Evercore Investment Banking Pitch Book

Process Considerations

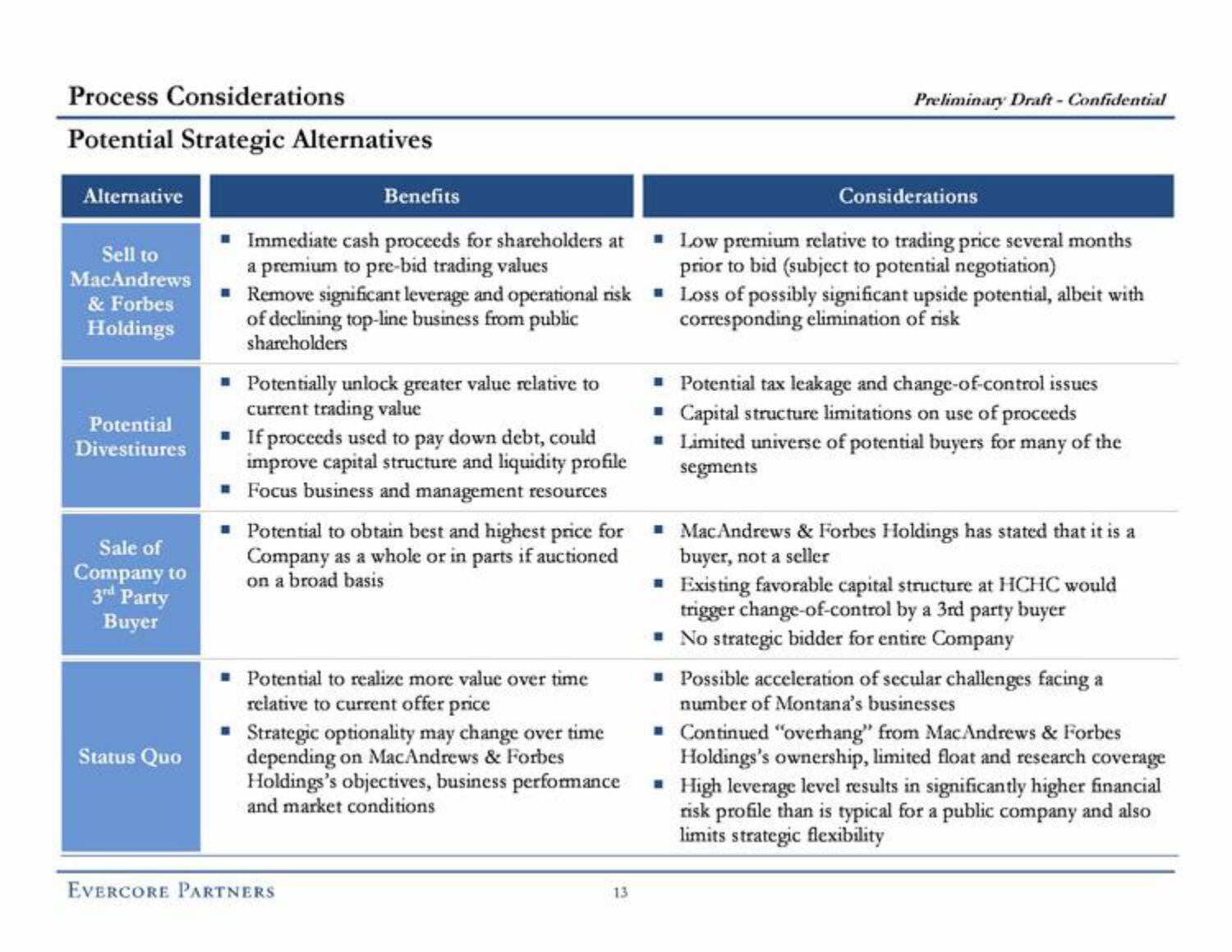

Potential Strategic Alternatives

Alternative

Sell to

MacAndrews

& Forbes

Holdings

Potential

Divestitures

Sale of

Company to

3rd Party

Buyer

Status Quo

Benefits

Immediate cash proceeds for shareholders at

a premium to pre-bid trading values

Remove significant leverage and operational risk

of declining top-line business from public

shareholders

■ Potentially unlock greater value relative to

current trading value

■ If proceeds used to pay down debt, could

improve capital structure and liquidity profile

Focus business and management resources

Potential to obtain best and highest price for

Company as a whole or in parts if auctioned

on a broad basis

■ Potential to realize more value over time

relative to current offer price

Strategic optionality may change over time

depending on MacAndrews & Forbes

Holdings's objectives, business performance

and market conditions

EVERCORE PARTNERS

13

Preliminary Draft - Confidential

Considerations

■ Low premium relative to trading price several months

prior to bid (subject to potential negotiation)

Loss of possibly significant upside potential, albeit with

corresponding elimination of risk

Potential tax leakage and change-of-control issues

■ Capital structure limitations on use of proceeds

■ Limited universe of potential buyers for many of the

segments

Mac Andrews & Forbes Holdings has stated that it is a

buyer, not a seller

■ Existing favorable capital structure at HCHC would

trigger change-of-control by a 3rd party buyer

■ No strategic bidder for entire Company

■ Possible acceleration of secular challenges facing a

number of Montana's businesses

■ Continued "overhang" from Mac Andrews & Forbes

Holdings's ownership, limited float and research coverage

High leverage level results in significantly higher financial

risk profile than is typical for a public company and also

limits strategic flexibilityView entire presentation