Forte's Value Destruction Analysis

Investors Growing Frustrated with Management and the Board

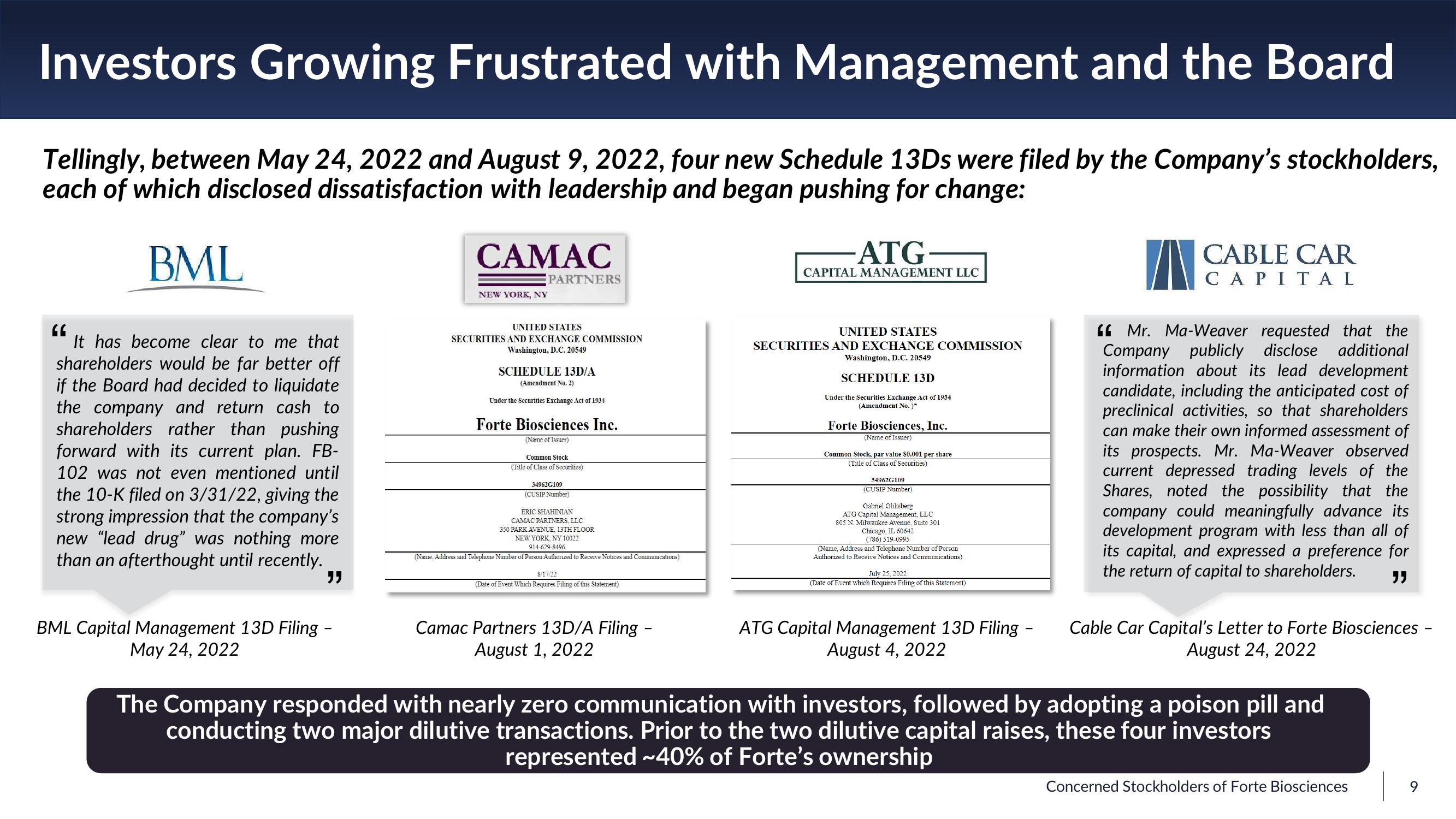

Tellingly, between May 24, 2022 and August 9, 2022, four new Schedule 13Ds were filed by the Company's stockholders,

each of which disclosed dissatisfaction with leadership and began pushing for change:

BML

It has become clear to me that

shareholders would be far better off

if the Board had decided to liquidate

the company and return cash to

shareholders rather than pushing

forward with its current plan. FB-

102 was not even mentioned until

the 10-K filed on 3/31/22, giving the

strong impression that the company's

new "lead drug" was nothing more

than an afterthought until recently.

BML Capital Management 13D Filing

May 24, 2022

""

CAMAC

PARTNERS

NEW YORK, NY

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 2)

Under the Securities Exchange Act of 1934

Forte Biosciences Inc.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

34962G109

(CUSIP Number)

ERIC SHAHINIAN

CAMAC PARTNERS. LLC

350 PARK AVENUE, 13TH FLOOR

NEW YORK, NY 10022

914-629-8496

(Name. Address and Telephone Number of Person Authorized to Receive Notices and Communications)

8/17/22

(Date of Event Which Requires Filing of this Statement)

Camac Partners 13D/A Filing -

August 1, 2022

-ATG-

CAPITAL MANAGEMENT LLC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

Forte Biosciences, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

34962G109

(CUSIP Number)

Gabriel Gliksberg

ATG Capital Management, LLC

805 N. Milwaukee Avenue, Suite 301

Chicago, IL 60642

(786) 519-0995

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 25, 2022

(Date of Event which Requires Filing of this Statement)

ATG Capital Management 13D Filing -

August 4, 2022

M

Mr. Ma-Weaver requested that the

Company publicly disclose additional

information about its lead development

candidate, including the anticipated cost of

preclinical activities, so that shareholders

can make their own informed assessment of

its prospects. Mr. Ma-Weaver observed

current depressed trading levels of the

Shares, noted the possibility that the

company could meaningfully advance its

development program with less than all of

its capital, and expressed a preference for

the return of capital to shareholders. ""

CABLE CAR

CAPITAL

Cable Car Capital's Letter to Forte Biosciences

August 24, 2022

The Company responded with nearly zero communication with investors, followed by adopting a poison pill and

conducting two major dilutive transactions. Prior to the two dilutive capital raises, these four investors

represented ~40% of Forte's ownership

Concerned Stockholders of Forte BiosciencesView entire presentation