J.P.Morgan Investment Banking Pitch Book

VALUATION ANALYSIS

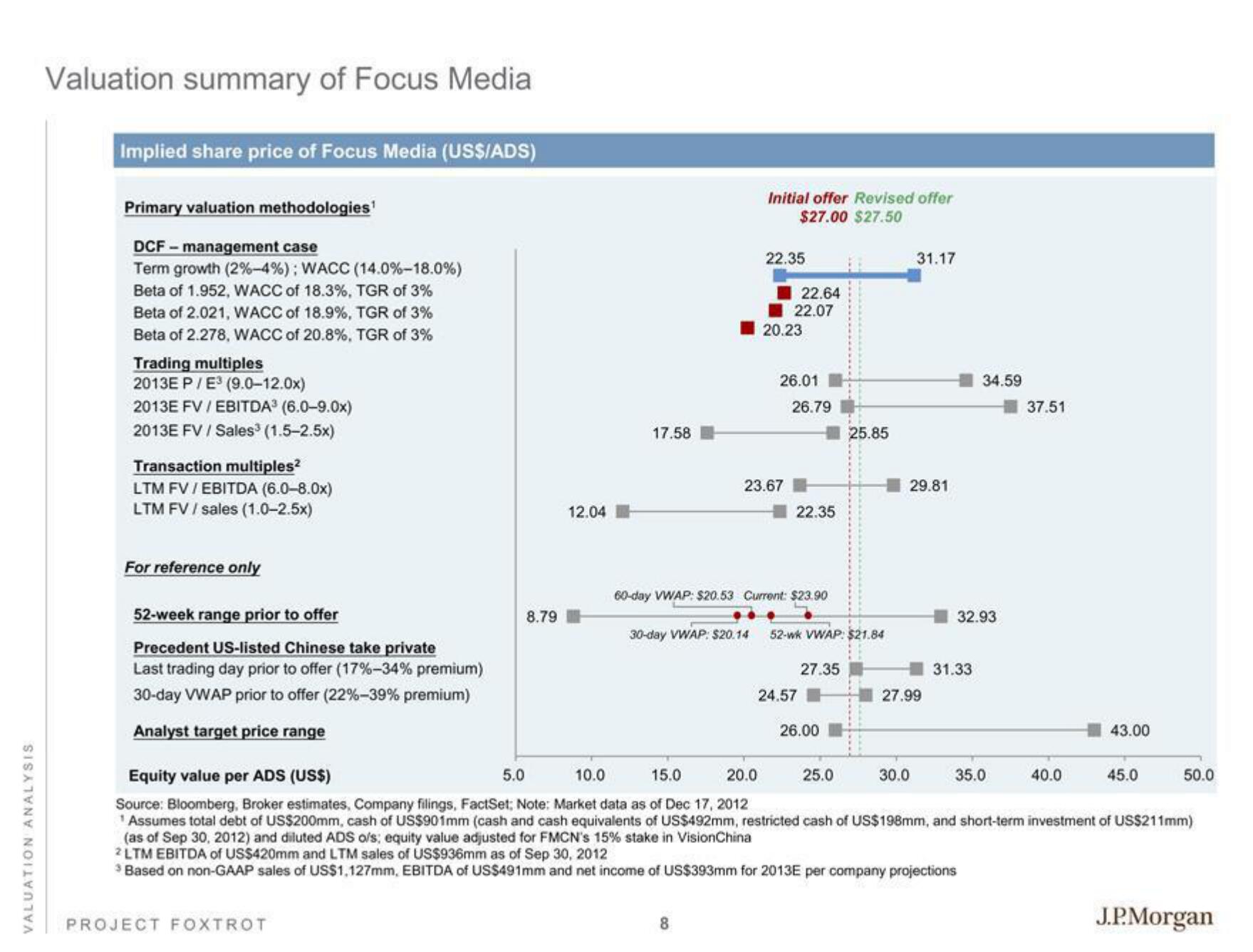

Valuation summary of Focus Media

Implied share price of Focus Media (US$/ADS)

Primary valuation methodologies¹

DCF-management case

Term growth (2% -4% ) : WACC (14.0 % -18.0%)

Beta of 1.952, WACC of 18.3%, TGR of 3%

Beta of 2.021, WACC of 18.9%, TGR of 3%

Beta of 2.278, WACC of 20.8%, TGR of 3%

Trading multiples

2013E P/E³ (9.0-12.0x)

2013E FV/EBITDA³ (6.0-9.0x)

2013E FV / Sales³ (1.5-2.5x)

Transaction multiples²

LTM FV/EBITDA (6.0-8.0x)

LTM FV / sales (1.0-2.5x)

For reference only

52-week range prior to offer

Precedent US-listed Chinese take private

Last trading day prior to offer ( 17% -34% premium)

30-day VWAP prior to offer (22% -39% premium)

Analyst target price range

8.79

PROJECT FOXTROT

12.04

17.58

Initial offer Revised offer

$27.00 $27.50

30-day VWAP: $20.14

22.35

8

23.67

22.64

22.07

20.23

26.01

26.79

60-day VWAP: $20.53 Current: $23.90

22.35

24.57

52-wk VWAP: $21.84

27.35

26.00

25.85

25.0

31.17

29.81

27.99

30.0

34.59

32.93

31.33

Equity value per ADS (US$)

5.0

10.0

15.0

20.0

Source: Bloomberg, Broker estimates, Company filings, FactSet; Note: Market data as of Dec 17, 2012

¹ Assumes total debt of US$200mm, cash of US$901mm (cash and cash equivalents of US$492mm, restricted cash of US$198mm, and short-term investment of US$211mm)

(as of Sep 30, 2012) and diluted ADS o/s; equity value adjusted for FMCN's 15% stake in Vision China

2LTM EBITDA of US$420mm and LTM sales of US$936mm as of Sep 30, 2012

³ Based on non-GAAP sales of US$1,127mm, EBITDA of US$491mm and net income of US$393mm for 2013E per company projections

37.51

35.0

43.00

40.0

45.0

50.0

J.P.MorganView entire presentation