Bank of America Investment Banking Pitch Book

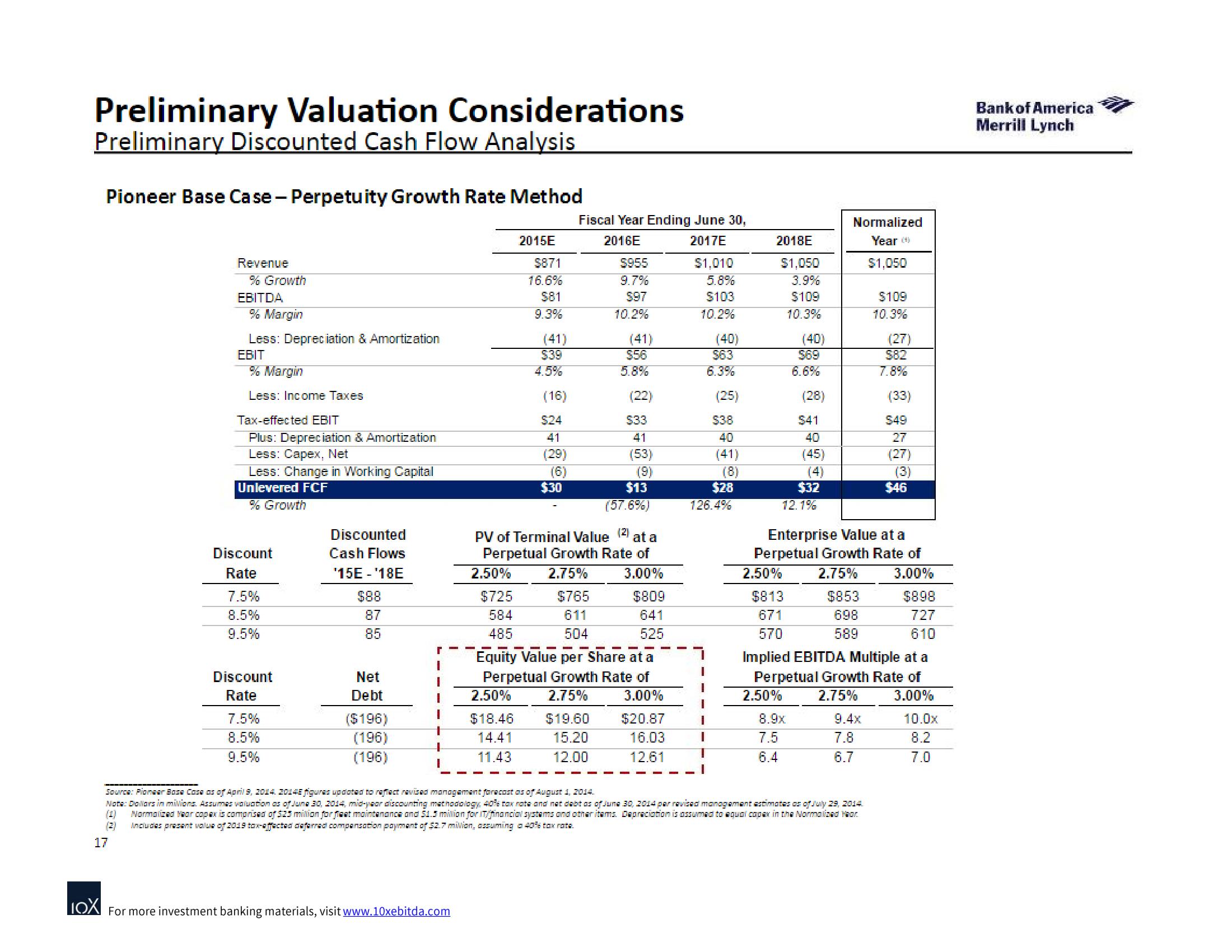

Preliminary Valuation Considerations

Preliminary Discounted Cash Flow Analysis

Pioneer Base Case - Perpetuity Growth Rate Method

Revenue

% Growth

EBITDA

% Margin

Less: Depreciation & Amortization

EBIT

% Margin

Less: Income Taxes

Tax-effected EBIT

Plus: Depreciation & Amortization

Less: Capex, Net

Less: Change in Working Capital

Unlevered FCF

% Growth

Discount

Rate

7.5%

8.5%

9.5%

Discount

Rate

7.5%

8.5%

9.5%

Discounted

Cash Flows

'15E - ¹18E

$88

87

85

Net

Debt

($196)

(196)

(196)

↓

I

IOX For more investment banking materials, visit www.10xebitda.com

2.50%

$725

584

485

2015E

$871

16.6%

581

9.3%

$18.46

14.41

11.43

(41)

$39

4.5%

(16)

$24

41

(29)

(6)

$30

Fiscal Year Ending June 30,

2016E

2017E

$1,010

5.8%

$103

10.2%

$955

9.7%

$97

10.2%

$765

611

504

(41)

$56

5.8%

(2)

PV of Terminal Value

at a

Perpetual Growth Rate of

2.75%

3.00%

(22)

$33

41

(53)

19

$13

(57.6%)

$809

641

525

Equity Value per Share at a

Perpetual Growth Rate of

2.50% 2.75% 3.00%

$19.60

$20.87

15.20

16.03

12.00

12.61

(40)

$63

6.3%

(25)

I

I

T

I

$38

40

(41)

(8)

$28

126.4%

2018E

$1,050

3.9%

$109

10.3%

(40)

2.50%

$813

671

570

569

6.6%

(28)

8.9x

7.5

6.4

541

40

(45)

(4)

12.1%

$32

Normalized

Year

$1,050

$853

698

589

Enterprise Value at a

Perpetual Growth Rate of

2.75%

3.00%

9.4x

87

7.8

$109

10.3%

6.7

Source: Pioneer Bose Cose as of April 9, 2014. 20145 figures updated to reflect revised management forecast as of August 1, 2014.

Note: Dollars in milions. Assumes valuation as of June 30, 2014, mid-year discounting methodology, 40% tax rate and nat debt as of June 30, 2014 par revised management estimates or of July 29, 2014.

(1) Normalized Year copax is comprised of $23 million for fleet maintenance and 51.3 million for IT/financial systems and other itams. Depreciation is assumed to qualcopex in the Normalized Hear

(3) Includes present value of 2019 tax-affected deferred compensation payment of $2.7 million, assuming a 40% tax rate.

17

(27)

Implied EBITDA Multiple at a

Perpetual Growth Rate of

2.50% 2.75%

3.00%

$82

7.8%

(33)

$49

27

(27)

(3)

$46

$898

727

610

10.0x

8.2

7.0

Bank of America

Merrill LynchView entire presentation