Bakkt SPAC Presentation Deck

FINANCIALS ILLUSTRATIVE TRANSACTION OVERVIEW

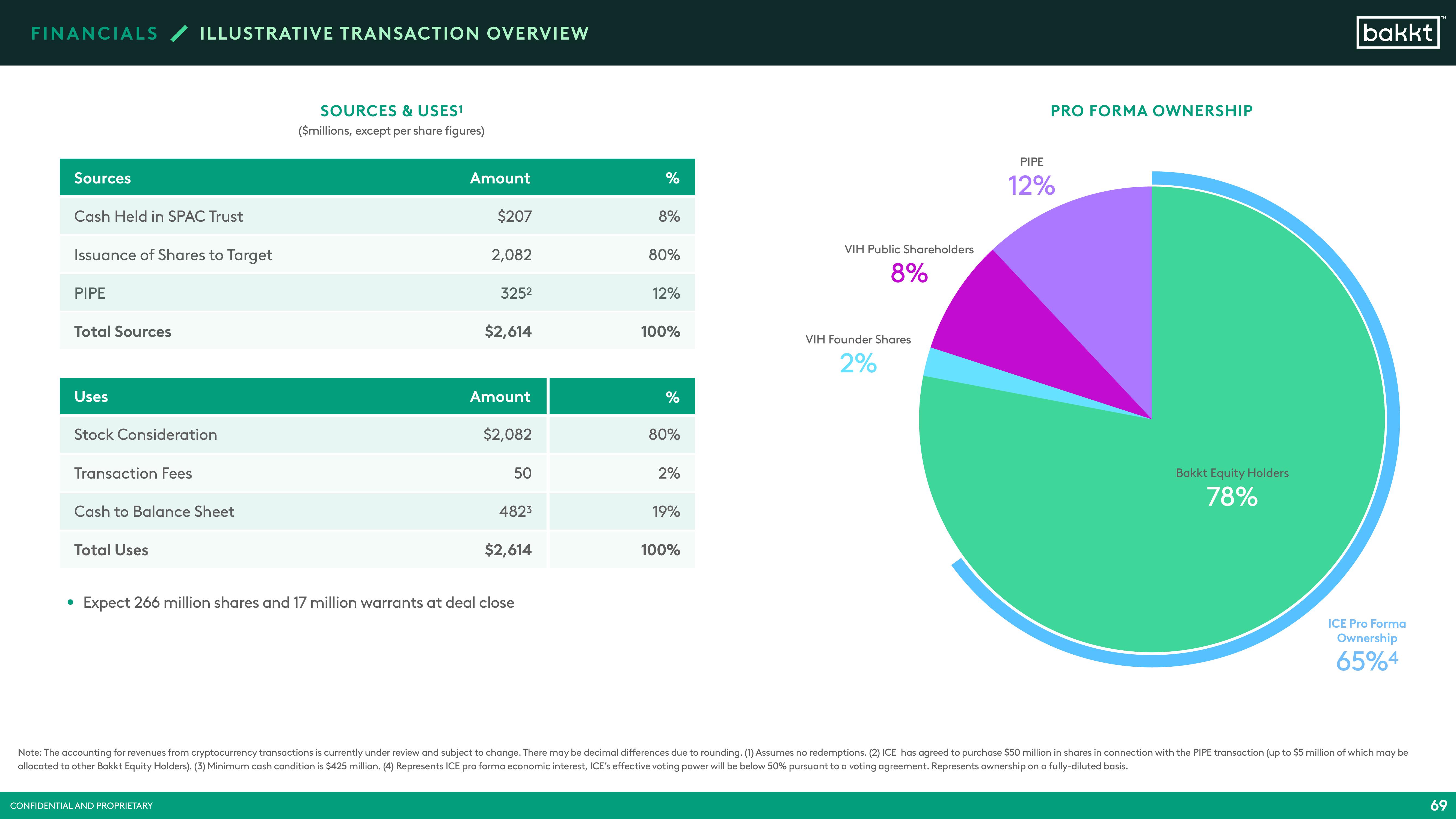

Sources

Cash Held in SPAC Trust

Issuance of Shares to Target

PIPE

Total Sources

Uses

Stock Consideration

Transaction Fees

Cash to Balance Sheet

Total Uses

SOURCES & USES¹

($millions, except per share figures)

Amount

CONFIDENTIAL AND PROPRIETARY

$207

2,082

3252

$2,614

Amount

$2,082

50

4823

$2,614

• Expect 266 million shares and 17 million warrants at deal close

%

8%

80%

12%

100%

%

80%

2%

19%

100%

VIH Public Shareholders

8%

VIH Founder Shares

2%

PRO FORMA OWNERSHIP

PIPE

12%

Bakkt Equity Holders

78%

bakkt

ICE Pro Forma

Ownership

65%4

Note: The accounting for revenues from cryptocurrency transactions is currently under review and subject to change. There may be decimal differences due to rounding. (1) Assumes no redemptions. (2) ICE has agreed to purchase $50 million in shares in connection with the PIPE transaction (up to $5 million of which may be

allocated to other Bakkt Equity Holders). (3) Minimum cash condition is $425 million. (4) Represents ICE pro forma economic interest, ICE's effective voting power will be below 50% pursuant to a voting agreement. Represents ownership on a fully-diluted basis.

69View entire presentation