HSBC Results Presentation Deck

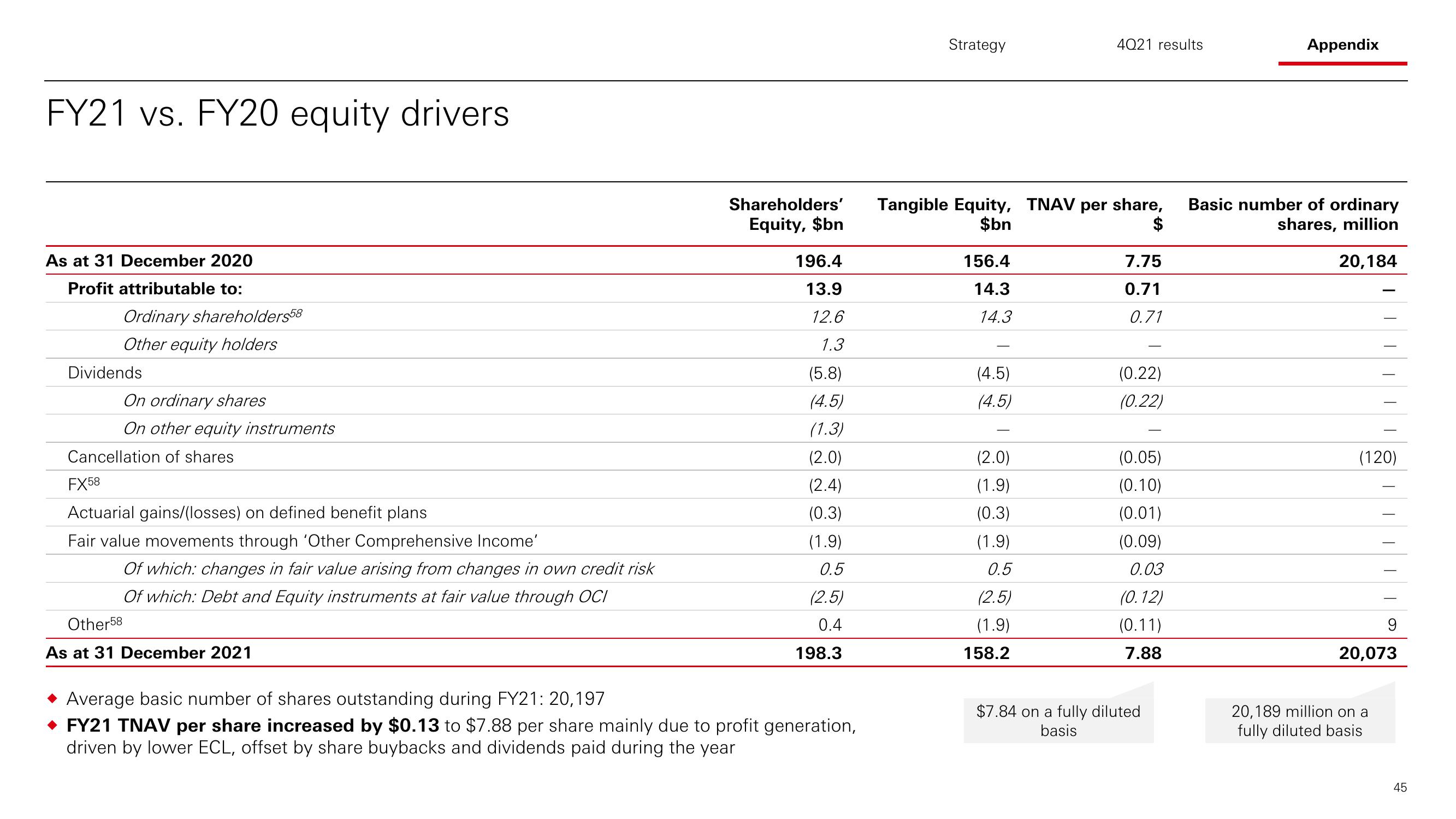

FY21 vs. FY20 equity drivers

As at 31 December 2020

Profit attributable to:

Ordinary shareholders58

Other equity holders

Dividends

On ordinary shares

On other equity instruments

Cancellation of shares

FX58

Actuarial gains/(losses) on defined benefit plans

Fair value movements through 'Other Comprehensive Income'

Of which: changes in fair value arising from changes in own credit risk

Of which: Debt and Equity instruments at fair value through OCI

Other58

As at 31 December 2021

196.4

13.9

12.6

1.3

(5.8)

(4.5)

(1.3)

(2.0)

(2.4)

(0.3)

(1.9)

0.5

Shareholders' Tangible Equity, TNAV per share,

Equity, $bn

$bn

$

(2.5)

0.4

198.3

Strategy

Average basic number of shares outstanding during FY21: 20,197

◆ FY21 TNAV per share increased by $0.13 to $7.88 per share mainly due to profit generation,

driven by lower ECL, offset by share buybacks and dividends paid during the year

156.4

14.3

14.3

(4.5)

(4.5)

(2.0)

(1.9)

(0.3)

(1.9)

0.5

4021 results

(2.5)

(1.9)

158.2

7.75

0.71

0.71

(0.22)

(0.22)

(0.05)

(0.10)

(0.01)

(0.09)

0.03

(0.12)

(0.11)

7.88

$7.84 on a fully diluted

basis

Appendix

Basic number of ordinary

shares, million

20,184

T

T

20,189 million on a

fully diluted basis

T

(120)

T

T

T

T

9

20,073

45View entire presentation