Apollo Global Management Investor Day Presentation Deck

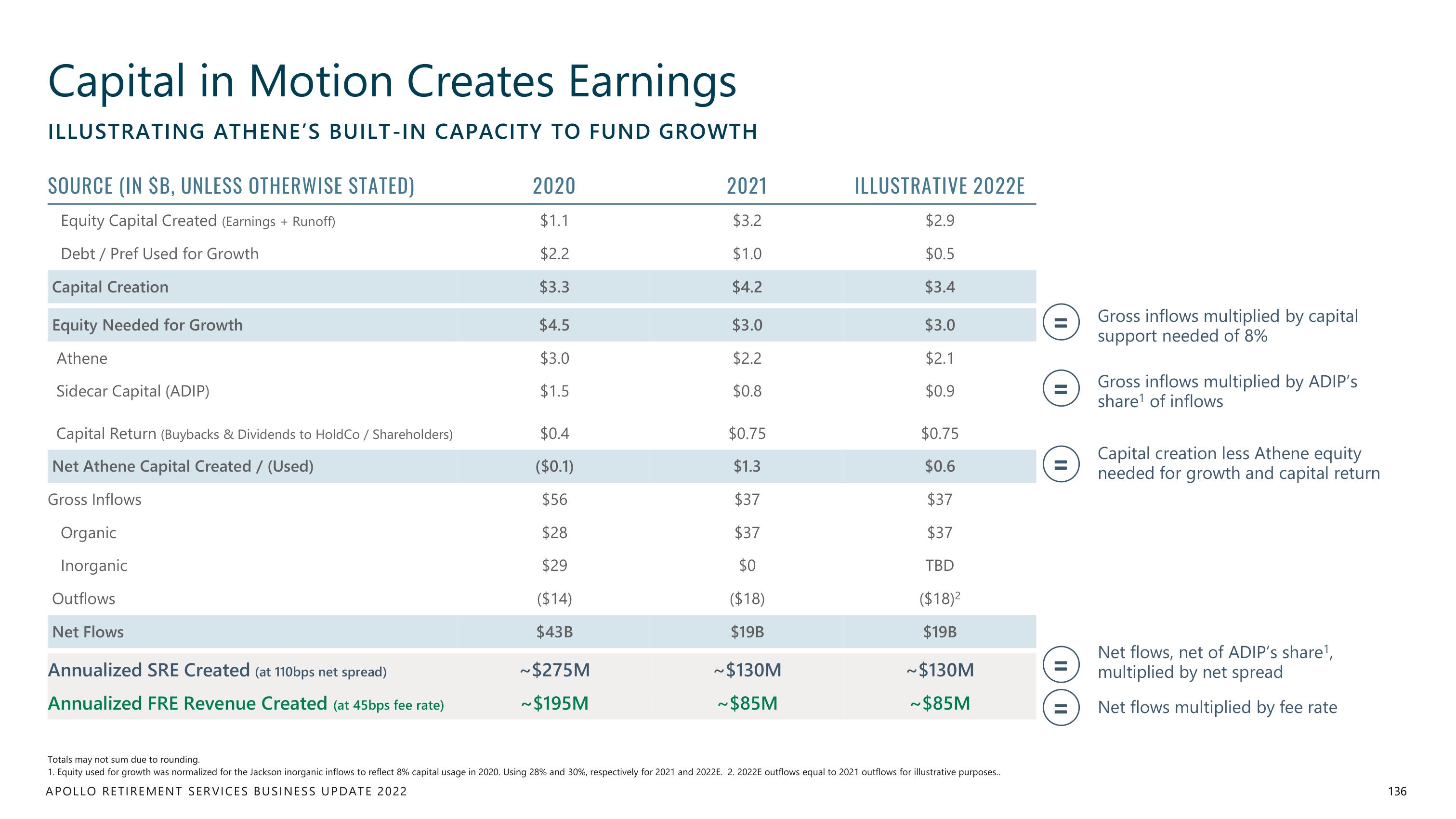

Capital in Motion Creates Earnings

ILLUSTRATING ATHENE'S BUILT-IN CAPACITY TO FUND GROWTH

SOURCE (IN $B, UNLESS OTHERWISE STATED)

Equity Capital Created (Earnings + Runoff)

Debt / Pref Used for Growth

Capital Creation

Equity Needed for Growth

Athene

Sidecar Capital (ADIP)

Capital Return (Buybacks & Dividends to HoldCo/ Shareholders)

Net Athene Capital Created / (Used)

Gross Inflows

Organic

Inorganic

Outflows

Net Flows

Annualized SRE Created (at 110bps net spread)

Annualized FRE Revenue Created (at 45bps fee rate)

2020

$1.1

$2.2

$3.3

$4.5

$3.0

$1.5

$0.4

($0.1)

$56

$28

$29

($14)

$43B

~$275M

~$195M

2021

$3.2

$1.0

$4.2

$3.0

$2.2

$0.8

$0.75

$1.3

$37

$37

$0

($18)

$19B

~$130M

~$85M

ILLUSTRATIVE 2022E

$2.9

$0.5

$3.4

$3.0

$2.1

$0.9

$0.75

$0.6

$37

$37

TBD

($18)²

$19B

~$130M

~$85M

Totals may not sum due to rounding.

1. Equity used for growth was normalized for the Jackson inorganic inflows to reflect 8% capital usage in 2020. Using 28% and 30%, respectively for 2021 and 2022E. 2. 2022E outflows equal to 2021 outflows for illustrative purposes..

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

||

=

Gross inflows multiplied by capital

support needed of 8%

Gross inflows multiplied by ADIP's

share¹ of inflows

Capital creation less Athene equity

needed for growth and capital return

Net flows, net of ADIP's share¹,

multiplied by net spread

Net flows multiplied by fee rate

136View entire presentation