Credit Suisse Investment Banking Pitch Book

Selected Wall Street equity research analysts summary

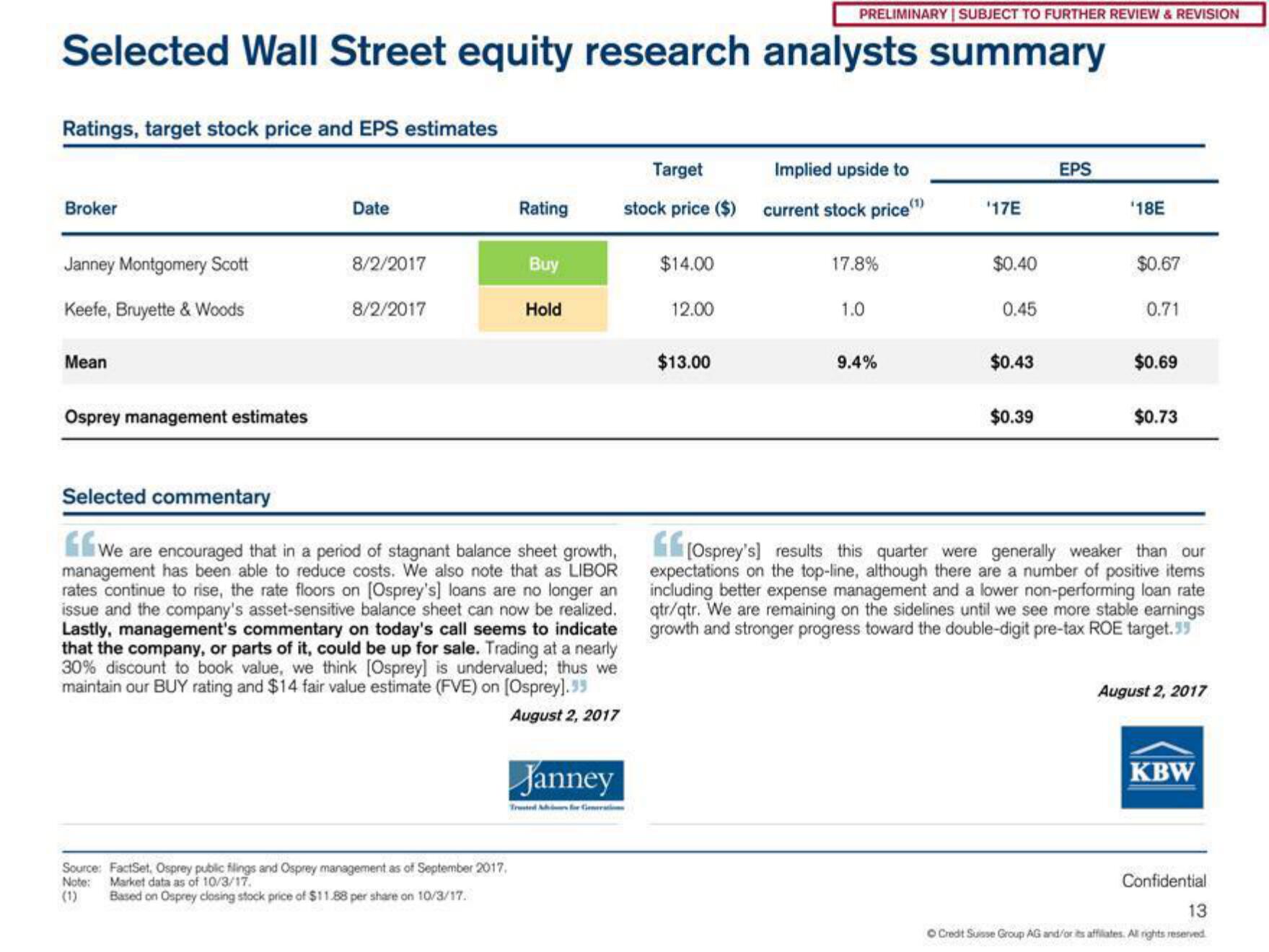

Ratings, target stock price and EPS estimates

Broker

Janney Montgomery Scott

Keefe, Bruyette & Woods

Mean

Osprey management estimates

Date

8/2/2017

8/2/2017

Rating

Source: FactSet, Osprey public filings and Osprey management as of September 2017.

Note:

Market data as of 10/3/17.

(1)

Based on Osprey closing stock price of $11.88 per share on 10/3/17.

Buy

Hold

Selected commentary

We are encouraged that in a period of stagnant balance sheet growth,

management has been able to reduce costs. We also note that as LIBOR

rates continue to rise, the rate floors on [Osprey's] loans are no longer an

issue and the company's asset-sensitive balance sheet can now be realized.

Lastly, management's commentary on today's call seems to indicate

that the company, or parts of it, could be up for sale. Trading at a nearly

30% discount to book value, we think [Osprey] is undervalued; thus we

maintain our BUY rating and $14 fair value estimate (FVE) on [Osprey].35

August 2, 2017

Janney

Target

stock price ($)

$14.00

12.00

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

$13.00

Implied upside to

current stock price(¹)

17.8%

1.0

9.4%

'17E

$0.40

0.45

$0.43

$0.39

EPS

'18E

$0.67

0.71

$0.69

$0.73

[Osprey's] results this quarter were generally weaker than our

expectations on the top-line, although there are a number of positive items

including better expense management and a lower non-performing loan rate

qtr/qtr. We are remaining on the sidelines until we see more stable earnings

growth and stronger progress toward the double-digit pre-tax ROE target.55

August 2, 2017

KBW

Confidential

13

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation