Bausch Health Companies Shareholder Engagement Presentation Deck

19

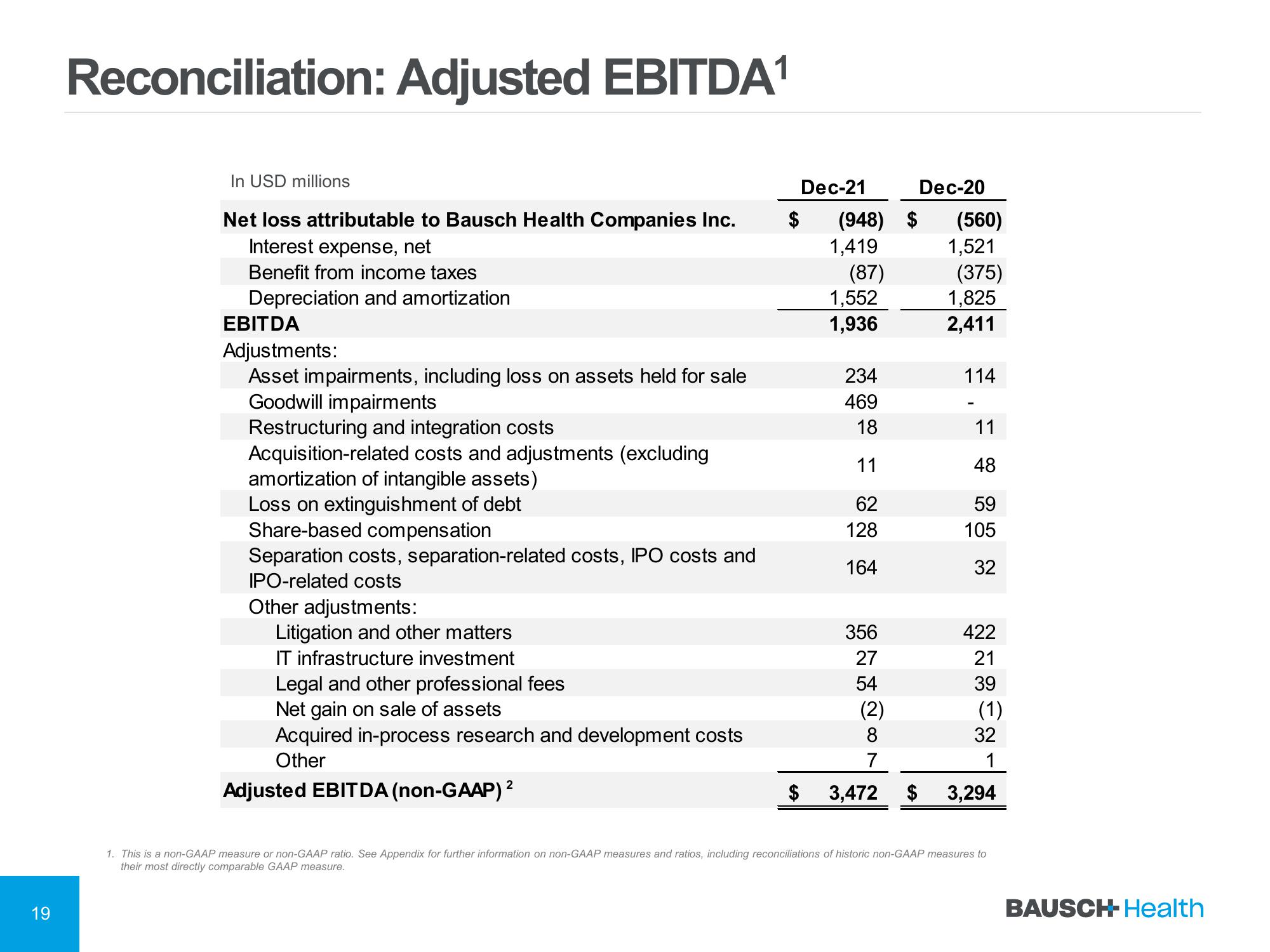

Reconciliation: Adjusted EBITDA¹

In USD millions

Net loss attributable to Bausch Health Companies Inc.

Interest expense, net

Benefit from income taxes

Depreciation and amortization

EBITDA

Adjustments:

Asset impairments, including loss on assets held for sale

Goodwill impairments

Restructuring and integration costs

Acquisition-related costs and adjustments (excluding

amortization of intangible assets)

Loss on extinguishment of debt

Share-based compensation

Separation costs, separation-related costs, IPO costs

IPO-related costs

Other adjustments:

Litigation and other matters

IT infrastructure investment

Legal and other professional fees

Net gain on sale of assets

Acquired in-process research and development costs

Other

2

Adjusted EBITDA (non-GAAP) ²

$

Dec-21

$

(948) $

1,419

(87)

1,552

1,936

234

469

18

11

62

128

164

356

27

54

(2)

8

7

3,472

$

Dec-20

(560)

1,521

(375)

1,825

2,411

114

11

48

59

105

32

422

21

39

(1)

32

1

3,294

1. This is a non-GAAP measure or non-GAAP ratio. See Appendix for further information on non-GAAP measures and ratios, including reconciliations of historic non-GAAP measures to

their most directly comparable GAAP measure.

BAUSCH- HealthView entire presentation