareholders' equity

Plus: Estimated impact of adjustments on denominator

Average common shareholders' equity - adjusted

Less: Average intangible assets

Average tangible common shareholders' equity - adjusted

Return on average common shareholders equity - GAAP

Return on average common shareholders equity - adjusted (¹)

Return on average tangible common shareholders equity - adjusted(¹)

$

$

Sept. 30

2022

1,536

48

1

| |

69

1,654

107

1,761 $

56,813 $

59

56,872

29,035

27,837

10.7 %

11.5%

25.1

$

June 30

2022

1,454

92

(30)

89

1,605

109

1,714

56,803

76

56,879

29,173

27,706

10.3 %

11.3%

24.8

$

$

1,327

166

53

155

(57)

$

1,644

105

1,749

60,117

158

60,275

28,905

31,370 $

9.0 %

11.1 %

22.6

$

$

Dec. 31

2021

1,524

163

165

1,852

110

1,962

61,807

164

61,971

27,523

34,448

9.8 %

11.9%

22.6

(1) The adjusted performance ratios, including adjusted return on average assets, adjusted return on average common shareholders' equity, and adjusted return on average tangible common shareholders' equity,

are non-GAAP in that they exclude merger-related and restructuring charges, selected items, and, in the case of return on average tangible common shareholders' equity, amortization of intangible assets.

Truist's management uses these measures in their analysis of the Corporation's performance. Truist's management believes these measures provide a greater understanding of ongoing operations and enhance

comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges. These measures are not necessarily comparable to similar measures that may be presented by

other companies.

$

69

$

$

Sept. 30

2021

1,616

132

147

23

1,918

113

2,031

62,680

151

62,831

27,149

35,682

10.2 %

12.1 %

22.6

TRUIST HE

A-13View entire presentation