HPS Specialty Loan Fund VI

Responsible Investing

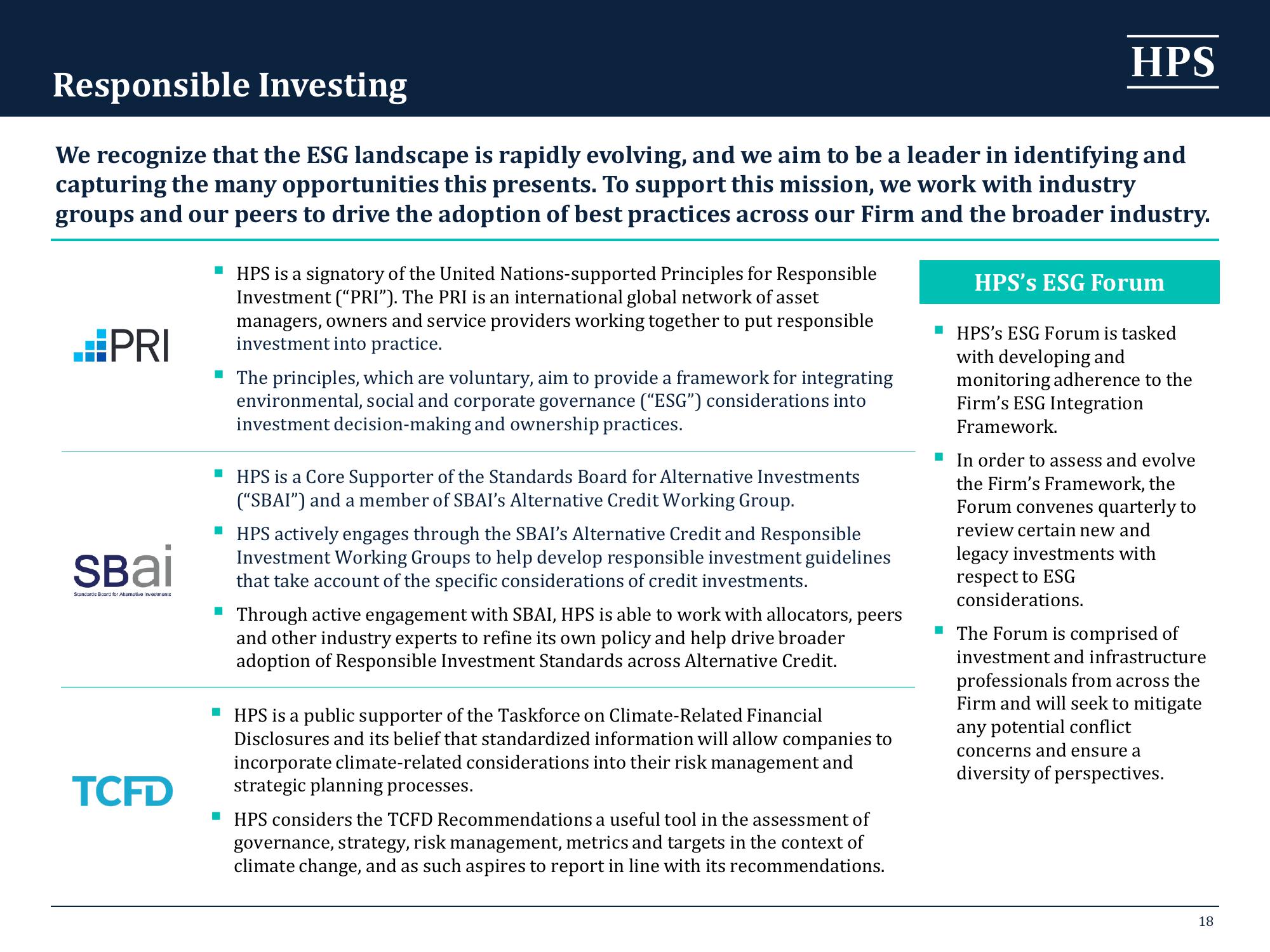

We recognize that the ESG landscape is rapidly evolving, and we aim to be a leader in identifying and

capturing the many opportunities this presents. To support this mission, we work with industry

groups and our peers to drive the adoption of best practices across our Firm and the broader industry.

PRI

Sвai

Standards Board for Akomotive Investments

TCFD

HPS is a signatory of the United Nations-supported Principles for Responsible

Investment ("PRI"). The PRI is an international global network of asset

managers, owners and service providers working together to put responsible

investment into practice.

The principles, which are voluntary, aim to provide a framework for integrating

environmental, social and corporate governance ("ESG") considerations into

investment decision-making and ownership practices.

▪ HPS is a Core Supporter of the Standards Board for Alternative Investments

("SBAI") and a member of SBAI's Alternative Credit Working Group.

▪ HPS actively engages through the SBAI's Alternative Credit and Responsible

Investment Working Groups to help develop responsible investment guidelines

that take account of the specific considerations of credit investments.

Through active engagement with SBAI, HPS is able to work with allocators, peers

and other industry experts to refine its own policy and help drive broader

adoption of Responsible Investment Standards across Alternative Credit.

▪ HPS is a public supporter of the Taskforce on Climate-Related Financial

Disclosures and its belief that standardized information will allow companies to

incorporate climate-related considerations into their risk management and

strategic planning processes.

HPS

▪ HPS considers the TCFD Recommendations a useful tool in the assessment of

governance, strategy, risk management, metrics and targets in the context of

climate change, and as such aspires to report in line with its recommendations.

HPS's ESG Forum

▪ HPS's ESG Forum is tasked

with developing and

monitoring adherence to the

Firm's ESG Integration

Framework.

■ In order to assess and evolve

the Firm's Framework, the

Forum convenes quarterly to

review certain new and

acy investments with

respect to ESG

considerations.

The Forum is comprised of

investment and infrastructure

professionals from across the

Firm and will seek to mitigate

any potential conflict

concerns and ensure a

diversity of perspectives.

18View entire presentation