LSE Mergers and Acquisitions Presentation Deck

London

Stock Exchange Group

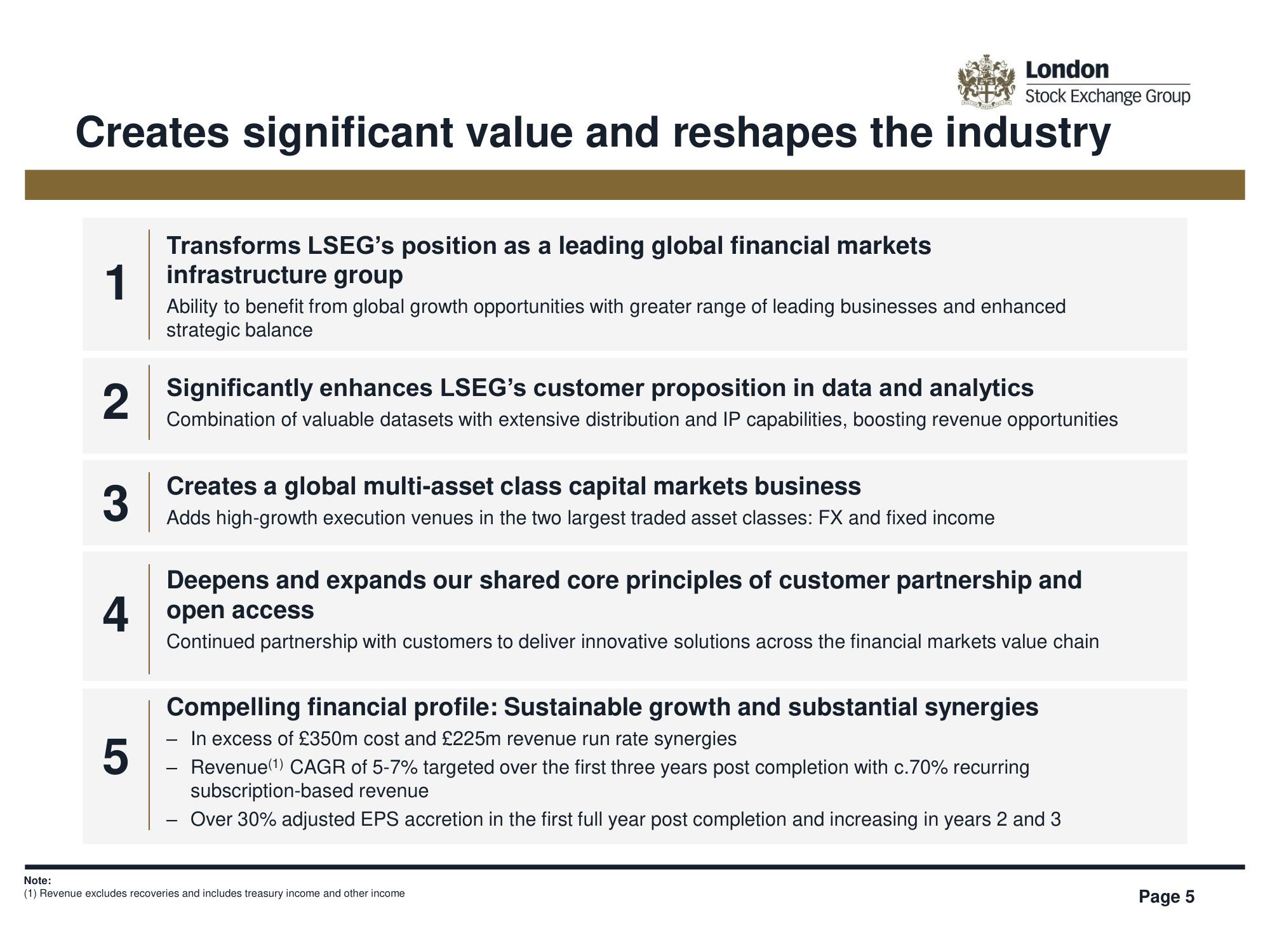

Creates significant value and reshapes the industry

Transforms LSEG's position as a leading global financial markets

infrastructure group

1

Ability to benefit from global growth opportunities with greater range of leading businesses and enhanced

strategic balance

2

3

Significantly enhances LSEG's customer proposition in data and analytics

Combination of valuable datasets with extensive distribution and IP capabilities, boosting revenue opportunities

5

Creates a global multi-asset class capital markets business

Adds high-growth execution venues in the two largest traded asset classes: FX and fixed income

Deepens and expands our shared core principles of customer partnership and

open access

4

Continued partnership with customers to deliver innovative solutions across the financial markets value chain

Compelling financial profile: Sustainable growth and substantial synergies

In excess of £350m cost and £225m revenue run rate synergies

Revenue (¹) CAGR of 5-7% targeted over the first three years post completion with c.70% recurring

subscription-based revenue

Over 30% adjusted EPS accretion in the first full year post completion and increasing in years 2 and 3

Note:

(1) Revenue excludes recoveries and includes treasury income and other income

Page 5View entire presentation