Deutsche Bank Fixed Income Presentation Deck

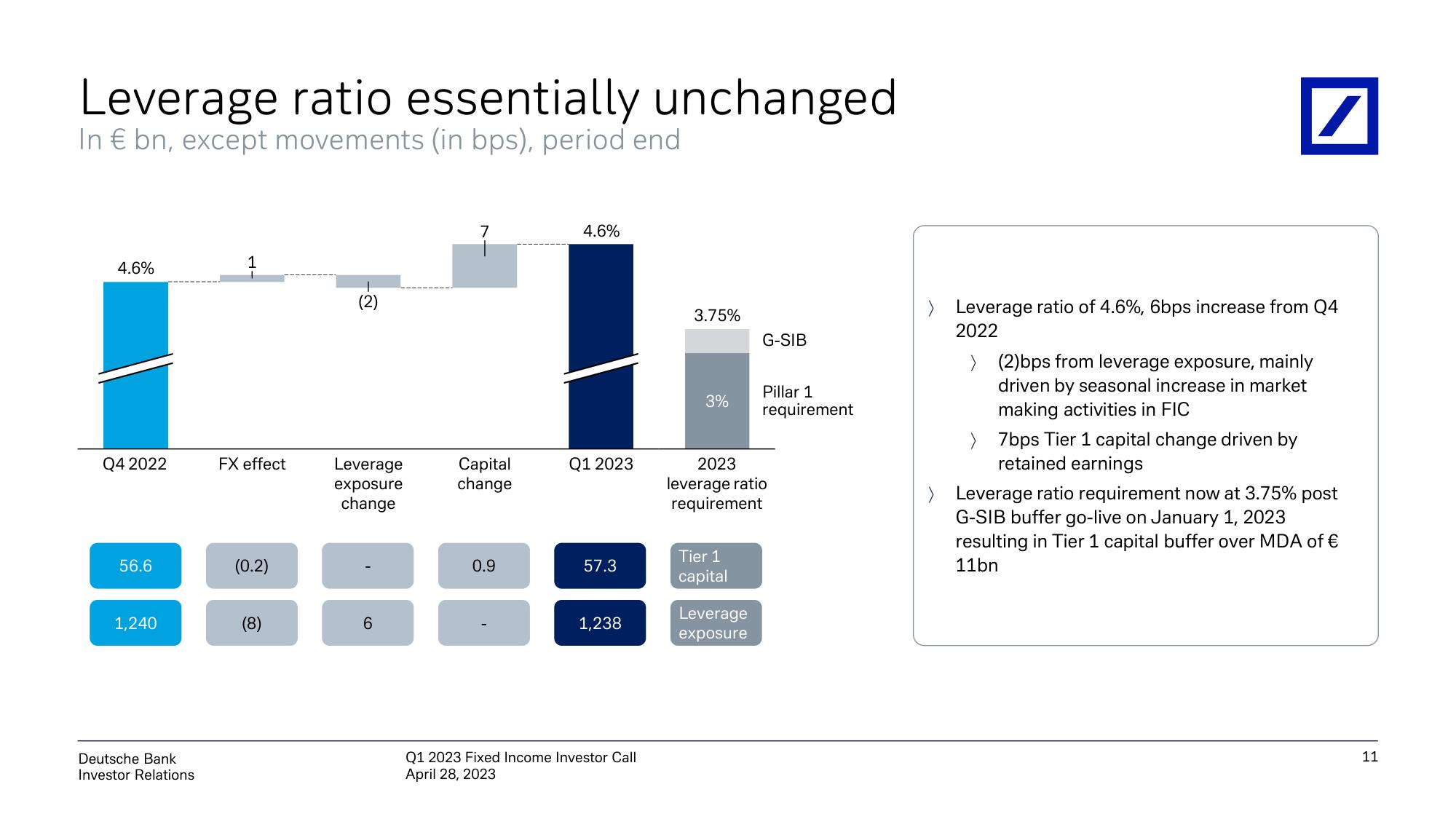

Leverage ratio essentially unchanged

In € bn, except movements (in bps), period end

4.6%

Q4 2022

56.6

1,240

Deutsche Bank

Investor Relations

1

FX effect

(0.2)

(8)

(2)

Leverage

exposure

change

6

7

Capital

change

0.9

4.6%

Q1 2023

57.3

1,238

Q1 2023 Fixed Income Investor Call

April 28, 2023

3.75%

3%

Tier 1

capital

G-SIB

2023

leverage ratio

requirement

Leverage

exposure

Pillar 1

requirement

/

> Leverage ratio of 4.6%, 6bps increase from Q4

2022

> (2) bps from leverage exposure, mainly

driven by seasonal increase in market

making activities in FIC

> 7bps Tier 1 capital change driven by

retained earnings

> Leverage ratio requirement now at 3.75% post

G-SIB buffer go-live on January 1, 2023

resulting in Tier 1 capital buffer over MDA of €

11bn

11View entire presentation