Hanmi Financial Results Presentation Deck

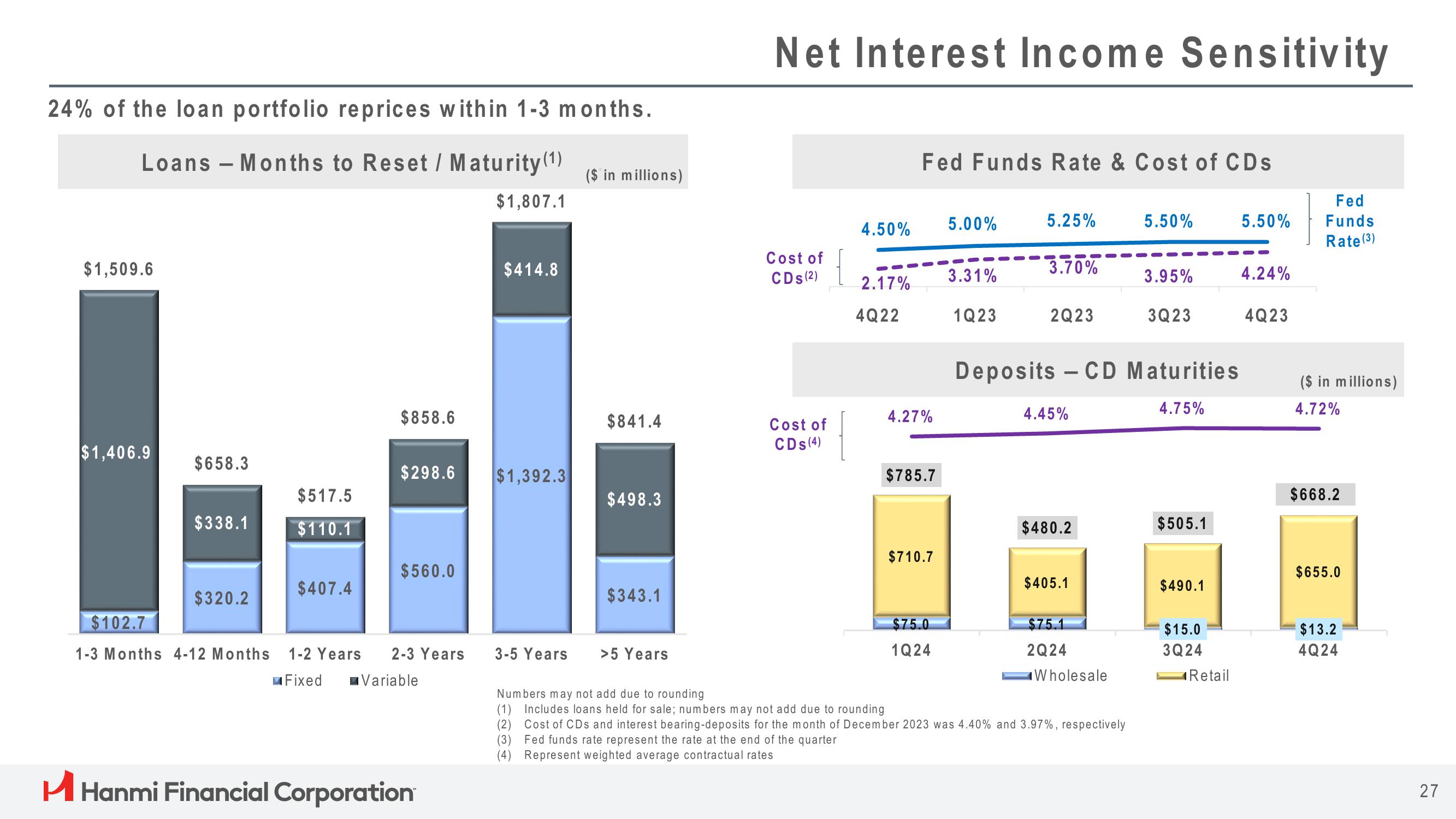

24% of the loan portfolio reprices within 1-3 months.

Loans - Months to Reset / Maturity (1)

$1,807.1

$1,509.6

$1,406.9

$658.3

$338.1

$320.2

$517.5

$110.1

$407.4

$858.6

$298.6

$560.0

$102.7

1-3 Months 4-12 Months 1-2 Years 2-3 Years

Fixed

Variable

H Hanmi Financial Corporation

$414.8

$1,392.3

($ in millions)

$841.4

$498.3

$343.1

3-5 Years >5 Years

Net Interest Income Sensitivity

Cost of

CDs (2)

Cost of

CDs (4)

4.50%

2.17%

4Q22

Numbers may not add due to rounding

(1) Includes loans held for sale; numbers may not add due to rounding

Fed Funds Rate & Cost of CDs

4.27%

$785.7

$710.7

$75.0

1Q24

5.00%

3.31%

1Q23

5.25%

3.70%

2Q23

4.45%

$480.2

Deposits - CD Maturities

4.75%

$405.1

$75.1

2Q24

Wholesale

5.50%

(2) Cost of CDs and interest bearing-deposits for the month of December 2023 was 4.40% and 3.97%, respectively

(3)

Fed funds rate represent the rate at the end of the quarter

Represent weighted average contractual rates

(4)

3.95%

3Q23

$505.1

$490.1

$15.0

3Q24

Retail

5.50%

4.24%

4Q23

Fed

Funds

Rate (3)

($ in millions)

4.72%

$668.2

$655.0

$13.2

4Q24

27View entire presentation