Axos Financial, Inc. Fixed Income Investor Presentation

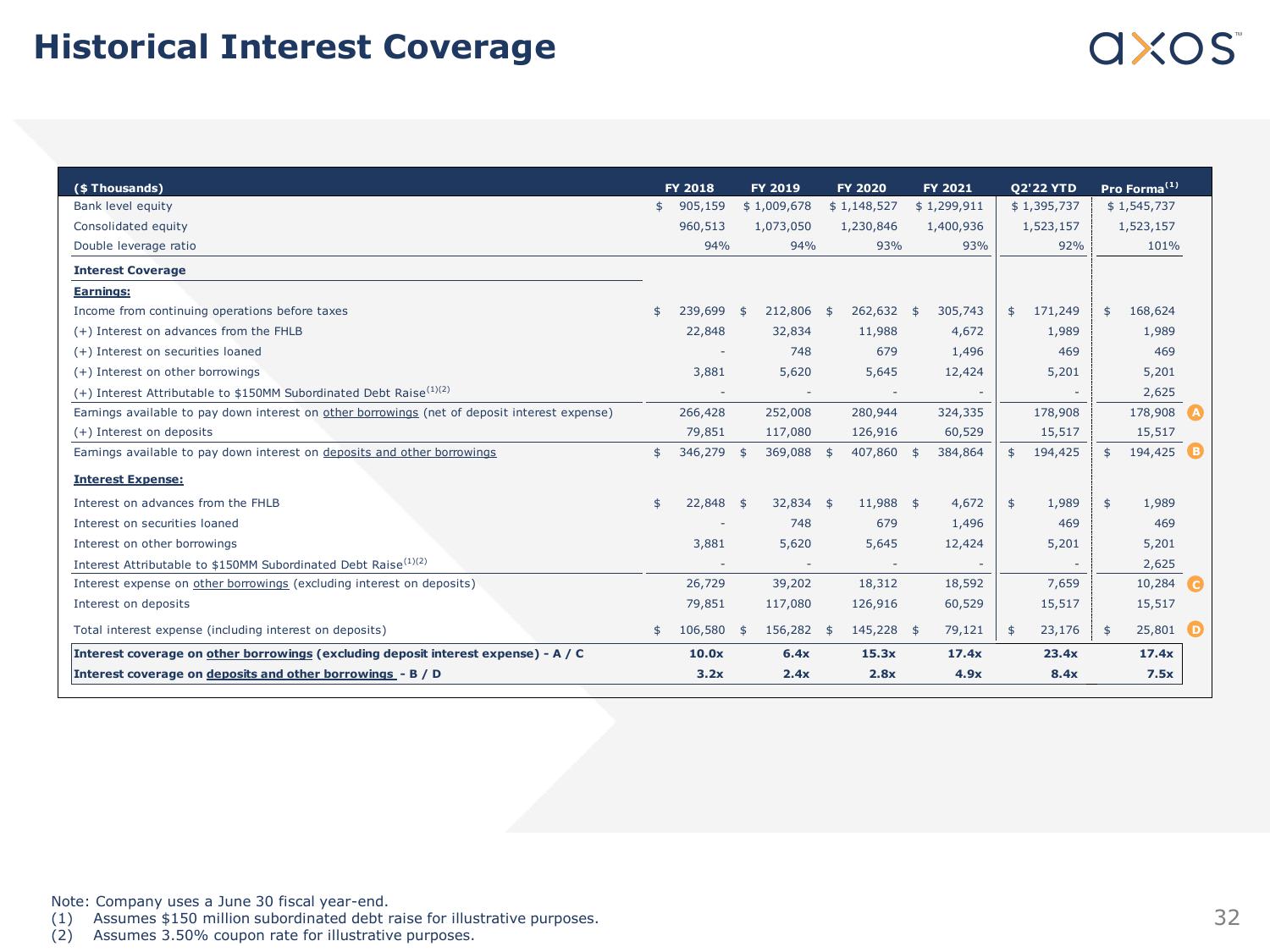

Historical Interest Coverage

($ Thousands)

Bank level equity

Consolidated equity

Double leverage ratio

Interest Coverage

Earnings:

Income from continuing operations before taxes

(+) Interest on advances from the FHLB

(+) Interest on securities loaned

(+) Interest on other borrowings

(+) Interest Attributable to $150MM Subordinated Debt Raise (1)(2)

Earnings available to pay down interest on other borrowings (net of deposit interest expense)

(+) Interest on deposits

Earings available to pay down interest on deposits and other borrowings

Interest Expense:

Interest on advances from the FHLB

Interest on securities loaned

Interest on other borrowings

Interest Attributable to $150MM Subordinated Debt Raise(¹)(2)

Interest expense on other borrowings (excluding interest on deposits)

Interest on deposits

Total interest expense (including interest on deposits)

Interest coverage on other borrowings (excluding deposit interest expense) - A/C

Interest coverage on deposits and other borrowings - B / D

Note: Company uses a June 30 fiscal year-end.

(1) Assumes $150 million subordinated debt raise for illustrative purposes.

(2) Assumes 3.50% coupon rate for illustrative purposes.

$

$

$

FY 2018

905,159

960,513

94%

$

3,881

266,428

79,851

$ 346,279 $

FY 2019

$ 1,009,678

1,073,050

239,699 $ 212,806 $

22,848

32,834

748

5,620

22,848 $

3,881

26,729

79,851

94%

106,580 $

10.0x

3.2x

FY 2020

$1,148,527.

1,230,846

252,008

117,080

369,088 $

32,834 $

748

5,620

39,202

117,080

156,282 $

6.4x

2.4x

93%

262,632 $

11,988

679

5,645

FY 2021

$ 1,299,911

1,400,936

93%

280,944

126,916

407,860 $

11,988 $

679

5,645

18,312

126,916

145,228

15.3x

2.8x

$

305,743

4,672

1,496

12,424

Q2'22 YTD

$ 1,395,737

1,523,157

$

324,335

60,529

384,864 $

18,592

60,529

79,121

17.4x

4.9x

4,672 $

1,496

12,424

$

92%

171,249

1,989

469

5,201

178,908

15,517

194,425

axos

7,659

15,517

23,176

23.4x

8.4x

Pro Forma (¹)

$ 1,545,737

1,523,157

101%

$ 168,624

1,989

469

5,201

2,625

178,908

15,517

$ 194,425

1,989 $

469

5,201

$

1,989

469

5,201

2,625

10,284

15,517

25,801

17.4x

7.5x

32View entire presentation